Last Updated on November 25, 2025

QuickBooks provides an Employer Identification Number (EIN), also known as a Federal Employer Identification Number, a unique nine-digit number assigned to you by the Internal Revenue Service (IRS) to identify the purpose of your business. There may be times when you need to Change EIN in QuickBooks if your business information has changed or if you entered it incorrectly. This blog serves as a guide to help you understand the conditions under which you can change your EIN and the steps to do so.

Users of QuickBooks who need to add an EIN to their QuickBooks Payroll Subscription require specific information, including their ZIP code, service key, and the EIN.

If you need any kind of assistance related to QuickBooks, you can contact our experts at +1(855)-510-6487 anytime, around the clock.

Important Things to Remember When Adding an EIN to QuickBooks

There are certain things you need to ensure before adding the EIN to QuickBooks. Let’s go through them individually.

- You are requested to use the same device and the same QBDT payroll account to process the payroll for multiple companies under Payroll Subscription.

- Don’t use more than one company file associated with the Employer Identification Number (EIN) for the same QuickBooks Payroll account. Using multiple files for the EIN can cause errors since it allows only one company file per EIN.

- Ensure that you maintain details such as contact information and the payroll administrator across all the companies around the payroll subscription.

- QuickBooks allows limited users of companies for payroll subscription. For example: a subscription to QuickBooks Enhanced Payroll allows adding up to only three companies.

- Ensure to keep your privacy with your service key. Sharing the key can allow unauthorized users access to payroll subscription information.

- Check if your QuickBooks Payroll subscription is active; if it is inactive, here’s how you can reactivate it:

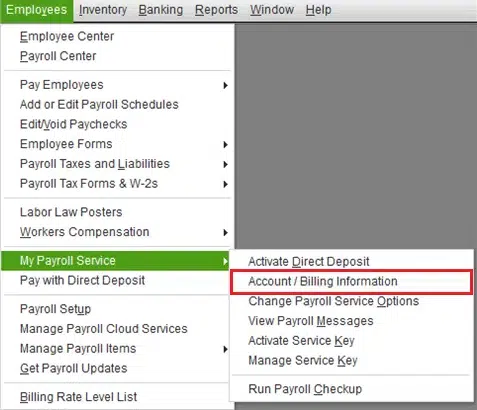

- Go to the Employees tab, then move to the My Payroll Service section.

- Move to the Account/Billing Info.

- Now, sign in to your Intuit Account with the correct details.

- Under the Status section, choose the Re-subscribe option and follow the on-screen instructions.

- Enable the manual payroll under the Edit tab in QBDT to update the EIN.

- Use the same registered copy of QuickBooks Desktop on the same PC to process payroll for all users under one subscription.

- QBDT Payroll allows only one company data file per EIN.

- The contact details and payroll administrator must be the same for all companies under a single subscription.

- When you are using Direct Deposit, you can process payroll for multiple companies under the same subscription.

- Only a limited number of companies are allowed, as per the subscription, depending on the company data files:

- Payroll Basic: Standard, or Enhanced: up to 3 EINs

- Payroll Enhanced for Accountants: up to 50 EINs

- Payroll Assisted: Every EIN is billed separately, with applicable discounts for companies.

The above-mentioned points are to be followed and verified when you are changing or modifying the EIN in QuickBooks.

Detailed Steps to Add EIN to QuickBooks Desktop

This section of the blog explains how to add the EIN to your QuickBooks Desktop. We have written step-by-step instructions to perform this operation without any difficulty.

- Launch the QuickBooks Desktop.

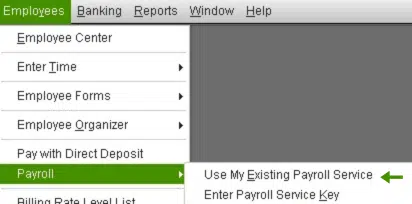

- Move to the Payroll tab, and choose the Employees tab.

- Now, tap on Use My Existing Payroll Service.

- Under the Identify Subscription section, opt for Use Subscription Number XXXX (X represents the QuickBooks version).

- When your subscription doesn’t appear, choose the other option: I have an existing subscription and a Zip Code, and input the required information.

- Now, on the Add Company Information screen, tap on the Next tab and enter your EIN.

- When you want to save a copy, tap on Print, or return to QuickBooks Desktop by choosing Return to QuickBooks Desktop.

- Now, for the Service Key activation:

- Go to the Employees menu.

- Then move to the My Payroll Services tab.

- Tap on the Manage Service Key section.

- Tap on View, and QuickBooks will display your new Service Key with an Active status.

These were the steps that you should follow, as per your QuickBooks version, to add an EIN in your QBDT.

How to Change Employer Identification Number with the Internal Revenue System

Changing your employer identification number (EIN) with the IRS is an easy process and can be done without any errors, but before that, you should remember certain things that are essential.

- Sole proprietorship: An unincorporated business that is owned by one person is known as a sole proprietorship. This is one of the simplest forms of business. Its liabilities are your personal liabilities, and you undertake the risks of the business for all assets owned, whether or not used in the business.

- Information by type of business entity:

- Definitions of various entity types

- Which forms each entity type may file

- When you need a new EIN

- When you don’t need a new EIN

- Corporation: A corporation is defined as a legal entity or structure created under the authority of the laws of a state, consisting of a person or group of persons who become shareholders.

- The forms that are usually filed are a Form 1120 series return, plus other returns that apply:

- Form 1118, Foreign Tax Credit-Corporation

- Form 1120, U.S. Corporation Income Tax Return

- Form 1120-C, U.S. Income Tax Return for Cooperative Associations

- Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

- Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation

- Form 1120-H, U.S. Income Tax Return for Homeowners Associations

- Form 1120-L, U.S. Life Insurance Company Income Tax Return

- Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons

- Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return

- Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations

- Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts 5

- Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies

- Form 1120S, U.S. Income Tax Return for an S Corporation

- Form 1120-SF, U.S. Income Tax Return for Designated Settlement Funds (Under section 468B)

- Form 1120-W, Estimated Tax for Corporations

- Form 1120-X, Amended U.S. Corporation Income Tax Return

- Partnership: When there is an existing relationship between two or more persons who join together to carry on a business. All the partners provide money, property, labor, or skill, and have shares in the profits and losses of the business.

- Estate: An estate is a legal entity created as the result of a person’s death. The decedent’s estate is a separate legal entity for federal tax purposes. An estate consists of real and/or personal property of the deceased person. The estate pays any debts owed by the decedent and then distributes the balance of the estate’s assets to the beneficiaries of the estate.

- Trust: A trust is an arrangement through which trustees take title to property for the purpose of protecting or conserving it for the beneficiaries under the ordinary rules applied in chancery or probate courts. A trust is a legal entity created under state law and taxed under federal law.

To learn more about the relationship between the two, you can move ahead to understand the EIN with the IRS in detail.

Steps to Change EIN in QuickBooks Desktop Payroll Service

To update the EIN in your QBDT payroll, you can follow the steps below to apply to your specific payroll service.

QuickBooks Desktop Payroll Assisted

- Update your company’s legal name, download the assisted legal name change form, and then upload the finished form.

- You should update your Federal EIN following these steps:

- Download, complete, and sign the Entity Change Packet and collect all the essential documents.

- Later, email the finished packet along with the supporting documents.

- Now, within 3-5 business days, you’ll receive a confirmation email for the same.

QuickBooks Desktop Payroll Basic, Standard, or Enhanced

In scenarios where you wish to update your company’s legal name in the QBDT payroll basic, standard, or enhanced version. Here are the steps to help you do it:

- Update the company’s legal name by going to the Company tab and selecting the My Company window.

- Tap on the Edit section.

- Here, under legal information, input your legal business name and tap OK.

- Now, update your federal EIN by first going to the Company menu and choosing the My Company option.

- Under the Company Information window, tap on the Edit menu.

- Now, from the left menu, choose the Company Identification section.

- In the Federal Employer Identification No. field and enter your new EIN and tap on OK.

You have now successfully updated your EIN and can continue running the payroll operations in QB.

Conclusion

This detailed guide will help you change EIN in QuickBooks and explain how to do so in different versions of QB, such as payroll-assisted and Desktop Payroll. We have gone through the important aspects to remember before you begin changing your EIN. Additionally, we have guided you through the detailed steps on how you can change the number in different versions. However, if you need any further help with changing the EIN in your QuickBooks Desktop or other versions, feel free to contact our experts at +1(855)-510-6487.

Frequently Asked Questions (FAQs)

What are the steps to change the EIN in the QuickBooks Online version?

When you need to change or update the EIN in QuickBooks Online, follow the following steps:

1. Move to the Settings tab.

2. Choose the Accounts and Settings option and tap on the Company tab.

3. Then, tap on the Edit option to edit and update the section.

4. Once the edit is done, tap on the Save button and then Done to save the changes.

Why should I change the Employer Identification Number (EIN)?

The need for a business to change or update the EIN is when the ownership or legal structure is changed. For instance, when you convert a proprietorship into a partnership, you require a new EIN, or when you close one business and start a new business, a new EIN is required.

Where to find the EIN in QuickBooks Payroll?

To find the Employer Identification Number in QuickBooks Payroll, follow the given steps:

1. Move to the Company window.

2. Choose the My Company option.

3. From the left section, tap on the Company Identification window.

4. You can notice the Federal EIN situated.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.