Last Updated on November 20, 2025

Suppose your unpaid payroll checks or the status of your payroll payments is bothering you and causing you trouble while performing critical business operations. In that case, you can delete or change your payroll schedule in QuickBooks, which is one of the solutions to resolve the issue. Outdated payroll details or incorrect employee information can also be the reason why this problem is bothering you. This blog provides an in-depth discussion on this issue and offers ways to resolve it smoothly without causing any trouble.

If you need assistance with changing your payroll schedule or information, please don’t hesitate to contact our experts at TFN for guidance.

What are the Different Kinds of Pay Schedules in QuickBooks?

Listed below are the types of payment schedules available in QuickBooks for your employees:

- Pay Per Week: On a specific day each week, payments are scheduled for the employees. Payments are made on Fridays of every week, totalling approx. 52 payments per year.

- Every Other Week: Paying off the employees every two weeks. For instance, employees will receive a payout of about 26 times per year if the scheduled date is every other Friday.

- Twice a month: Paying the employees twice a month is a good way to maintain the payouts. In such cases, payments will be made on the 15th and 30th of the month, that is, in the middle and end of the month. That means employees receive 24 paychecks per year.

- Monthly: Paying employees every month means the payout will be 12 times per year for each employee.

These were the types of payment schedules created for employees to receive their paychecks.

How to Change Payroll Schedule in QuickBooks Versions?

Payroll schedules enable employers to verify which employee is required to be paid at what time of the month. Employees can also check and confirm their next payment schedule date.

- When using the Direct Deposit payroll, the payroll date can be adjusted to accommodate lead times and federal time-outs.

- You can either set up payroll schedules or choose a schedule when launching for the first time.

- In QBDT, a total of 200 payroll schedules can be set up for employees.

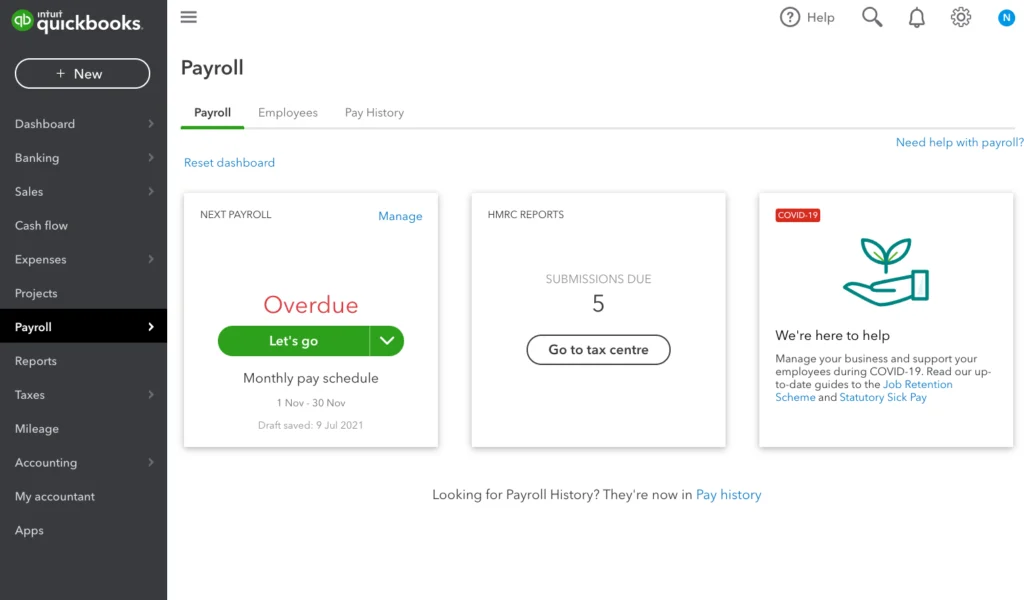

Now that we know about how to change your payroll schedule in QuickBooks, let’s move ahead to learn how to set up the payroll schedule in QB Online.

Setting Up Pay Schedule in QuickBooks Online

When setting up or updating the pay schedule for employees, follow the steps for the applicable payroll products.

- In the Payroll tab, choose the Employees menu.

- Find and select the Employee.

- Tap on Start or Edit under the Employment details.

- Under the Pay Schedule drop-down menu, choose the pay schedule for the employees and click the +Add Pay Schedule option.

- Save after selecting the appropriate details.

Are you a user of QB Desktop? Don’t fret, we’ve got you with the next section.

Setting Up Pay Schedule in QuickBooks Desktop

To set up a pay schedule in QuickBooks Desktop, follow the steps mentioned.

- Note down the important payroll information for the employees.

- In the Employees menu, select the Payroll Center option.

- Tap on the Pay Employees option.

- Under the Pay Schedules menu, select New.

- When the ‘What do you want to name this payroll schedule?’ tab appears on the screen, then gives the name to the table.

- Under the ‘How often will you pay your employees on this schedule?’ drop-down menu, choose the frequency of payment for the payroll schedule.

- To choose a pay schedule for employees as per the pay schedule: Daily, Weekly, Biweekly, Monthly, Quarterly, or Annually, then:

- Write the pay period and the end date.

- The date that should be visible on the paycheck corresponding to the pay period.

- Set up the paychecks’ date and the pay end date after opting for semimonthly.

- Hit OK.

- Check the pay schedule that should be made for the employees with the same pay scale.

- Choose ‘Yes’ if the user wants to assign payroll for all employees.

- Choose ‘No’ if users want to assign the pay frequency manually.

- Once you complete the steps, payroll can be viewed in the table under the Create Paychecks tab.

This was all about setting up your payroll schedule in QuickBooks Desktop.

Procedure to Update the Payroll Schedule in QuickBooks

While setting up the payroll, the pay period and dates can be adjusted according to the employee’s details. The payroll process, including the date and check date, can be modified to account for transmitting lead times and federal holidays if you use Direct Deposit or QB Desktop Payroll Assisted. There are two important reasons why users should modify their payment schedule:

- If there is a company-wide payroll adjustment.

- If the company has added a new type of employee who requires a different compensation structure.

To implement the things mentioned above, follow the steps:

- Navigate to the Payroll Center under the Employees tab.

- Under the “Create Paycheck” option, select the payroll schedule that you want to update.

- Hit Edit Schedule after selecting the Payroll Schedules from the list.

- Perform the needed changes in the Edit Payroll Schedule tab.

Now, let’s discuss how to set up a payroll schedule for a specific employee.

Setting Up a Payroll Schedule for An Employee in QuickBooks

For setting up a payroll schedule for an employee, follow these steps:

- In the Employees tab, select Employee Center.

- Double-tap on the employee’s name.

- Choose the Payroll Schedule menu from the Payroll Info tab.

- Select the Payroll Schedule you want to assign to the employees and save it by pressing OK.

Let’s now learn how to deactivate or delete a payroll schedule in QB.

Steps to Deactivate or Delete the Payroll Schedule in QuickBooks

You can mark the status of the payroll schedule as inactive instead of deleting it. This prevents you from creating a new payroll schedule and allows you to activate it whenever needed. Follow these steps to deactivate the pay schedule:

- Choose Employee Center under the Employees tab.

- Select the payroll schedule that requires an update.

- Tap on Edit Schedule from the Payroll Schedules drop-down menu.

- Select OK after you have set the Schedule as inactive.

To delete the entire payroll, follow the steps outlined below.

Step 1: Remove Employees You want to Delete from Payroll Schedule

- Choose Payroll Center under the Employees menu.

- Double-tap on the employee’s name.

- Activate the Payroll Info.

- Verify if the schedule listed in the Payroll Schedule column is the one you want to delete. Clear the field or update the employee’s field in the table.

- To verify the payroll schedule for each employee follow the steps below.

Step 2: Delete the Payroll Schedule

- Choose Payroll Center under the Employees tab.

- Go to the Pay Employees tab.

- Choose the payroll schedule you want to delete from the Create Paychecks table.

- Opt for “Delete Schedule” from the Payroll Schedules drop-down menu. If a pop-up appears saying you cannot delete or make a payroll schedule inactive, then verify by following step 1.

- Then save the changes after hitting OK on the keyboard.

Explore the steps to cancel and reprocess a QB payroll schedule in the following section.

How do I Cancel and Reprocess a QuickBooks Payroll Schedule?

The paychecks should be completed by 5:00 p.m. (Pacific Time). It should be done two banking days prior to the date of the paycheck. Here is the information for users to follow before stopping the direct deposit in QuickBooks:

- Once the direct deposit has been processed for ACH, it can no longer be stopped by QuickBooks.

- The offload time for Direct Deposit’s ACH processing is 5 p.m., two working days prior to the paycheck date.

- If you cancel the Direct Deposit paycheck in QuickBooks Desktop and transmit it to Intuit after offload time, then it will not prevent the Direct Deposit from posting to the employee’s bank account.

To review the payroll status, the user must navigate to the Account Maintenance page and follow the steps below.

- Under the Employee’s menu, go to the Sign-in section and select My Payroll Service and Account/Billing information. Then, access your account screen and enter the necessary details, such as your email address, user ID, and password.

- Tap on the View Payroll Activity option in the Direct Deposit section to write the DD pin.

- Lastly, monitor the payroll transmission with the employee’s required check.

If the status is not visible as ‘Payroll Processed’, the user can proceed by canceling the checks. Create a new payroll with the correct pay date by following the steps below.

Cancel a Direct Deposit Paycheck

- In the menu bar, select the Employees tab and tap the Edit/Void Paychecks menu.

- Edit the ‘Show paychecks‘ to include the dates of the paychecks that need to be cancelled/voided, and then press the Tab key on the keyboard.

- Choose Void and hit YES, and hit Void again.

Send Payroll and Direct Deposit Paycheck

- Head over to the Employees menu and tap on Send Payroll Data, then head over to the Send/Receive Payroll Data window.

- Choose View to review the direct deposit paychecks before sending them, and tap Send All to send the DD.

- Then, enter the Direct Deposit PIN, select OK, and if you see the “QuickBooks can’t find the following account“ message, then follow these steps:

- If the direct deposit bank account has just changed, select the account to use for payroll fees from the Accounts list.

- After that, select Payroll Service Asset Account from the Accounts drop-down when you’re sending a zero payroll after deleting a paycheck. Please note that QuickBooks uses this account to post any tax credits or overpaid taxes resulting from the void.

This was about cancelling and reprocessing a QuickBooks payroll schedule.

Quickview Table for Change Payroll Schedule in QuickBooks

Tabulated below is a summary of the blog that provides a concise overview of changing the payroll schedule in QuickBooks.

| Description | Changing the payroll schedule in QuickBooks is a solution to ensure your employees are paid on time, whether it’s weekly, monthly, or bi-monthly. |

| Things to keep in mind | When changing the pay schedules, ensure that you set up dates for paying employees according to the new schedules. Set up the correct dates since the paychecks should be processed 2 days prior to the payment. |

| How to Change the Payroll Schedule for Employees? | To change the payroll schedule for employees, navigate to the Payroll tab and then select the Employees option to modify the pay schedule under the Employment Details section of the employee. |

Conclusion

In this blog, we have covered the top ways to change payroll schedules in QuickBooks. Additionally, we have outlined the steps that will guide you through the process of making changes in QBDT and QBO. Moreover, we have also discussed how to cancel and delete the deposit paycheck for the employees. If you still need assistance with setting up payroll for your employees, please don’t hesitate to contact our experts. Dial +1(855)-510-6487.

Frequently Asked Questions (FAQs)

How do I change the dates of my payroll in QuickBooks Online?

To change the payroll dates in QBO, follow the steps below.

1. Move to the Payroll tab and then click Employees.

2. Choose your employee.

3. Under ‘Employment details‘, choose the ‘Start‘ or ‘Edit‘ option.

4. From the Pay Schedule menu, choose the pay schedule for the employee to be processed.

5. Click on “+ Add Pay Schedule” to create a new pay schedule.

6. Hit Save after selecting the correct fields.

How can I modify QuickBooks Online Payroll’s Pay Period?

Modifying the QuickBooks Online can be done by firstly moving to the Gear icon, choosing Payroll Settings, and then opting for Pay Schedules in the QBO. To alter the pay period, select the desired period and schedule the corresponding date for the change.

How to Update Payroll Schedule in QB?

Update the Payroll Schedule in QuickBooks by following these steps:

1. Access Payroll Settings:

2. Edit Pay Schedules

3. Set Pay Schedule Details

4. Review and Confirm.

5. Inactive Pay Schedules.

6. Update Employee Pay Frequency.

7. Adjust Future Dates.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.