Last Updated on November 20, 2025

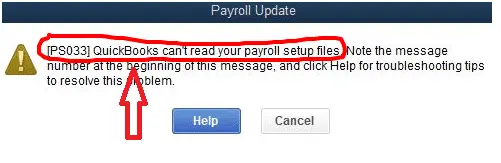

If there is damage in the QuickBooks Payroll Setup (CPS) folder, it can lead to the following error when updating payroll:

| “QuickBooks can’t read your payroll setup files. [Error PS033]” |

However, that is not the only reason for QuickBooks error PS033; there’s a lot more to the story. To resume sending paychecks, it is important to update the tax table. To do so, it is imperative to resolve the error.

In this blog, we will explore all the reasons why you run into QuickBooks error PS033 and take you through expert-recommended ways to resolve it.

Why Can’t You Update QuickBooks Tax Table Due to PS033?

Here are different factors that can give way to payroll update error PS033 in QuickBooks Desktop. Let us explore them one by one.

- QB Desktop program is either damaged or incompletely installed

- Company file data is damaged or has other issues

- The PSID entered in the company file is incorrect

- Windows registry or components are damaged or missing

- QuickBooks payroll subscription is either inactive, expired, or paused

- The Employer Identification Number (EIN) is either incorrect or invalid

- There is more than one active payroll in the inactive direct deposit agreement

- QuickBooks is outdated or incompatible with the operating system

- The service key is incorrect

- Intuit file copy service might not be running

However, this list is not exhaustive, and the error can stem from other causes as well.

Top Ways to Troubleshoot QuickBooks Error PS033 When Updating Payroll

Now, let us go through several proven ways to resolve QuickBooks error PS033 when updating the payroll tax table. Carry out these solutions to eliminate the problem from the root.

1. Update the Operating System and QuickBooks Desktop

Whichever operating system is installed on your computer, be it Windows or MacOS, update it. After that, update the QuickBooks Desktop application.

2. Check the Payroll Service Status

Check your payroll service status in QuickBooks and make sure it is active. Here are the steps on how to do that:

- Firstly, close the QuickBooks company file and restart the computer.

- Launch QuickBooks, open the Employees menu, and choose My Payroll Service.

- Select Manage Service Key.

- Check the Service Name and make sure it is correct. Moreover, ensure the Status is Active.

- Now, select Edit and make sure the service key number is correct. If you need to make changes to it, please do so.

- Tap on Next, unmark the checkbox for Open Payroll Setup, and choose Finish.

Now, download the QuickBooks payroll update.

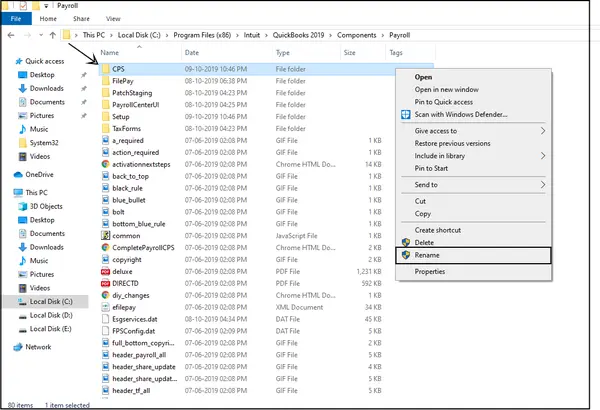

3. Change the Name for QuickBooks CPS Folder

Renaming the CPS folder can help you resolve the QuickBooks can’t read your payroll setup files error PS033.

- Firstly, open the QuickBooks CPS folder. The location for it usually is: C:\Program Files\Intuit\QuickBooks 20nn\Components\Payroll\CPS

- (Note: nn in the above line will depend on the QuickBooks version year, such as QuickBooks 2021 or 2022.)

- Now, right-click on the folder and change its name to CPSOLD.

Finally, resume the payroll operation that gave you an error earlier.

4. Disable the User Account Control (UAC) in Windows

If you can’t install the QuickBooks payroll update, try disabling the User Account Control (UAC) feature first.

- Type Control Panel in the search box beside the Start menu and open it.

- Tap on User Accounts and choose Classic view.

- Click on Change User Account Control Settings.

- (Note: If you see a pop about UAC, tap on Yes).

- Slide the bar, set it to Never Notify, and choose OK. This will disable the UAC.

If you see a prompt, choose Yes and then restart the computer. Now, retry the payroll update.

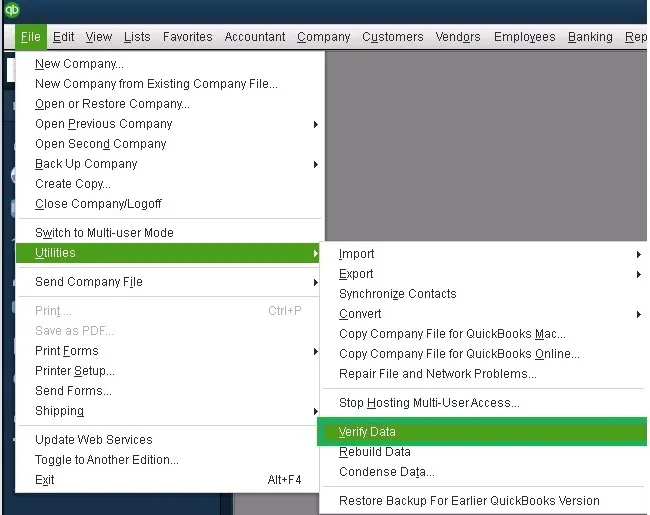

5. Verify and Rebuild the Company File

Issues in the company file can also lead to the payroll update error. Therefore, verify and rebuild the company file to check for issues and resolve them.

If, however, you continue to see the QuickBooks error code PS033, try the next solution.

6. Boot the Computer in Safe Mode

Safe mode eliminates other programs and services running in the background that can interrupt QuickBooks’ operations. Here is how to boot your computer in safe mode:

- Close all programs and shut down the computer

- Then, while starting it, press and hold the Shift key.

- From the list of options you see, choose Safe Mode.

Install QuickBooks payroll update in safe mode and then switch back to normal mode.

7. Install FCS Configuration

To resolve QuickBooks error PS033, enable the Intuit File Copy Service (FCS) by following the steps below:

- Launch the Run window by pressing the Windows + R keys together.

- Enter COMPMGMT.MSC into the Run box and choose OK.

- From the Computer Management Window, choose Services and Applications.

- Mark the Services.

- Scroll down to find the Intuit QuickBooks FCS and double-tap on it.

- Go to Startup type and choose Manual.

- Tap on Apply, followed by OK.

In the end, install the payroll updates.

Conclusion

This was all on troubleshooting QuickBooks error PS033 when updating the payroll tax table. However, if the problem persists, configure the Windows firewall and antivirus to allow QuickBooks through. Moreover, check the internet settings as well. For better assistance, speak to a QuickBooks expert. They will resolve the issue for you and help you resume sending paychecks. Dial +1(855)-510-6487 now!

Frequently Asked Questions

What are QuickBooks PSXXX errors?

QuickBooks error PS038, PS033, PS101, PS036, etc are payroll update errors. The meaning of these errors is very obvious — they arise when you try to update QuickBooks Desktop payroll, or in other words, the tax tables.

What is the error code PS033 in QuickBooks Desktop?

Error code PS033 is an error that arises when updating payroll in QuickBooks Desktop. It is triggered by an outdated operating system, an inactive payroll subscription, User Account Control (UAC) restrictions, third-party programs interfering with QuickBooks processes, etc.

How do I fix QuickBooks error PS033 when updating payroll?

To resolve QuickBooks error PS033 when updating payroll, enable the Intuit File Copy Service, boot the computer in safe mode, verify and rebuild the company data, rename the CPS folder, and update QuickBooks software and the operating system.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.