Last Updated on November 20, 2025

Before you send paychecks, you would need to update the tax table to get the latest tax rates and ensure correct tax calculations. However, while updating payroll, you can come across QuickBooks error PS101, with an error message like this:

| “Error code PS101: Payroll update didn’t complete successfully, try again.” |

Resolving this error will enable you to resume sending paychecks, but first, you will need to understand the root causes. In this blog, we will explore different reasons for QuickBooks payroll error PS101 and expert-recommended ways to fix it.

Possible Reasons for Payroll Update Error PS101

Here are some common reasons why you can’t update payroll due to error code PS101 in QuickBooks Desktop:

- There might be damage to the CPS folder

- Internet security or Firewall settings might be correct

- Your system might have multiple installations of the same version of QuickBooks Desktop

- The application cannot connect to the server, or the server is under maintenance

- Your network connection might be poor or unstable

- QuickBooks program might be damaged, outdated, or incorrectly installed

- There is damage or corruption in the Windows registry, Microsoft components, or QB files of installation

Now that you have an understanding of the reasons for PS101, let us see how to fix it.

Top Ways to Troubleshoot QuickBooks Error PS101

To resolve QuickBooks error PS101, there are a handful of things you can try, such as verifying the payroll service subscription, checking the registration and activation status of the application, running Quick Fix my Program and File Doctor, and configuring the Firewall and antivirus settings.

Let us do so one by one. However, before that, update Windows or the operating system you use.

1. Ensure the Payroll Service Subscription is Active

QuickBooks payroll service subscription must be active for you to be able to get tax table updates. Let us check to make sure that is correct. However, first, close all programs and restart the PC.

- Launch QB Desktop and open the Employees menu.

- Choose My Payroll Service, followed by Manage Service Key.

- Check the Service Name and the Status. The status should be Active, and the Service Name should be correct.

- Choose Edit to check the service key number and verify that it is correct. If it is not, make the required changes.

- Click on Next, unmark the checkbox for the Open Payroll Setup box, and finally, choose Finish.

The application will get the latest tax table updates to your computer. However, if it fails and gives a QuickBooks payroll update error PS101, check QuickBooks registration.

Related Post: QuickBooks Error 181016 or 181021 – Troubleshooting Guide

2. Check if the QuickBooks Application is Registered and Activated

We need to check and make sure that QuickBooks Desktop is registered and activated.

- Press the F2 key to bring forth the Product Information window.

- Next to the license number, ensure that you see Activated.

However, if you find that the status is not activated, register the QB Desktop application. Then, update QuickBooks, followed by the tax table.

3. Utilize Quick Fix my Program and Program Diagnostic Tool

Although a payroll error doesn’t directly connect with a damaged program, several times an issue with the program leads to QuickBooks errors. To resolve that, you can take the help of QuickBooks Tool Hub. Before following the steps below, download and install QuickBooks Tool Hub.

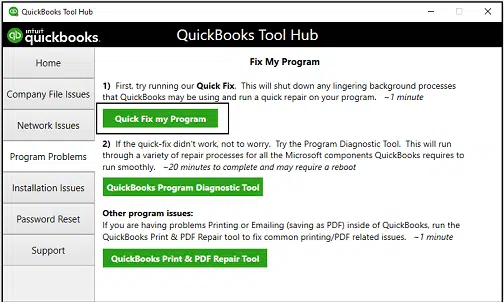

- Open QB Tool Hub, followed by the Program Problems tab.

- Click the button for Quick Fix my Program.

- Now, from the Program Problems tab, choose QuickBooks Program Diagnostic Tool.

Give the tool a while to repair the QB program. Once it is done, update the QuickBooks Desktop tax table. If it fails, move to the next step.

4. QuickBooks Install Diagnostic Tool

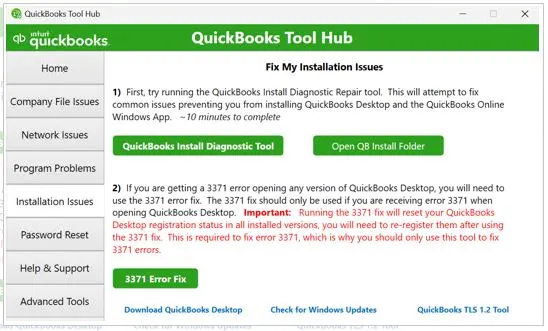

If the software is missing crucial installation files or the Windows is missing Microsoft components, or such files or components have gone corrupt, you will find problems when installing the software or working on it. QuickBooks Install Diagnostic Tool repairs the damaged installation files or Windows registry.

- Open QB Tool Hub and select Installation Issues.

- Select the button for QuickBooks Install Diagnostic Tool.

Wait for some minutes before the tool appears and resolves installation issues, which will further take 10 to 15 minutes. Thereafter, restart the PC and then try installing the payroll update. If you see QuickBooks error PS101, configure the firewall and antivirus program.

5. Create Firewall and Antivirus Exceptions for QuickBooks

Windows Firewall should allow QuickBooks to access certain ports. Check and ensure that the Firewall is blocking QuickBooks.

Moreover, the antivirus or security program can block QB programs from running, quarantine them, or prevent them from connecting to servers online.

Therefore, create QuickBooks exemptions to your antivirus.

6. Launch Reboot.bat File as an Administrator

Re-registering the .DLL file can resolve QuickBooks error PS101 and other payroll update issues. However, to do so, run the reboot.bat file.

- Close all the windows of QuickBooks Desktop. Close any programs that you don’t need either.

- Right-click on QuickBooks Desktop and choose Open File Location.

- Look for the reboot.bat file, right-click on it, and select Run as administrator.

The utility will now repair and re-register the mentioned components. Once done, resume the operation.

Related Post: Fix QuickBooks Error 17337: Can’t Download the Payroll Update

7. Install QuickBooks Updates in Selective Startup Mode

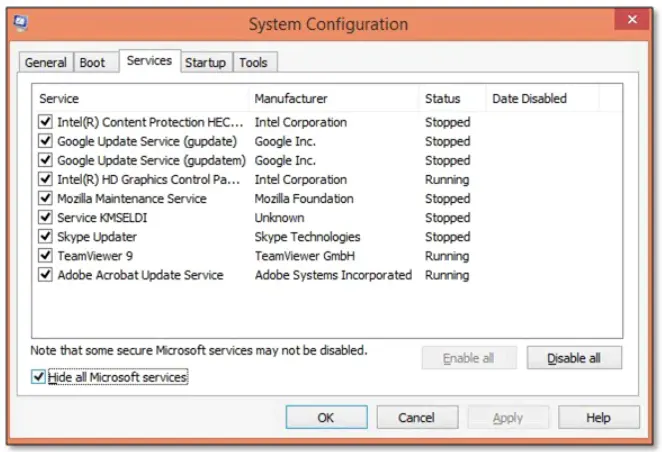

Third-party programs and background processes can interrupt the installation of QuickBooks or its updates. To address that, perform the installation in Selective Startup mode.

- Open the Run command by searching for it in the Start menu.

- Type MSConfig into the Run box and hit Enter.

- From the General tab, select Selective Startup followed by Load System Services.

- Next, from the Services tab, select the option to Hide all Microsoft Services.

- Choose Disable All, and then deselect the option to Hide all Microsoft services.

- Browse through the services and double-check to make sure that you have selected Windows Installer.

- Choose OK, proceed to the System Configuration window, and choose Restart.

Finally, install QuickBooks updates.

Know More about: Troubleshooting QuickBooks Error 61686/ EXEAdapter Error

Conclusion

This was all on why QuickBooks error PS101 shows up when installing tax table updates. We also discussed detailed troubleshooting methods to fix the error.

However, if you continue to face the challenge, it would be best to speak to a QB expert. Dial +1(855)-510-6487!

Frequently Asked Questions

How to manually update QuickBooks Payroll?

To update QB manually, launch the application and sign into your company file. Open the Employees menu, followed by Get Payroll Updates. Lastly, tap on Payroll Update Info.

Why is my QuickBooks not updating?

If QuickBooks is unable to update the software or payroll, check the internet security settings and your network connection. Ensure that the firewall is not blocking QuickBooks and that the antivirus or security software doesn’t prevent QB programs from running.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.