With the help of QuickBooks payroll tax tables, you can calculate and report taxes and ensure compliance with Internal Revenue Services and Tax agencies. Moreover, suppose you’re eyeing the most current and accurate rates and calculations for supported provincial and federal tax tables, payroll tax forms, EFILE options, etc.. In that case, you must ensure the Update Tax Table In the QuickBooks desktop. To do so, you must have an active QB Desktop Payroll subscription.

Update the tax table every time you pay your employees. However, if you have a QB Online Payroll subscription, the updates will be automatically installed.

By now, you will have understood the benefits of updating QuickBooks Payroll Tax Tables. Before you proceed with the update process, consider the factors mentioned in the next section.

Cautionary Steps Before You Update Payroll Tax Tables In QuickBooks

Before you begin with the QuickBooks Desktop Payroll tax table update process, make sure you take into consideration the below-given factors:

- If you are planning to update the tax table, make sure to have an active payroll subscription.

- Ensure to have an updated version of the QuickBooks desktop and update your QB Desktop if required.

- It’s essential to have a stable internet connection while updating the payroll tax table.

- We would suggest you download the tax table at least within 45 days. Alternatively, you may update the same each time you make a payment to your employees.

- If you want to receive the QuickBooks Payroll Tax Table Update automatically, you must turn on the automatic updates feature on the QuickBooks desktop.

How To Verify QuickBooks Payroll Tax Table Version?

The current payroll tax table version 11932003 on QuickBooks Desktop 2023 and 11933003 on QuickBooks Desktop 2024 were released on December 19, 2023, and are effective from January 1, 2024, to June 30, 2024. On the other hand, the latest Payroll Update is 22404, released on January 25, 2024. Based on these stats, you can easily verify whether you have the latest payroll tax table version. Now, let’s follow the below-given steps to verify QuickBooks payroll tax tables. follow the below-given steps to verify QuickBooks payroll tax tables. Downloading the Latest Tax Table in QuickBooks Desktop

Not sure which version you have? Follow the below-given steps to verify QuickBooks Payroll Tax Tables.

- Open the QuickBooks application and go to the Employees menu.

- From there, choose My Payroll Service followed by Tax Table Information.

- The first three numbers signify your tax table version under ‘You are using tax table version’. It should read as 11732003 or 11733003. However, if you have already updated your product earlier this year, you would have the release 117.

Note: Ensure you use QuickBooks Desktop 2023, QuickBooks Desktop 2024, QuickBooks Desktop Enterprise Solutions 23.0, or QuickBooks Desktop Enterprise Solutions 24.0 to download this particular tax table update.

How To Download QuickBooks Latest Payroll Tax Table Updates?

Important: If you have your employees in Nova Scotia, you have to calculate the taxes differently because of the recent changes made to the TD1. Follow the article on Changes to the 2018 Nova Scotia Personal Tax Credits Return for detailed instructions.

All things considered, the easiest way to stay current with the latest payroll tax table updates is to set up automatic updates so that QuickBooks downloads them automatically as soon as they become available. However, if you prefer another approach, you can opt to download the updates manually. Therefore, follow the steps given below to ensure you’re getting the latest payroll tax table updates through the QuickBooks application.

- Open the QuickBooks application and go to the Help menu. From there, click on Update QuickBooks.

- Now, go to the Update Now tab and select Get Updates.

- When the download completes, exit QuickBooks Desktop.

Learn How to Download the Latest Tax Table Updates for QuickBooks

In this particular section, we have detailed the steps to download the latest payroll tax table update for QuickBooks. Follow the steps below:

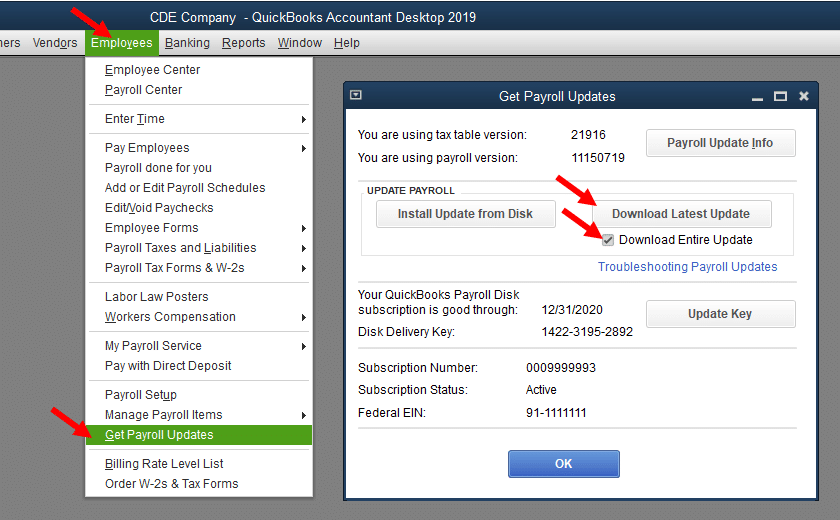

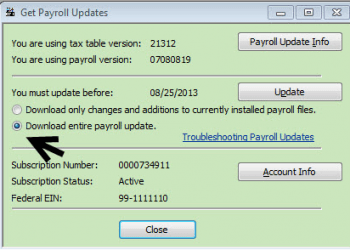

- Open QuickBooks, move to the Employee menu and select Get Payroll Updates.

- In the Get Payroll Updates window, check the Download Entire Update checkbox.

Lastly, hit OK to conclude. An informational window will appear when the download is complete.

What Features Can Be Availed If You Download the Latest Payroll Tax Table

For the January 2024 tax table update, there are multiple TD1 changes from the July 2023 payroll tax table update. See the table below to get the latest QuickBooks Desktop tax table information.

Here are the Current & Historical TD1, CPP, and EI Amounts

| Effective Date | 7/1/2023 | 1/1/2023 |

| Tax Table version # | 118 | 117 |

TD1 Amounts

| Federal | 15,000 | 15,000 |

| AB | 21,003 | 21,003 |

| BC | 11,981 | 11,981 |

| MB | 19,145 | 10,855 |

| NB | 12,458 | 12,458 |

| NL | 10,382 | 10,382 |

| NS | 11,481 | 11,481 |

| NT | 16,593 | 16,593 |

| NU | 17,925 | 17,925 |

| ON | 11,865 | 11,865 |

| PE | 12,000 | 12,000 |

| QC | 17,183 | 17,183 |

| SK | 17,661 | 17,661 |

| YT | 15,000 | 15,000 |

| ZZ (employees outside Canada) | 0 | 0 |

| Effective Date | 1/1/2023 | 7/1/2022 |

| Tax Table version # | 118 | 117 |

Canada Pension Plan (CPP) – outside Quebec

| Maximum Pensionable Earnings | 66,600 | 66,600 |

| Basic Exemption | 3,500 | 3,500 |

| Contribution Rate | 5.95% | 5.95% |

| Maximum Contribution (EE) | 3,754.45 | 3,754.45 |

| Maximum Contribution (ER) | 3,754.45 | 3,754.45 |

Employment Insurance (EI) – outside Quebec

| Maximum Insurable Earnings | 61,500 | 61,500 |

| Premium EI Rate (EE) | 1.63% | 1.63% |

| Premium EI Rate (ER) (1.4*EE) | 2.28% | 2.28% |

| Maximum Premium (EE) | 1,002.45 | 1,002.45 |

| Maximum Premium (ER) | 1,403.43 | 1,403.43 |

| Effective Date | 7/1/2023 | 1/1/2023 |

| Tax Table version # | 118 | 117 |

Quebec Pension Plan (QPP)

| Maximum Pensionable Earnings | 66,600 | 66,600 |

| Basic Exemption | 3,500 | 3,500 |

| Contribution Rate | 6.40% | 6.40% |

| Maximum Contribution (EE) | 4,038.40 | 3,776.10 |

| Maximum Contribution (ER) | 4,038.40 | 3,776.10 |

Employment Insurance (EI – Quebec only)

| Maximum Insurable Earnings | 61,500 | 61,500 |

| Premium EI Rate (EE) | 1.27% | 1.27% |

| Premium EI Rate (ER) (1.4*EE) | 1.78% | 1.78% |

| Maximum Premium (EE) | 781.05 | 781.05 |

| Maximum Premium (ER) (1.4*EE) | 1,093.47 | 1,093.47 |

Quebec Parental Insurance Plan (QPIP)

| Maximum Insurable Earnings | 91,000 | 91,000 |

| Contribution Rate (EE) | 0.49% | 0.49% |

| Contribution Rate (ER) (1.4*EE) | 0.69% | 0.69% |

| Maximum Contribution (EE) | 449.54 | 449.54 |

| Maximum Contribution (ER) (1.4*EE) | 629.72 | 629.72 |

| Commission des normes du travail (CNT) | ||

| Maximum earnings subject to CNT | 91,000 | 91000 |

How Can You Resolve Payroll Update Issues?

If you have outdated TD1 amounts even after installing the Latest QuickBooks Payroll Tax Table Updates, correcting them is crucial. Ensuring your payroll tax table is up-to-date is a cakewalk with the following checks.:

- You need to check if the update is downloaded on or after the tax table effective date. For example, if you downloaded tax table version 118 on June 15, 2023, you won’t see the updated amounts until the tax table becomes effective on July 1, 2023.

- After June 15, 2023, once you have downloaded the product update containing the new tax tables, the user will need to start a payroll or open and close QB desktop for TD1 amounts to update

- Have you ever adjusted the TD1 amounts manually at any time in the past or after setting up a new employee? If yes, then, in that case, the new tax table will not override any previously adjusted amounts. Thus, you have to update the TD1 amounts in the future manually.

- Have you set up any of your employees over the basic TD1 amounts? QB Desktop updates the TD1 amounts on its own only for those employees who have a basic amount for the previous tax tables.

Get Technical Help?

We hope the information provided in this blog has helped you Install QuickBooks Payroll Tax Table Update. However, if you still encounter any issues while updating the payroll, place a call on the Asquare Cloud Hosting Helpline Number. Our experts are available round the clock to help you get your QB working error-free.

FAQs On QuickBooks Payroll Tax Table Update

QuickBooks payroll tax table updates are available on Intuit’s official website. Moreover, you can also download them directly from the QuickBooks Desktop application.

a. Open the QuickBooks Desktop application

b. Click on the Employees menu and select My Payroll Service

c. Now, choose Tax Table information

d. The three digits in the beginning denote the tax table update version.

e. Check the latest payroll news and updates or Payroll update info

f. Click on Download entire update followed by Update

g. Once the download is finished, restart the QB Desktop.

QuickBooks regularly releases new tax table updates with revised federal and provincial tax rates, forms, e-file options, etc. Updating the QuickBooks Desktop tax table is important for accurate tax calculations and compliance with the laws. However, to download the recent QuickBooks Payroll Tax Table Update, you need to have an active QB payroll subscription

QuickBooks updates the tax codes and tax basis, as when changes the tax basis, HRMC also sends the tax codes. For the users of QuickBooks Online payroll, QuickBooks automatically updates the tax tables.

It is quite easy to update the payroll account in QB Desktop Payroll Basic, Enhanced, or Standard. To do so:

a. Click on the Employees menu, followed by my payroll service

b. Now, choose Accounts/Billing information

c. Login to your Intuit account using the credentials

d. Navigate to the payroll info section and enter the payroll pin

e. Now, fill in the bank account information and choose update.

You should regularly check for payroll updates every month. Moreover, ensure to update your QuickBooks payroll tax table whenever there is a significant update or before depositing paychecks.

Oriana Zabell, a professional cloud engineer, has over three years of experience in desktop, online QuickBooks support and troubleshooting. She is currently working as a cloud hosting consultant with Asquare Cloud Hosting. She loves to read and write about the latest technologies such as cloud computing, AI, DaaS, small businesses, manufacturing. When not writing, she is either reading novels or is indulged in a debate with movie fanatics.