Last Updated on November 20, 2025

When you are reconciling in QuickBooks, you might find that the beginning balance is off. This can happen both when you are reconciling for the first time and when you have already reconciled in the past. The problem of QuickBooks reconciling the beginning balance wrong often stems from an incorrect opening balance. In this guide, we will tell you how to resolve that.

Opening Balance Vs Beginning Balance in QuickBooks

Opening balance and beginning balance are two things that might sound similar, but in the context of QuickBooks, they are not the same.

| What is the Opening Balance? | What is the Beginning Balance? |

| When you begin with QuickBooks accounting, you are required to connect your bank account to the application. The opening balance is the amount your bank account had when you first began accounting. You can understand it as the initial balance at the start of the first accounting period. | Beginning balance is the amount or balance at the beginning of an accounting period. It is often the closing balance of the last accounting period and is passed on to the following accounting period. Thus, the closing balance of the last accounting period will be the beginning balance of the following accounting period. |

Why is QuickBooks Reconciling the Beginning Balance Wrong?

An incorrect beginning balance is one of the many QuickBooks reconciliation discrepancies a user faces. There are various reasons why you might find the Beginning Balance to be zero or incorrect when beginning with reconciliation and selecting an account to reconcile. It could be that:

- The account balance set up wasn’t right, or there was no account balance set up

- You have voided, modified, or deleted the transactions that had been reconciled and cleared

- The company file might have been converted from one version of QuickBooks to another

- There could be damage to your company’s file data

To correct the beginning balance in QuickBooks Desktop and Online, the steps will differ. Therefore, there is a need for separate sections for the two.

Section 1: Correcting the Beginning Balance in QuickBooks Desktop

Let us show you how to correct a zero balance or an incorrect balance in QuickBooks Desktop.

A. Correcting a Zero Balance

The opening balance is allowed to be recreated only during the first reconciliation. Therefore, if it is your first reconciliation, you can edit the opening balance. This will be done in two steps – first, you create a journal entry, and then you reconcile.

Step 1: Creating the Required Journal Entry

The correct date and amount that you desire in the Begin Reconciliation window, you will need to enter that into QuickBooks as a form of journal entry. It can be done in this manner:

- Open the Company file and tap on Make General Journal Entries.

- Now, change the date; set it to the right statement date of the beginning balance.

- Tap on the Account dropdown menu and choose the account you want.

- In the Debit column, type in the correct opening balance.

- Tap on Opening Balance Equity and choose Save.

Step 2: Reconciling to Correct the Beginning Balance

Next, you will be required to reconcile and correct the beginning balance.

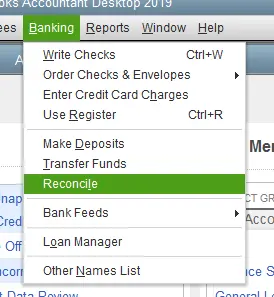

- Open the Banking menu and tap on the Reconcile option.

- Tap on the Account dropdown menu and choose a suitable account.

- Provide the statement date and ending balance; it should match the journal entry you just made.

- Tap on Continue.

- Choose the Journal Entry in the Deposits and Other Credits section.

- (You should be able to see the amount shown for the Difference as zero.)

- Finally, select Reconcile Now.

This was all about correcting a zero balance in QuickBooks Desktop.

B. Correcting an Incorrect Balance

Now, let us show you how to correct an incorrect balance. This can be caused by cleared transactions being edited or voided.

1. Find Transactions that Can Cause a Reconciliation Discrepancy

Reports like the Reconcile Discrepancy report, the Audit Trail report, and the Previous Reconciliation report exist to help you find transactions that give rise to reconciliation problems.

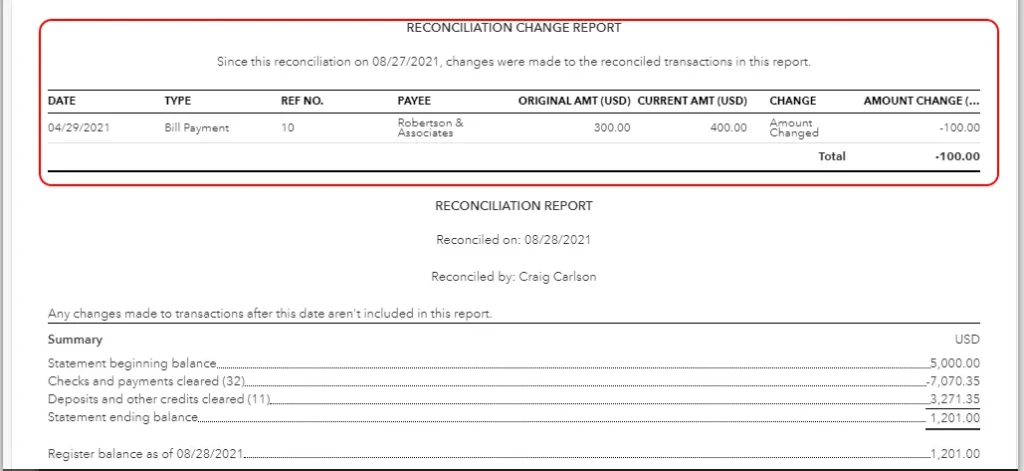

a. Run the Reconcile Discrepancy Report

You can utilize the reconcile discrepancy report to find the transactions that cause a reconciliation problem.

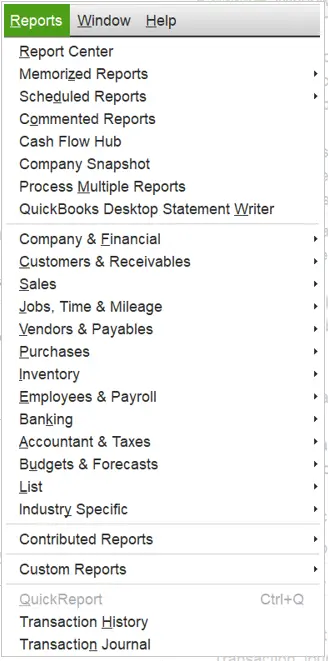

- Open the Reports menu, tap on Banking, and then select Reconciliation Discrepancy.

- Choose the Account, and then tap on OK. You’ll see a list of transactions to which any changes were made since you last reconciled.

- This report will help you find the transaction(s) that led to a problem.

In case you find a discrepancy, you need to note two things: the transaction date and the Entered/Last Modified. This will give you an idea of when the change happened.

b. Run the Audit Trail Report

The Audit Trail report will help you find all the transactions that were changed over a period of time.

- Open the Reports menu, choose Banking, followed by Previous Reconciliation.

- Choose the account you need to reconcile.

- Now, choose the statement date that is the latest. Tap on Transactions cleared at the time of reconciliation. (The report will show as a PDF file.) Now, choose Display.

- Take a note of the date when the statement and the reconciliation were created.

- Open the Reports menu, click on Accountant & Taxes, followed by Audit Trail.

- Tap on the Account filter and choose the account you wish to reconcile.

- Tap on Customize Report.

- Choose Filters, and then from the filters, select Account.

- From the Account dropdown menu, choose the account.

- Tap on Display. For the Date filter, leave the From field blank and select your statement date in the To field.

- Finally, choose OK.

- Now, for the Entered/Modified filter, choose the From date as your previous reconciliation creation date, as shown in the PDF, and the To date as today’s date.

Now, look for the transactions that you can find in the report that explains the reconciliation discrepancy you are facing.

c. Run the Previous Reconciliation Report

Note that QuickBooks Pro users can only access the last reconciliation report. Therefore, they should save a PDF copy of other reports on their hard drive to keep a copy of them. Here is how to fetch the Previous Reconciliation Report to look for discrepancies:

- Open the Reports menu, choose Banking, followed by Previous Reconciliation.

- Choose the Account and Statement Ending Date and then tap on Display.

Now, compare your report to the past statements issued by your bank or credit card.

2. Address the Discrepancy

Now, you will need to address the QuickBooks reconciliation discrepancy. This is a comprehensive process.

3. Knowing the Impact of Switching Versions

If you have switched from one version of QuickBooks to another, for example, from QuickBooks Desktop for Mac to the one for Windows, or from QuickBooks Online, you can run into reconciliation problems.

This occurs because the way reconciliation works is different in the three QB programs mentioned above.

Section 2: Correcting the Beginning Balance in QuickBooks Online

In this section, we will discuss how you can correct the beginning balance in QuickBooks Online.

1. Check the QuickBooks Opening Balance

You need to check the opening balance for the account you are facing reconciliation issues with. For instance, the opening balance might often exclude the pending transactions at the time of account creation.

Important: In case you have added transactions that are dated older than the date of the opening balance or account creation, the steps to reconcile them will differ. You will need to do that first before you continue with the steps below:

- Look for the account on the list.

- Tap on the View register.

- Look for the opening balance entry. In the Account column, you will find Opening Balance Equity.

- Note down the date and balance.

In case you had forgotten to enter an opening balance, you will need to do that first.

2. Verify the Opening Balance

The opening balance should match your real-life account. Therefore, check the opening balance and match it with the real-life account.

- Log in to your credit card or bank’s website, and look for your bank statement.

- Now, look for your account balance on the day you added your account to QuickBooks.

- Check if these two balances match.

- In case the balances match, the opening balance was set up correctly

- In case the balances don’t match, the opening balance wasn’t set up correctly, and you need to correct it.

Here is how you can correct the opening balance in QBO:

- Open QuickBooks, tap on the opening balance entry to expand the view.

- Go to the Deposit column, edit the balance, ensuring that it matches the bank records.

- Tap on Save.

Then, move to the next step.

3. Check Your Account Register

The opening balance is the only entry that should be reconciled when reconciling your account for the first time. This means that no other transaction should be reconciled. Here is how you can check that:

- Look for the account on the list.

- Go to View register, which will give you more details.

- Look for the opening balance entry. You will find the Opening Balance Equity in the Account column.

- Now, in the checkmark column, you should be able to see an R.

- Verify the other transactions. They should have either a blank entry or an R in the checkmark column.

- If you find an R on any other transactions, tap on the transaction to view.

- Tap on the box in the checkmark column. Tap on it many times until you find that the box is blank. Finally, choose Save.

Now, you can continue reconciling the account.

Conclusion

This was all about correcting the QuickBooks reconciling the beginning balance wrong on both the desktop and online versions. Hopefully, you can carry out reconciliation without a problem. If you continue to struggle with reconciliation, speak to a QB expert. Dial +1(855)-510-6487 and connect with them now!

Frequently Asked Questions

Why is my beginning balance wrong on reconciliation in QuickBooks?

There could be many reasons you find the beginning balance to be wrong when you begin reconciling in QuickBooks. It could be because the account wasn’t set up correctly or the opening balance was entered incorrectly. Moreover, another reason could be that a transaction from the last reconciliation period might have been voided or deleted.

What if my beginning balance does not match my statement?

If your beginning balance doesn’t match your statement, you need to correct it. If you don’t, you will find the beginning balance to be wrong when you start with reconciliation. Hence, locate the opening balance entry in QuickBooks, expand it, and if required, edit it from the Deposit column to make things right.

How do you correct the beginning balance of a reconciliation statement?

To correct the beginning balance of a reconciliation statement, you need to check your opening balance and make the required changes. Often, you’d need to make a journal entry for that. You can also edit the opening balance entry.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.