Last Updated on November 20, 2025

Sometimes, small businesses and accountants find QuickBooks payroll not calculating taxes. This could be because of many reasons, such as the wage limit reached, tax or payroll items set up incorrectly, outdated tax tables, etc.

In this blog, we will explore several reasons why QuickBooks payroll fails to calculate and deduct taxes and then follow that with solutions to fix the issue.

Why is QuickBooks Not Deducting Payroll Taxes?

QuickBooks tax withholding depends on many factors such as how frequently the employee is paid, taxable wage, number of dependents, and filing status.

Let us explore why payroll taxes are not automatically calculated in QuickBooks desktop.

- The total wage in an employee’s last paycheck might have been too low.

- The total annual salary might exceed the yearly limit.

- You haven’t updated your payroll tax table.

- The employee has claimed as tax exempt because of reasons like having too many dependents.

QuickBooks Payroll Not Calculating Taxes? Salient Methods to Fix That

We saw multiple reasons why, when running payroll, you might find payroll taxes not calculating in QuickBooks Desktop. However, fortunately, there are proven ways to fix that. Let us look at these solutions you should run to ensure QB payroll calculates taxes.

1. Update QuickBooks Desktop

Before you begin with comprehensive troubleshooting, the first and foremost thing you need to do is update the QuickBooks application. This act alone is often able to fix common errors users face.

Moreover, you can schedule the automatic update to ensure you are always using the latest release. Once you have done this, move on to updating the QB payroll.

2. Update QuickBooks Tax Table

Intuit periodically rolls out payroll updates with revised tax tables and tax rates. These updates often resolve many payroll issues. Therefore, we recommend you update your payroll tax table. Once done, proceed to the next step.

3. Refresh the Payroll Service

Open the QuickBooks Account Maintenance page and then carry out these steps to refresh the payroll service.

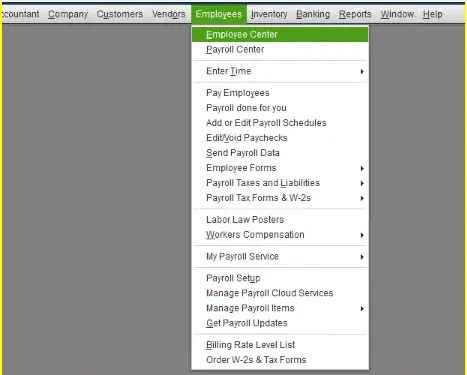

- Go to the Employees tab, scroll down to My Payroll Service, and select it.

- Select Account/Billing information.

- Provide the Intuit user ID and password.

- Review the Service Status in the Service Information section.

Important Note: In case you find that it is Suspended, keep your cursor over the Annual Billing Details section. Now, type in the credit card details.

- Finally, choose Save.

Now, check if your QuickBooks is calculating payroll correctly, as it usually should.

You May Also See: Resolve QuickBooks Error Code PS038: Can’t Run or Update Payroll

4. Check the Status of Your Payroll Subscription

To ensure QuickBooks withhold taxes, let us check the status of the payroll subscription.

- Launch QB Desktop and log into your company file.

Note: Make sure to sign in as the Primary Admin or Payroll Admin.

- Go to Employees, followed by Payroll Center.

- Now, click on the Payroll tab.

- Check the payroll service you’re using under Subscription Statuses.

Verify that the payroll status is Active.

If you find the payroll subscription inactive, you need to resubscribe. Here is how to reinitiate your payroll subscription.

- Sign into your QB company file as admin and open the Employees menu.

- Choose My Payroll Service followed by Account/Billing Info.

- Type in your Intuit Account login details and sign in. You will see the QuickBooks Account page.

- Now, under the Status field, select Resubscribe.

- QuickBooks will now guide you on how to reactivate your payroll service. Follow those instructions.

Once you have reinitialized your payroll subscription, create paychecks. If you find QuickBooks payroll not calculating taxes even now, move to the next solution.

Note: Need help calculating accurate pay for your employees? Use our QuickBooks Payroll Calculator to instantly estimate hourly or salary-based paychecks, including taxes and deductions.

5. Verify Employees’ Tax Configuration

The reason why QuickBooks is not withholding taxes might not lie with QuickBooks but with how you have set the employees’ taxes. Let us verify employees’ tax configuration and ensure everything is correct.

a.) Verify Employees’ Tax Information

If there are specific employees for whom you find payroll taxes not calculating in QuickBooks Desktop, check if their tax information is entered correctly.

- Open the Employees menu and choose Employee Center.

- Double-tap on the employee’s name.

- Click on the Payroll Info tab and choose Taxes.

Now, review all the tax information and make any changes if required.

b.) Check if the Employee is Tax Exempt

If an employee has claimed as tax exempt because they have too many dependants or if the gross wages of the employee’s last wages are too low, QuickBooks will not calculate taxes for them.

Therefore, check whether the employee in question is eligible to pay payroll taxes. Moreover, ensure that the total annual salary doesn’t exceed the salary limit because, in that case you will find QuickBooks payroll not calculating taxes.

c.) Check Whether Employees are Set to Do Not Withhold

If there is an employee that should not be tax exempt, but QuickBooks is not withholding payroll taxes for them, check whether they are set as Do Not Withhold.

- Open the Employees menu and choose Employee Center.

- Double-tap on the employee’s name.

- Click on the Payroll Info tab and choose Taxes.

- Now, in the Federal and State sections, view the Filing Status.

If the employees are set as Do Not Withhold, correct that and then create paychecks.

6. Revert Paychecks

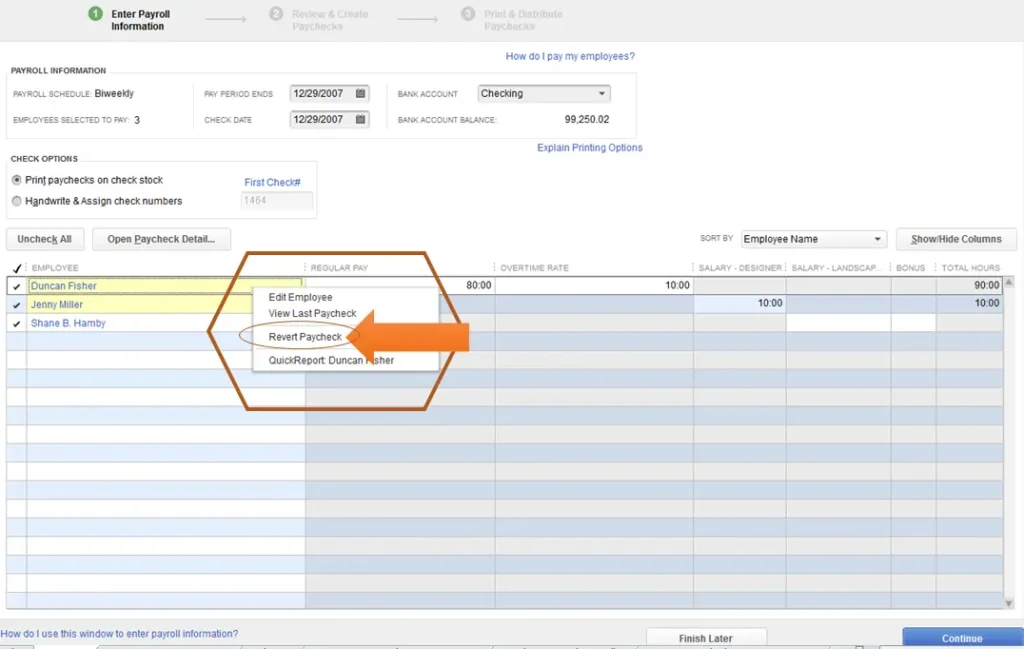

If you still find QuickBooks payroll not calculating taxes, you can revert the employee’s paycheck to refresh the employee’s payroll information.

- Launch QB Desktop and open the Employees menu.

- Select Pay Employees followed by Scheduled Payroll.

- Now, tap on Resume Scheduled Payroll.

- Right-tap the employee name to which you wish to revert the paycheck.

- Finally, choose Revert Paychecks.

This should make sure QuickBooks calculates payroll taxes for employees.

Summing It Up

This was all about why is QuickBooks payroll not calculating taxes and how to resolve that. Carry out the solutions given in this guide and if you face a problem, connect with a QB expert. They are proficient in troubleshooting accounting and technical issues in QuickBooks. Dial +1(855)-510-6487 and talk to a QB expert now!

Frequently Asked Questions

Why is QuickBooks payroll not calculating taxes?

QuickBooks might not be calculating payroll taxes if the employee is tax exempt, the tax table is outdated, or their wages don’t meet the salary limit. Let see how we can ensure QuickBooks calculates taxes with the help of this guide.

Does QuickBooks automatically calculate payroll taxes?

QuickBooks payroll automatically calculates taxes based on your preferences. This saves you huge time and allows you to focus on your core business operations.

Does QuickBooks payroll take out taxes?

QuickBooks comes with the option to automate taxes, which means the software can pay your taxes and file the forms so that you don’t have to do it yourself. However, QuickBooks Online Payroll Core doesn’t automate local taxes.

Why is my QuickBooks Payroll not calculating taxes?

QuickBooks Payroll is not calculating taxes, which in turn means the software is not properly deducting and reporting employee payroll taxes. Here are reasons why this occurs:

1. Outdated Tax Tables: QuickBooks uses tax tables to calculate taxes. If these tables are not updated, this error may pop up.

2. Incorrect Employee Settings: If an employee’s tax information is entered incorrectly in QuickBooks, the calculations will be affected.

3. Payroll Item Issues: If payroll item settings are not configured correctly, this can also impact the tax calculations.

4. Exceeded Annual Limits: Some tax withholdings have annual limits. If an employee’s earnings exceed these limits, QuickBooks may not calculate the tax correctly.

5. Software or Update Issues: Some Issues with the QuickBooks software itself, including a lack of updates, can prevent correct tax calculations.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.