Last Updated on January 16, 2026

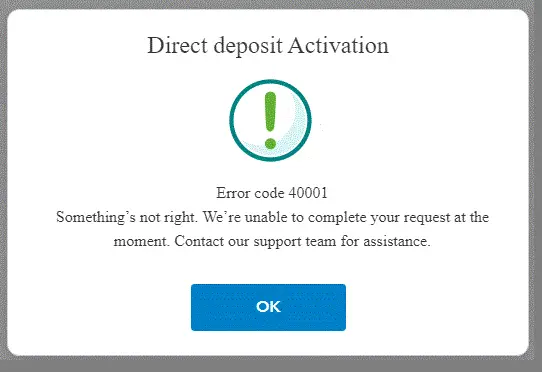

You might run into QuickBooks error 40001 when activating direct deposit. This is one of the errors that keep you from depositing paychecks. Here is what the error message might look like:

| “Error Code: 40001 Something’s not right. We’re unable to complete your request at the moment. Contact our support team for assistance.” |

If you need to send paychecks to employees, you know how the delay in depositing paychecks can affect your business and work environment (and since you are reading this blog, I assume that you do need to send paychecks and you tried to activate direct deposit). Therefore, it becomes extremely urgent to resolve payroll errors like 40001.

However, there is nothing to worry about, as we have dug out plenty of proven solutions to help you resolve QuickBooks error 40001. Therefore, go through the guide and follow the instructions as given.

If you still encounter any issues with your direct deposit, feel free to contact our experts at +1(855)-510-6487.

Reasons for QuickBooks Error Code 40001 While Activating Direct Deposit

There are several reasons why you run into error code 40001 QuickBooks desktop while activating direct deposit. Let us look at them one by one.

- You might not have logged in with the administrator account in QuickBooks.

- The QuickBooks Desktop version you are using is outdated.

- You might get the QuickBooks payroll error code 40001 when the Realm ID in QuickBooks doesn’t match the number Intuit has in the payroll system.

- The internet connection might be poor or unstable.

- QuickBooks or Windows is missing some crucial components.

Now that you have an idea of why you run into QuickBooks error code 40001 when trying to deposit paychecks, we will show you how to fix that.

Read More: QuickBooks Direct Deposit Not Working can disrupt employee payroll and cause delays. This issue may occur due to banking errors, inactive payroll subscriptions, or incorrect settings. Learn how to resolve QuickBooks Direct Deposit Not Working quickly and ensure timely payments.

What are the Prerequisites to Fix QuickBooks Error 40001?

In this section, we will discuss the things you should keep in mind before you fix the issue.

- Ensure to use a good and stable internet connection.

- Use the software as an admin.

- Check if your payroll subscription is active.

- Check if the EIN and the business name match the IRS records.

- Update your QuickBooks to the latest version.

- Turn off the firewall settings or antivirus settings.

Now that you have understood the things to maintain, let’s move ahead to the troubleshooting methods.

Expert Recommended Ways to Resolve QuickBooks Error 40001

Let us take you through the proven ways to avoid QuickBooks direct deposit error 40001 with detailed instructions. Therefore, follow the steps listed below, and if you run into a problem, do not hesitate to reach out to us.

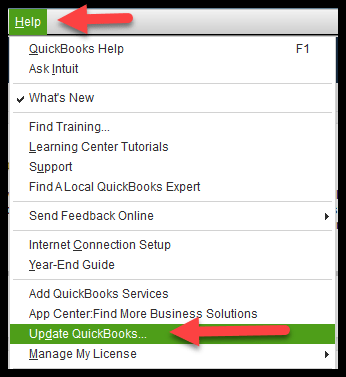

Solution 1: Update QuickBooks Desktop

Getting the latest version of QBDT can avoid most of the errors in the application. Here’s how:

- Access the QuickBooks application.

- Then, move to the Help menu.

- Click on the Update QuickBooks option.

- Tap on the Get Updates section.

- Once the download is finished, restart the application.

- Head to the Employees tab.

- Click on the Get Payroll Updates option from the drop-down menu.

- Tap on the Download latest updates option.

Once done, try activating direct deposit again and check whether the QuickBooks error 40001 you encountered earlier is resolved. However, if the error persists, proceed to the next step.

Note: It is important to regularly update the QuickBooks software and payroll tax table to ensure accurate calculations and compliance with tax laws. Keeping updates current helps prevent payroll errors. Learn how to update the QuickBooks software and payroll tax table easily.

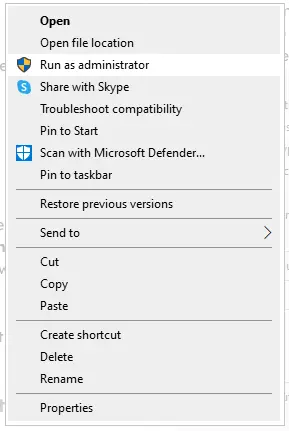

Solution 2: Launch QuickBooks Desktop as an Administrator

You might not be able to activate QuickBooks Direct Deposit if you lack the necessary permissions. Allow the admin to access the QB application with admin permissions.

- Locate the QuickBooks application on the Desktop.

- Right-click on the icon.

- Choose the Run as administrator option.

- If asked, enter the Windows admin login credentials.

- Hit Enter.

Finally, try activating direct deposit and check if it works. However, if you encounter the error, proceed to the next step.

Solution 3: Run QuickBooks Tool Hub

The tool is available in the QuickBooks Tool Hub. The first step is to download and install the QuickBooks Tool Hub.

- Access the QuickBooks Tool Hub.

- Go to the Company Files Issues tab.

- Choose the Run QuickBooks File Doctor option.

- Now, browse for the files.

- Choose the Check your file option.

- Click on Continue.

- Enter the QuickBooks admin ID and password, then tap Next.

If the issue is with the program, then try to use the Quick Fix my Program tool in the tool hub by following the steps below:

- Launch the QuickBooks Tool Hub in your system.

- Go to the Program Problems section.

- Tap on the Quick Fix my Program option.

If you get the activate direct deposit error message 40001 in QuickBooks Desktop, let us check the company file for data damage.

Solution 4: Use Verify and Rebuild Company File

Damage or corruption to a company file can lead to QuickBooks payroll errors. Therefore, let’s run the verify and rebuild utility on the company file to find the damage or corruption and resolve it.

Verify the Company Data

- Access the QuickBooks Desktop.

- Then move to the File menu.

- Tap on the Utilities tab.

- Choose the Verify Data option.

Rebuild the Company Data

- Head to the File tab in QuickBooks Desktop.

- Then go to the Utilities section.

- Choose the Rebuild Data option.

- If you haven’t created a backup for the files, create one and tap OK.

- Tap on Save.

- Go to File and select Utilities.

- Then, select Verify Data again to check for additional damage.

After doing so, try to activate the payroll direct deposit and see if it works. If QuickBooks says something’s not right when activating payroll direct deposit, let us repair QuickBooks.

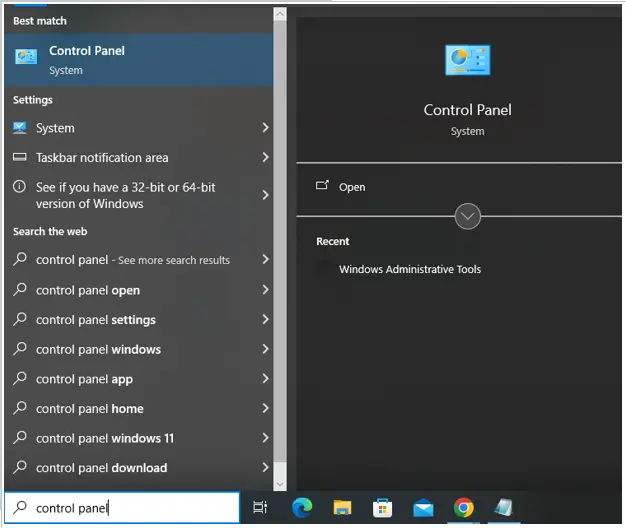

Solution 5: Repair the QuickBooks Program from the Control Panel

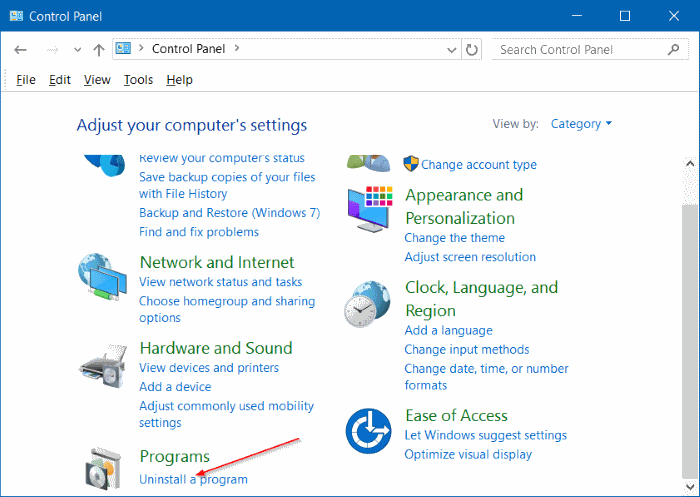

A damaged application could cause QuickBooks error code 40001. To resolve that, we can use the repair tool in the Control Panel.

- In the search bar in the Taskbar, type in Control Panel.

- Double-click the Control Panel to open it.

- Choose Uninstall a Program.

- Now, in the list of programs, you can find the version of QuickBooks Desktop you wish to repair.

- Right-click on it and choose Repair.

- Now, follow the instructions you see on the screen to repair the QB program. Remember not to uninstall it.

Once you have repaired QuickBooks Desktop, try activating direct deposit and see if the error you faced is resolved.

Solution 6: Modify the .QBW.INI File

If you continue to encounter error 40001 in QuickBooks Desktop, use these steps to activate direct deposit payroll.

- Open QB Desktop and press the F2 (or Ctrl + 1).

- Then press the F3 (or Ctrl + 2) to open the Tech Help screen.

- Now, tap on the Open File tab.

- Then double-click the qbw.ini file to open it.

- Now, find the part of the qbw.ini file that says [QBLICENSE] PAYROLL_BUNDLE_STATE=Y.

- Here, modify the Y to N.

- Now, save the file by opening the File menu in the top-left corner and selecting Save.

- Now, go back to QB Desktop and access the WF Invites or PTC again.

- After you reach the Payroll Activation screen, follow the same steps with the .qbw file. However, instead of modifying Y to N there, remove the section: [QBLICENSE] PAYROLL_BUNDLE_STATE=Y].

Now check whether the 40001 error in QuickBooks Desktop has been resolved.

A Quick Glance at QuickBooks Error 40001

In this section, let’s have a summary of what we have talked about in this blog.

| Description | The QuickBooks error 40001 is an issue that you encounter when trying to activate the direct deposit for your paychecks in QBDT. |

| Causes Behind it | The reasons behind this error can be an outdated QB application, your Windows or the QB application is missing important components, a lack of admin credentials, or if the ID in Intuit does not match the QB. |

| Ways to Fix | To fix this error, you can update the QBDT to the latest version, provide admin access, launch the QB Tool Hub, use the Verify and Rebuild tool, or modify the qbw.ini file. |

Conclusion

This was all about why you get QuickBooks error 40001 while activating direct deposit. Additionally, we have gone through the reasons behind the error in your system. Furthermore, we have mentioned proven solutions to resolve this error code and successfully activate payroll direct deposit. However, if the issue persists or you have any queries, contact our +1(855)-510-6487 experts for free guidance.

Frequently Asked Questions (FAQ’s)

How can I fix the QuickBooks Payroll error 40001?

There are multiple fixes you can try to tackle the error code 40001.

1. Access QuickBooks with admin credentials.

2. Use the verify and rebuild tool.

3. Use the QuickBooks Tool Hub application.

4. Get to the latest version of QB.

What are the reasons behind the QuickBooks Payroll error 40001?

The common reasons behind the error in your system are a lack of administrative rights, an outdated QBDT or payroll tax table, an incorrect EIN, and a poor or unstable internet connection.

Why is my QuickBooks direct deposit not working today?

If your direct deposit is delayed, it might be because of a bank holiday or maybe a delay from the bank’s side. However, if you are unable to make a direct deposit, this could be because of incorrect or incomplete bank information, which includes the name of the payee, account number, and routing number.

What is the error message for error 40001 in QuickBooks Desktop?

You might see QuickBooks error code 40001 when trying to activate payroll direct deposit. The error message on the screen will state, “Error Code: 40001. Something’s not right. We’re unable to complete your request.” The error occurs if you are using an outdated version of QuickBooks Desktop or haven’t logged in as an administrator.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.