Last Updated on January 19, 2026

QuickBooks allows you to transfer employees and contractors paychecks into their bank accounts via direct deposit. This is way faster than the traditional way of sending paychecks. However, QuickBooks Direct Deposit not working or failing is a situation that many users have encountered.

The reasons can be an outdated QB version or issues with the company file. In this blog, we will figure out why payroll direct deposit is not working and how to resolve it using proven steps.

If you need any help with your direct deposit transactions in QuickBooks, feel free to contact our experts at +1(855)-510-6487.

Why is QuickBooks Payroll Direct Deposit Not Working?

When making a direct deposit in QuickBooks, you might find that it doesn’t work. Here are several reasons the direct deposit is not working.

- You might not have entered all the employee or contractor’s account details.

- The pay date you have selected might fall on a bank holiday or weekend.

- The bank account might have been closed, invalid, or insufficiently funded.

- You might have entered the employee’s account information incorrectly.

- The paycheck might be submitted after the cutoff time, i.e., PST (Pacific Standard Time).

- There might be an issue with the bank or financial institution’s server.

- Your QuickBooks software or the payroll tax table might be outdated.

These reasons explain why you cannot deposit paychecks instantly into your employees’ or contractors’ bank accounts. Now, let’s move on to the next section to understand the prerequisites for this issue.

Note: QuickBooks Payroll Direct Deposit simplifies employee payments by sending salaries directly to bank accounts, reducing errors and saving time. Businesses trust this feature for secure, fast, and accurate payroll processing.

Things to Ensure Before You Fix QuickBooks Direct Deposit Not Working

There are certain key prerequisites you should meet before you begin fixing the direct deposit issue in your system.

- Maintain an active QuickBooks Payroll Subscription.

- Get the latest version of QB and payroll.

- A stable, uninterrupted internet connection.

- Log in to QuickBooks as an admin.

- Ensure that you have created a backup for the company file.

- Check the system date and time settings.

Now, let’s move on to the next section and understand the steps to fix this problem.

Solutions to Try When You Find QuickBooks Direct Deposit Not Working

In this section, we are going to tell you what you should do if you find QuickBooks Direct Deposit Failed. Go through these steps one by one and follow the instructions given.

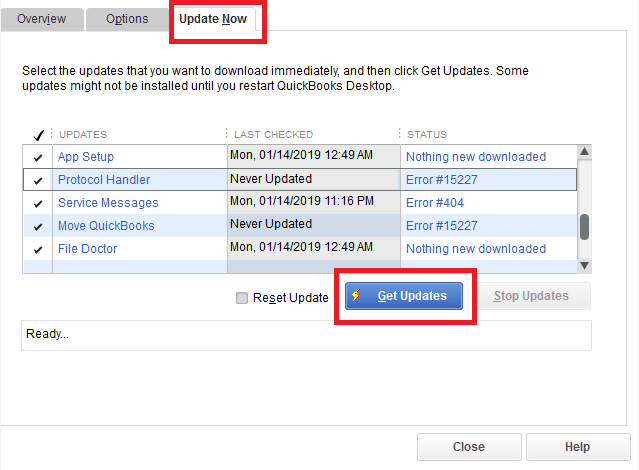

1. Update QuickBooks Software and Payroll

The first thing you need to do is update QuickBooks Desktop to the latest release.

- Access the QuickBooks application.

- Then, move to the Help menu.

- Click on the Update QuickBooks option.

- Tap on the Get Updates section.

- Once the download is finished, restart the application.

- Head to the Employees tab.

- Click on the Get Payroll Updates option from the drop-down menu.

- Tap on the Download latest updates option.

When done, try creating a direct deposit and check if it works. However, if you run into an issue, check and confirm the funding time.

2. Activate Direct Deposit in QuickBooks

To create a direct deposit in QuickBooks, you must first enable it. However, if you haven’t activated direct deposit yet, let us show you how.

- Open QB Desktop and press the F2 (or Ctrl + 1).

- Then press the F3 (or Ctrl + 2) to open the Tech Help screen.

- Now, tap on the Open File tab.

- Then double-click the qbw.ini file to open it.

- Now, find the part of the qbw.ini file that says [QBLICENSE] PAYROLL_BUNDLE_STATE=Y.

- Here, modify the Y to N.

- Now, save the file by opening the File menu in the top-left corner and selecting Save.

- Now, go back to QB Desktop and access the WF Invites or PTC again.

- After you reach the Payroll Activation screen, follow the same steps with the .qbw file. However, instead of modifying Y to N there, remove the section: [QBLICENSE] PAYROLL_BUNDLE_STATE=Y].

Once you have enabled direct deposit, try creating a direct deposit. If you get QuickBooks error 40001 while activating payroll direct deposit, that’s another scenario, and we have compiled a dedicated guide for it.

3. Check and Confirm the Funding Time

Several funding times can be set in QuickBooks, and these determine how Intuit processes paychecks after you send them. Here are common funding times offered by Intuit:

- Same-day: If you have a Premium or Elite subscription, you can set the funding time to the same day so employees receive paychecks on the day you send them to Intuit.

- Next-day: Choosing this will deposit employees’ paychecks into their bank accounts the next day after you send them to Intuit for processing.

- Two-day: Choosing this will deposit employees’ paychecks 2 days after you send them to Intuit for processing.

- Five-day: Choosing this will deposit employees’ paychecks into their bank accounts five days after you send them to Intuit for processing.

Therefore, if you find that the paychecks are not deposited by the time you want, you should check the funding time set in QuickBooks.

- Log in to the QBO company and choose the Gear or Settings icon.

- Now navigate to Payroll settings, then to the Direct Deposit section.

- Check the funding time and, if needed, change it.

However, if you still find QuickBooks Direct Deposit not working, proceed to the next step.

4. Check the Bank Account and Company Information

First, ensure compliance by sharing the correct information with Intuit. This includes

- Company’s name, address, and EIN.

- Details of the principal officer, including date of birth, Social Security number, and home address.

- Account numbers, banking credentials, or bank routing numbers.

Another reason you might not be able to set up direct deposit in QuickBooks is that your account hasn’t been verified. This can be because your account has insufficient funds. Therefore, check your bank account. If your account seems fine, but QuickBooks payroll direct deposit is not working, move to the next step.

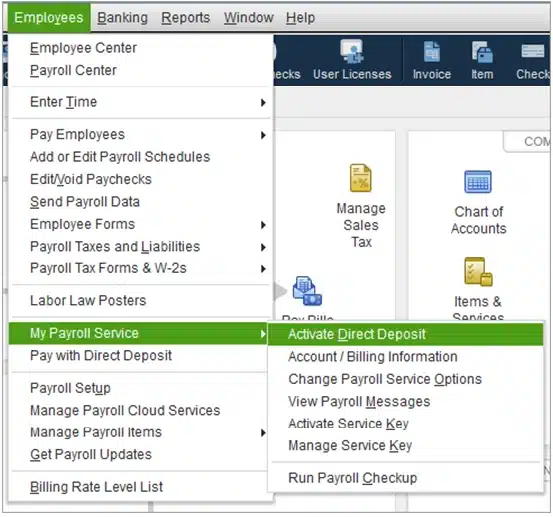

5. Reconnect Bank Account

To get the direct deposit to work, you can reconnect the bank account. Here is how to do that in simple steps.

- Open the QuickBooks company and go to the Employees menu.

- Select My Payroll Service, followed by Activate Direct Deposit.

- Choose Getting Started, then Start on the Business tab, and finally Next.

- Enter the principal officer’s information, then choose Next.

- Choose the option to add a new bank account.

- Please enter your bank’s name, online banking login information, or, if prompted, your bank routing and account numbers.

- Now, you must create a PIN that you must enter each time you send payroll to QuickBooks. Therefore, enter a PIN that you can remember and note it down.

- Verify the PIN twice and then choose Submit.

- Tap on Next, followed by Accept and Submit.

- If you are asked to, verify the principal officer’s SSN, then hit the Submit button.

Finally, try creating a direct deposit, and if you run into QuickBooks Desktop or QuickBooks Online direct deposit not working, let us review the employee’s information.

6. Review Employee’s Banking Information

When you try to pay an employee via direct deposit, you need to enter vital information. If they are incorrect, the direct deposit might not work. Therefore, cross-check all the details of the employee to whom you are sending paychecks.

Quickview Table for QuickBooks Direct Deposit Not Working

In this section, let’s have a summary of what we have talked about in this blog.

| Description | You might run into the QuickBooks Direct Deposit not working problem in your system. An outdated QB application may cause this issue. |

| Causes Behind it | The causes for this error can be an outdated version of the QBDT, you haven’t entered all the employee or contractor’s account details, the pay date you have selected might fall on a holiday, the bank account might have been closed, or you might have entered the employee’s account information incorrectly. The paycheck may be submitted after the cutoff time, or there may be an issue with the bank’s or financial institution’s server. |

| Ways to Fix | To resolve the issue, you can update the QBDT and payroll, activate direct deposit, verify and confirm the funding time, or reconnect, or verify the bank account information. |

Conclusion

In this guide, we saw why you might find QuickBooks direct deposit not working and how to resolve that in simple steps. Hopefully, you can now send direct paychecks to your employees’ or independent contractors’ bank accounts. However, if the issue hasn’t been resolved yet or you run into problems, speak to a QuickBooks expert. Dial +1(855)-510-6487 and get in touch with our experts to get any additional help with your company files.

Frequently Asked Questions (FAQs)

Why is my direct deposit not going through?

The direct deposit sent through QuickBooks or another accounting software might not go through if the bank account you used is not verified, has insufficient funds, or the financial institution has put the paycheck on hold. Other reasons could be incorrect employee, employer, or company information.

What happens when QuickBooks direct deposit fails?

If your QuickBooks direct deposit fails, you will receive the funds in the business account you used to create the deposit in a few business days. You should void the paycheck instead of deleting it once the direct deposit fails.

Why are my deposits not showing up in QuickBooks?

If you cannot see your direct deposit in QuickBooks, it could be because it was incorrectly deposited, associated with a different check register, not yet deposited, or the bank account or details were incorrect. Moreover, because QuickBooks only displays payments in one currency at a time in the Bank Deposit window, payments made in other currencies might not appear. Do not worry; you can use the audit trail to find the missing direct deposits.

What time does QuickBooks direct deposit hit?

When the QuickBooks direct deposit hits, It depends on the receiver’s bank account, i.e., the employee or the independent contractor. Usually, the direct deposit hits the employee’s bank account from midnight to the early morning of the payday.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.