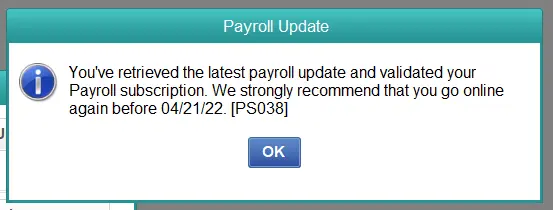

QuickBooks Error Code PS038 is an error that occurs when you try to run payroll, download tax table updates, or send paychecks online if their status gets stuck as “Online to Send.” This is the error message that you may see on the screen:

| “You’ve retrieved the latest payroll update and validated your Payroll subscription. We strongly recommend that you go online again before mm/dd/yyyy. [PS038]” |

The error PS038 hinders the payroll update process, preventing you from processing payroll and sending online paychecks. This can delay employee payments and lead to tax compliance issues. In this article, we will help you understand why the payroll error PS038 in QuickBooks occurs and proven ways to resolve it.

Possible Reasons for Payroll Service Error PS038 in QuickBooks Desktop

Knowing the causes of payroll error PS038 helps identify the root cause and helps you to proceed with effective troubleshooting, which helps save time and resolve the error timely. Here are a few reasons why error PS038 can occur:

- The payroll might be set up incorrectly, or employee data might be invalid.

- Company data might be corrupt or damaged.

- There might be an issue with QuickBooks installation or the recent update.

- QuickBooks might not be able to verify the payroll service subscription, or the subscription might have expired or is inactive.

- You might have set the payroll frequency incorrectly.

- There might be stuck or duplicate paychecks in the payroll processing queue.

- Inaccurate or outdated payroll information.

- The network connection might be poor, or the internet settings might not be correct.

- Windows Firewall or antivirus software might be blocking QuickBooks.

Now that you have an idea why you see payroll error PS038 in QuickBooks Desktop, let us show you how to resolve it.

Before You Troubleshoot Payroll Errors in QuickBooks Desktop

There are some quick fixes that can help you resolve QuickBooks error PS038 often before going to comprehensive troubleshooting, and some essential things you need to make sure of before you troubleshoot the payroll error. We have listed them here. Go through these one by one and follow the instructions given there.

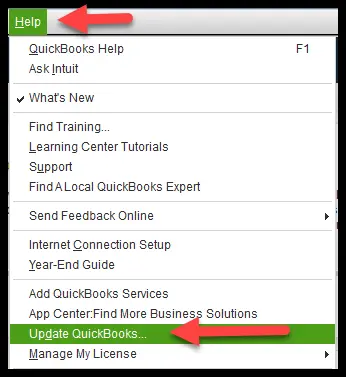

1. Update QuickBooks Desktop

To rectify QuickBooks error code PS038, the first thing you can do is update your QuickBooks Desktop (QBDT). When doing so, make sure to mark the checkbox for Reset Updates.

After you are done with these steps, if the error persists, follow the troubleshooting solutions given below.

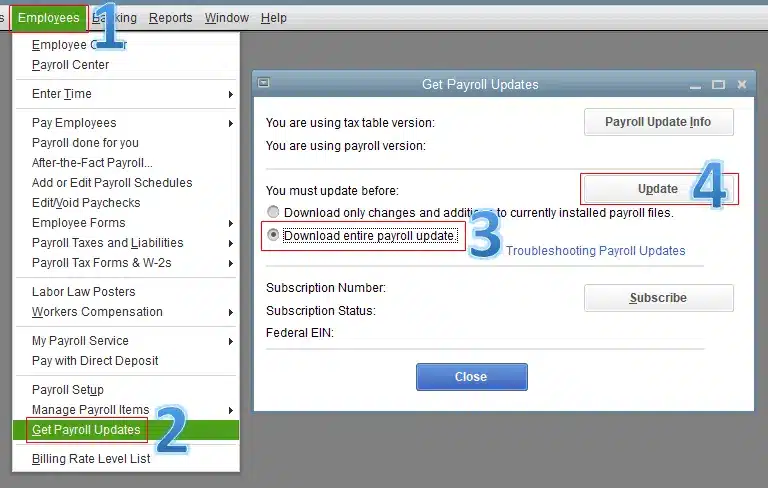

2. Update QuickBooks Payroll

After updating your QuickBooks Desktop, try to update the payroll tax table. If you get an error, move to the next step.

However, if you were successful in updating the tax table, send paychecks and check if the QuickBooks error PS038 you faced earlier is resolved.

3. Create a Local Backup of the Company File

Make sure to create a backup of the company file on your QuickBooks Desktop, before you proceed to the next section. Once done, proceed to comprehensive troubleshooting to resolve the payroll error.

Expert-Recommended Solutions for QuickBooks Error Code PS038 on Desktop

In this section, we will show you how to resolve QuickBooks error code PS038. With that done, you can experience accurate payroll processing and compliance by preventing duplicate payments and errors, maintaining payroll data integrity, and ensuring smooth operations. Go through the solutions listed below, one by one, and follow the instructions given carefully.

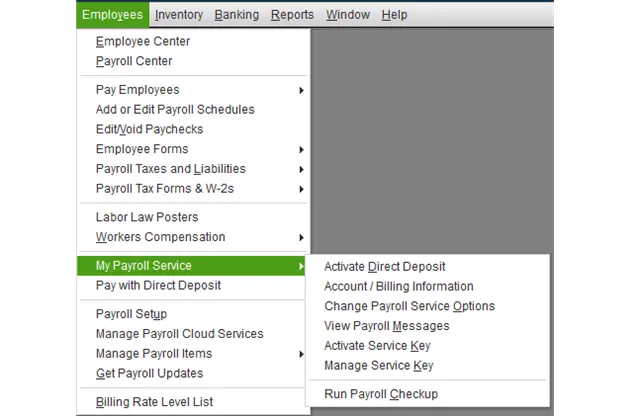

1. Send your Payroll Data or Usage Data

The first thing you can do is send payroll data, which will help improve payroll processing and fix compatibility issues.

- Go to the Employees menu, followed by My Payroll Service.

- Hit Send Usage Data and choose Send Payroll Data.

- Now, you will see the Send/Receive Data Window

- Choose Send All, and enter your payroll service pin if prompted.

Try to get payroll updates again if the send is successful. However, if the payroll update error PS038 QuickBooks Desktop persists, move to the next solution.

2. Find Stuck Paychecks

Stuck paychecks cause payroll error PS038 in QB. Thus, identifying stuck paychecks is necessary. Here is how you can find the stuck paychecks in QuickBooks Desktop.

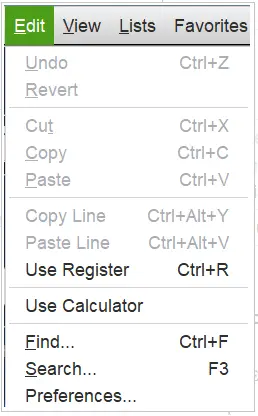

- Go to Edit and select Find.

- Tap on the Advanced tab.

- Go to the Choose Filter section and select Detail Level from the Filter list.

- Choose Summary Only.

- Go back to the Filter list.

- Scroll down to select Online Status and then select Online to Send.

- Select Find, and you’ll see paychecks that weren’t sent due to the error PS038.

Note down the “Number of matches” on the Find window somewhere, maybe on Notepad. Now, close the Find window and proceed to the next step.

3. Verify and Rebuild Company Data

The QB payroll error PS038 often arises due to data damage or corruption. Thus, verify and rebuild data to show the stuck paychecks waiting to be sent.

(i) Verify Company Data

Here is how you can verify data in QuickBooks Desktop.

- Click on the Window menu in QuickBooks Desktop and select Close All.

- Go to File and then choose Utilities.

- Tap on Verify Data.

- If you see on the screen:

- QuickBooks detected no problems with your data: it confirms that your data is clean. In that case, you can skip the next solution to resolve data damage using rebuild data utility.

- An error message: search on the Internet or our knowledge base to find out how to fix it.

- Your data has lost integrity: it means data damage was found in the file. Proceed to the next step to resolve data damage.

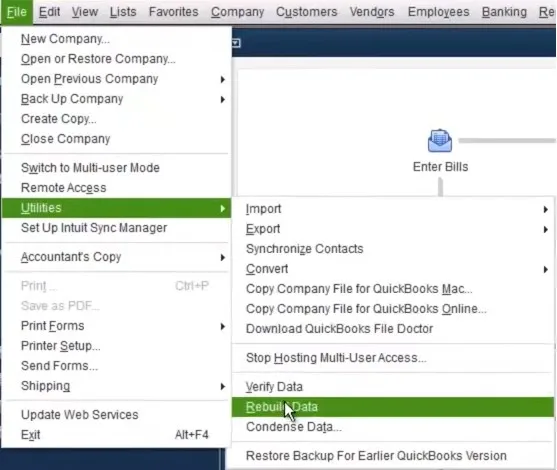

(ii) Rebuild Data to Resolve Damage

If data damage or corruption causes QuickBooks error PS038, rebuilding your data is crucial to fix it. Follow the instructions given below to rebuild QB company data.

Important Note: If you have used Assisted Payroll, contact Assisted Payroll before rebuilding your data.

- Go to File and click Utilities.

- Then select Rebuild Data.

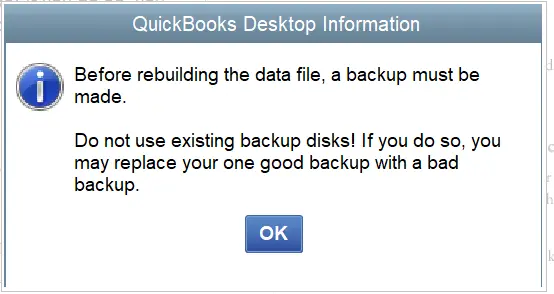

- QuickBooks will demand that you make a backup before rebuilding your company file.

- Select OK.

- Select where you want to save your backup and hit OK.

- Don’t replace another backup file; instead, enter a new name in the File name and select Save.

- Select OK when the message “Rebuild has completed” pops up.

- Go to File, followed by Utilities, and then choose Verify Data again to check for additional damage.

- If any damage is found after the verification, fix it manually.

- If no error is found, you can restore a recent backup.

- Go to File and then select Open/ Restore Company.

Note: When restoring the company file, do not replace or overwrite your existing company file. Also, you will lose any progress made or data entered into QB company since the moment the backup was created.

Now, try to download your payroll updates again; if you still see the payroll error, proceed to the next step.

4. Toggle the Stuck Paychecks

Stuck paychecks can give way to error code PS038 in QuickBooks Desktop. Therefore to update payroll, or resume sending paychecks, you need to resolve the stuck paychecks. Toggling the stuck paychecks in QuickBooks Desktop is the most practical way to resolve them.

- Open the oldest paycheck, which was stuck.

- Hit the Paycheck Detail button.

- You will reach the Review Paycheck window. Now, in the Earnings section, check the last earnings item in the list and add the same earnings item.

Example: If the last item on the list is the “hourly rate,” add another earnings item named “hourly rate” to the list.

- You will see a message that mentions Net Pay Locked.

- Select No.

- Ensure there are no changes to the tax amounts and net pay, and select OK.

- If you receive a message stating Past Transaction, choose Yes.

- Close the paycheck by selecting Save & Close.

- A warning message, “Recording Transaction”, will pop up. Hit Yes to it.

- Open the paycheck again.

- Tap on the Paycheck Details button.

- Now, delete the items you had just added to the Earnings section.

- Ensure there are no changes to the tax amounts and net pay, and select OK.

- Repeat these steps for each of the paychecks that are stuck.

- When finished, repeat the first step and download the tax table update again.

Note: To avoid such errors in the future, update QuickBooks Desktop automatically by enabling auto-updates. This will ensure QuickBooks downloads and installs the most recent updates as soon as they become available.

This should resolve QuickBooks error PS038 when updating payroll or sending paychecks.

5. Check Internet Connection

If, even after carrying out the above solutions, you find the payroll error PS038 occurs, you need to check your internet connection.

QuickBooks might run into various payroll or update errors if the process is interrupted due to poor internet. Moreover, ensure Windows Firewall is not blocking QuickBooks programs from connecting to the internet.

Conclusion

To resolve QuickBooks error code PS038, you need a systematic approach to identify and address the underlying causes and troubleshoot every aspect of it. Moreover, regular maintenance, updates, and backups can help you prevent and resolve error code PS038 in the future to ensure smooth and compliant payroll operations.

Frequently Asked Questions

Update your tax tables regularly, double-check your payroll setup, update your QuickBooks, and maintain a clean company file. Run the QuickBooks File Doctor tool to identify and fix file issues.

Regular backups ensure data safety but don’t prevent payroll errors. For comprehensive protection, combine backups with regular QuickBooks updates, file maintenance, and File Doctor tool runs.

Nope, your data is safe. This error just prevents you from processing payroll until it’s fixed. However, it is crucial to address the issue promptly to ensure data integrity.

If left unfixed, it might lead to duplicate payments, incorrect payroll calculations, or even compliance issues. Addressing the error promptly helps prevent broader QuickBooks problems.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.