Last Updated on November 25, 2025

Intuit offers a Payroll Subscription for QB, which allows you to automate payroll operations such as creating and sending paychecks, recording transactions and deposits, and calculating taxes. Therefore, it is a must to have an active QuickBooks payroll subscription to use these numerous benefits. In this detailed blog, we will cover everything about the QB Payroll and its different types of subscriptions from head to toe. So, let us get started with what a payroll subscription in QuickBooks actually is.

If you have any doubts or queries about the QuickBooks Payroll subscription or are confused about which plan you should choose, feel free to call us at +1(855)-510-6487 to get help from our team of QB experts.

What is QuickBooks Payroll Subscription? A Short Explanation

Payroll in QuickBooks software is a subscription-based service to help you automate and manage financial business operations efficiently. This software offers a range of features and tools to calculate, file, and pay employee salaries, estimates, and taxes, as well as process payments and file tax returns.

You can find this integrated feature in both the QuickBooks Desktop and QuickBooks Online. Simply opt for a subscription and select the plan that best suits your needs. Furthermore, the packages and pricing will be based on the plan you choose. Let’s go through the upcoming sections and discuss each type of its subscription version and insights.

Different QuickBooks Payroll Subscription Options | Which Should You Choose

QuickBooks offers various payroll subscription options tailored to match the needs of every user. So, let us discuss each of them in detail.

1. Basic Payroll Subscription

The basic payroll includes the necessary features such as calculating taxes, printing checks, and creating direct deposits. However, this level of subscription will not provide the tax form-filling options. This is for businesses that are just starting out and don’t require a feature-loaded subscription.

2. Enhanced Payroll Subscription

If you opt for the Enhanced QuickBooks Payroll Subscription, you will get the features of the Basic Payroll, along with the ability to file and pay taxes automatically. This is for businesses that need to e-file their forms and taxes through QuickBooks.

3. Assisted Payroll Subscription

Assisted Payroll provides seamless integration with the QB Desktop application, streamlining the whole payroll process. In this subscription, you will get automated payroll tax calculations, the ability to create year-end tax forms, and same-day direct deposit choices. If you opt for this subscription, you will also get time-to-time email reminders for tax filing deadlines and payments. With Assisted Payroll, companies will have the choice to pay the employees through cheque or direct deposit. Additionally, you will receive dedicated assistance from Intuit’s payroll experts for any payroll or tax-related issues.

QuickBooks would also be liable to pay any penalties that you incur due to QB not filing your taxes on time. This is perfect for businesses that just want to focus on their work progress and wish to automate their payroll-related tasks.

Note: If your QuickBooks Subscription Has Lapsed, you might lose access to payroll and updates. Renew your plan promptly to continue using QuickBooks without interruptions.

Why Should You Choose a QuickBooks Payroll Subscription? Its Advantages

Given below are some of the key advantages of using the payroll feature in QuickBooks Online and Desktop:

1. Prevention from Tax Penalties (For Assisted Payroll Only)

If you’re using QuickBooks Assisted Payroll and incur a penalty from the IRS due to tax miscalculations within the app, you may be eligible to receive the full penalty amount with interest from QuickBooks. For that, you need to send a copy of your payroll tax notice to Intuit.

Once you send your request, the Tax Notice Resolution Team will evaluate your complaint information. If the team needs any additional details from your side, they will try to reach you via email or phone three times within a 5-business-day period. If you don’t respond by that time, Intuit will no longer assist you in covering your penalties.

2. Same-day Direct Deposit

With higher tiers of the payroll subscription, you have the option for a same-day direct deposit if you deposit your funds before 5:00 AM on the payday. Some subscription tiers come with a single-day lead time.

3. Automated Tax Calculation and Form Completion

The QuickBooks Payroll can enable an accountant or the business owner to file forms and calculate taxes automatically. This feature is available with the payroll premium and elite subscriptions.

4. Automate Your Payroll

With the enhanced QuickBooks Payroll Subscription, you can automate the payroll procedures, such as time-tracking, salary estimation, tax withholding, etc.

5. Time-tracking Control Features to Create Invoices

You will be able to create invoices even when they move through locations with QB Payroll. Additionally, you will be provided with benefits such as time tracking and automated sheet management.

6. Get Expert Support Anytime or Anywhere

When you subscribe to QuickBooks Payroll Assisted, you can get in contact with QB technicians and specialists anytime you face any trouble.

7. Professional Setup

If you have the full-service payroll, you will get expert assistance in setting up your QB Payroll after providing your information.

8. Expert HR Assistance

Anytime you want any assistance from an expert HR or the advisors, you can contact them via the QuickBooks Online Payroll Elite and Premium subscription.

Additionally, you can fill out the e-file W-2 and 1099 forms and get the employee services, such as expert support in HR, workers’ compensation, health benefits, 401(k) plans, and employee benefits.

Here’s How to Set Up QuickBooks Payroll in the Desktop and Online Versions

In this section, we’ll provide the steps to set up QuickBooks Payroll for the Online and Desktop versions. Let us start with setting up payroll in QB Online.

A. Set up QuickBooks Online Payroll

After you buy a subscription for the QuickBooks Online Payroll, follow the steps given below to set it up:

- Start by signing in to the QB Online as an admin

- Navigate to the Payroll tab

- Select Overview and then hit the Get Started option

- Now, select if you or any other person has paid the employees in the present year or not, and click on Next

- Next, select the date on which you want to start paying the employees via QB Online Payroll, and then choose Next

- Then, proceed to type in your business address

- Make sure to type a physical address

- Ensure not to use a P.O. Box address

- The address you will feed will be used to determine your tax responsibilities

- Multiple work locations can be added later, along with your employees

- Make sure to type a physical address

- Now, enter the contact info for payroll

- Enter your contact information

- Or the person responsible for paying your employee

- This number will get all the important alerts and notifications from QB

- Enter your contact information

- Now, select how you used to run payroll prior to subscribing to QB Payroll

- In some cases, for certain apps, you might be able to import your employee information and pay history

- If you can’t, you can enter the information manually

- In some cases, for certain apps, you might be able to import your employee information and pay history

Note: If you have to pay your employees before the setup is complete, you can do so manually.

Add Your Employees and Their Payroll Details

You can add your employees to the QBO Payroll after performing the steps given above. First, make sure you have the following information in hand:

- W-4 form or any other equivalent forms, if needed

- Hiring Date

- Date of Birth

- Accurate paying rate

- Any applicable deductions from the final paycheck, such as insurance, retirement, and wage garnishments

- Employees’ bank account and pay card details

- Information on casual, sick, or paid leaves

After you have the above-given details, follow the steps given below to add your employees.

- First, select the Add an employee option

- Then, fill in the employee’s name and email address

- If your employee wishes to enter their own payroll information, you should:

- Select the Yes, allow the employee to enter their tax and banking info in Workforce option

- Then, the QuickBooks Workforce invitation would be sent to your employee via email

- Using that, your employee will be able to enter details like:

- Their address

- Their SSN (Social Security Number)

- The W-4 form

- Their banking information

- Next, click on the Add employee option

- Select Start or Edit:

- To change or add any employee info

- However, if your employee chose to self-set up their payroll, you won’t be able to change some fields in:

- Personal Info

- Tax withholding

- Payment method cards

- But, you can edit those fields by turning off the Employee self-setup

- Lastly, just press Save after you enter all the needed information

Once you have added the employee’s payroll details, you can add the tax details with the steps given in the next section.

Add Your Tax Details

You would need to add the following information while setting up your tax details:

- Employer Identification Number (EIN)

- State withholding or unemployment account numbers

- Account numbers of local tax withholding

- Tax filing frequency, such as:

- Federal, state, or local

- Tax rates as per the state:

- Surcharges

- Unemployment

- State disability

- Paid family leave

Now, to file your payroll taxes, follow the steps given below:

- Select the Settings option

- Click on Payroll Settings

- Navigate to the Taxes and forms section

- Click on Edit

- Now, choose one of the following:

- Automate taxes and forms:

- Choose this option if you want QB to file and pay your taxes automatically

- However, if the Auto-Pay/File option is turned off by you in the future, you would need to process any owed taxes beforehand yourself

- Otherwise, QB won’t process the future taxes automatically.

- I’ll initiate payments and filings using QuickBooks:

- You should choose this option in QB for manual, but e-payment of taxes

- I’ll pay and file the right agencies through their website or by mail:

- Select this option if you wish to pay the taxes manually outside of QuickBooks.

- However, you’d still be able to generate the payments and filings in QB.

- Automate taxes and forms:

- Press Save

- Finally, click on Done

After performing these steps, connect your bank to the QuickBooks Online Payroll.

Connect Your Bank Account to the QB Online Payroll

Connecting QuickBooks Online Payroll enables direct deposit. However, to connect your bank account, you will need to have the following information:

- Principal officer’s name

- Home address

- Social Security Number

- Date of birth

- Company bank account information and routing number

After you have the information given above with you, follow the steps given below:

- Navigate to the Connect your bank section

- Next, tap on Let’s go

- Here, click the Get Started option

- Now, hit the Edit

- Ensure to add any information that was missing, such as the federal tax ID

- Then, press Next

- Now, fill in the essential information, which includes:

- Principal Officer’s name

- Address

- Date of birth

- Social Security Number

- Choose the Next option

- Now, tap on the Add new bank account option

- Browse your bank’s name

- Fill in the online banking user ID and Password

- Or you can select Enter bank info manually:

- Next, type your bank account number and routing number

- Lastly, click on Save and tap on Accept and Submit

This would complete the payroll setup in QuickBooks Online. Let us take a look at the steps to set up payroll in QB Desktop.

B. Set Up QuickBooks Desktop Payroll

After purchasing the QuickBooks Payroll Subscription, follow the steps given below to set up payroll in the QB Desktop:

Activate Your QuickBooks Payroll Subscription

Once you’ve purchased the payroll subscription of your choice, you need to activate it. The method of activating your subscription will depend on whether you purchased the payroll online or from a retail store.

Scenario 1: If You Have Purchased the Payroll Subscription from Online Sources

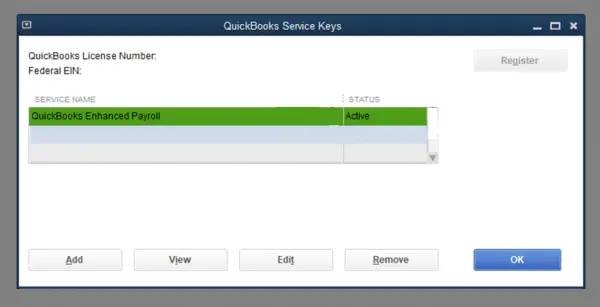

When you purchase a QuickBooks Payroll subscription of Basic, Enhanced, or Assisted from online or by phone, you will receive a 16-digit product service key via email. You will need to enter this key in QB to start using payroll features.

However, if you can’t find the email containing the service key, please check your spam and junk folders. Intuit also has an automated Service Key Retrieval tool to extract the service key. The details of your login account in Intuit will be required to sign in and use the tool. Once we ensure all these pointers, let’s follow the steps below to know your service key:

- Open the QB Desktop app

- Go to the Employees menu

- Click on the Payroll option

- Then, select Enter Payroll Service Key

- Click on Add

- Next, proceed to enter your 16-digit service key

- Click Next, followed by Finish

- Lastly, just wait for the tax table to download

If you purchased payroll from a retail store, follow the steps given in the next section.

Note: Running payroll smoothly requires the QuickBooks Payroll Tax Table Update. Install updates to maintain accurate tax deductions and stay compliant with IRS regulations.

Scenario 2: If the Payroll Subscription was Purchased From the Retail Store

If you purchase the QuickBooks Payroll subscription through a retail store, you should follow the steps below to enter the product key:

- Open the QuickBooks Desktop application

- Navigate to the Employees menu

- Then, select Payroll

- Now, proceed to click on the Install Payroll from box

- The Payroll Activation page would open

- Enter the Payroll License and Product Information

- Both the license and product information can be found on a yellow sticker on the CD folder inside the box

- Click on Continue

- Follow the guide on your screen to set up payroll

- Type in your service key

After activating your QuickBooks Payroll subscription, the next step is to complete the payroll setup.

Add Employees to Your Desktop Payroll

For adding your employees to the QB Desktop Payroll, first, you need to have the following information with you:

- W-4 form that has been completed

- Employees’ hiring date

- Birth date

- Pay rate

- Deductions from the paycheck, such as:

- Insurance contributions

- Retirement

- Wage garnishments

- Direct deposit info (if applicable)

- Pay card info or bank account info

- Sick, vacation, and PTO accrual rates and balance

Once you acquire the above given information and form, proceed to add your employees with the steps given below:

- Open your QuickBooks Desktop application

- Then, navigate to the Employees menu

- Now, select the Employee Center option

- Click on New Employee

- Enter the information that is required

- Finally, click on OK

Now, you would have to set up company contributions in QBDT payroll.

Set Up the Company Contributions in QB Desktop Payroll

To do this, you need to add payroll items, such as retirement deductions and medical care. You have the option to also add company-provided benefits, like paid vacation, sick time off, and other similar things, if they are applicable. After setting up the payroll items, you need to press the Assign to employees button to apply them to all the employees. Now, proceed to set up taxes in the QB Desktop Payroll.

Set Up Taxes in QBDT Payroll

Enter the following information while setting up taxes in the QuickBooks Desktop Payroll:

- State withholding account number

- And/or Unemployment account number

- Employer Identification Number (EIN)

- Deposit frequencies of the Federal and state

- State tax rates:

- Unemployment

- Surcharges

- State disability

- Paid family leave

- Other such rates and tax items

After you enter this information, your QB Desktop Payroll setup will be complete.

Here’s How to Renew Your QuickBooks Payroll Subscription Renewal

It is essential to renew or reactivate your QuickBooks Payroll Subscription once it has expired to continue enjoying the services. You can follow the steps given below to renew your payroll subscription:

Renew the QuickBooks Online Payroll Subscription

Follow the steps given below to renew your QB Online Payroll subscription:

- Start by clicking the Settings option

- Then, click on Account and Settings

- Head to the Billing and Subscription

- Select the Resubscribe for payroll option

- Ensure to review the subscription summary

- Now, type the payment info, and enter the payment method

- Finish the process by clicking the Resubscribe option

If you use QuickBooks Desktop, the steps to subscribe to your Payroll subscription again are given in the next section.

Renew the QuickBooks Desktop Payroll Subscription

The steps to renew the QB Desktop payroll subscription are given below:

For QuickBooks Desktop Payroll Assisted

If you have purchased the QuickBooks Assisted Payroll Subscription, you have the option to speak to QB experts, who can assist you with reactivating it.

For QuickBooks Desktop Payroll, Enhanced, and Basic

To re-subscribe to this tier of QBDT Payroll subscription, you can follow any of the three given methods:

Through the QuickBooks Desktop Company File

You can renew your payroll subscription through the QBDT company file by following the instructions given below:

- Open the QB Desktop application

- Navigate to the Employees menu

- Select the My Payroll Service option

- Click on Accounting/Billing info

- Sign in to your Intuit Account

- This would open the QB Account page

- Now, opt for Resubscribe in the Status tab

- Lastly, follow the guide on your screen to complete the reactivation process

This would renew your payroll subscription in QB Desktop.

Through the Intuit Account

You can renew your payroll subscription from the official Intuit website, with the steps given below:

- Log in to the Intuit account through the website

- Then, click on Resubscribe under the Status section

- Lastly, follow the steps on your screen to renew the QBDT Payroll subscription.

This renewal procedure will take up to 24 hours to complete. Once it is completed, you will see the Active status.

Verify Your QuickBooks Payroll Data in the Online and Desktop Versions

Once you have renewed your payroll service, try re-running through the payroll setup. You must review the payroll data, such as tax setup and employees.

Here’s How to Review the Payroll Data in QuickBooks Online

Follow the steps given below to review your payroll data in the QuickBooks Online application.

- Navigate to Payroll and tap on Employees

- Verify the review of every employee, and confirm their name and additional information, such as deductions, sick or casual leaves, W-4, etc

- Go to the Settings and choose Payroll Settings to access your tax rates

All you need to do is just carry out the instructions given above. However, if you use the QuickBooks Desktop version, then follow the next section.

Here’s How to Review the Payroll Data in QuickBooks Desktop

You should follow the instructions below to review the payroll data if you use the QuickBooks Payroll in its Desktop version by following the upcoming steps.

- Click Employees and select the Employee Center

- Next, verify each employee from the Employees tab

- You should validate the details and information, including deductions, W-4, sick or casual leaves, and more

- Lastly, click on the List and select the Payroll Item List to accurately evaluate the tax payroll items

Once done following the instructions given above, you will be able to renew or reactivate the QuickBooks Payroll subscription. Now, let’s wrap up this blog with a quick view of what we have covered so far in this post.

Quick View of the QuickBooks Desktop Payroll Subscription

The quick view table shows the concise and condensed version of this informative post about the QuickBooks Payroll subscription. This will show the exact topics in the chronological order of what we have covered so far in this blog.

| What is QuickBooks Payroll Subscription? | Under the QuickBooks Desktop, you can access the QuickBooks Payroll subscription, which offers you enhanced features to perform the employees’ payroll seamlessly. But to access it, you should have an active payroll subscription. |

| Here are the types of QB payroll subscriptions | The QuickBooks Desktop Payroll offers three levels of subscription: 1. Basic Payroll subscription 2. Enhanced Payroll subscription 3. Assisted Payroll subscription You can purchase any of these subscriptions according to your business’s requirements. |

| Features and benefits of the Payroll subscription | Prevention of tax penalties, easy to enable direct deposit on the same day, automated calculations and tax and form filling, offers automated Payroll, easy to do time-tracking, anytime support from QB technicians, professional setup, employee services, and expert HR consultancy are some highlight features and benefits that come with the payroll subscription in QuickBooks. |

| Set up the QB Online Payroll | To set up the QB Payroll, follow the instructions outlined below. 1. Begin with the Payroll Setup 2. Next, add your team and employees 3. Now, add your tax information Lastly, connect your bank account with QB Online Follow the above information to repeat this process in the future when needed. |

| Set Up the QB Desktop Payroll | To set up the QB Payroll, follow the steps given below. 1. Start by activating the payroll subscription by entering the payroll service key 2. Next, create the Payroll Pin for QB Desktop You need to carry out two specific steps to set up QuickBooks Payroll. |

| Effective ways to renew the Payroll subscription | To renew your QuickBooks Payroll subscription. 1. Reactivate your QuickBooks Desktop Payroll 2. Next, review your payroll data You need to perform these two steps to renew your payroll subscription. |

Conclusion

This post has given you an in-depth guide about the QuickBooks Payroll subscription. It has covered the information about the level of its subscription. Moreover, we have provided you with the detailed step-by-step process to subscribe to or renew your payroll account. All you need to do is follow the process as per the given instructions. However, while setting up your QB Payroll, having technical difficulties? Contact our specialists by dialing +1(855)-510-6487, and get expert help from certified QuickBooks advisors.

Frequently Asked Questions (FAQ’s)

What does the QuickBooks Payroll report cover?

With the help of QuickBooks Payroll, you can run, print, or export a payroll report. Moreover, it makes it easy to share valuable insights with the accountant without leaving space. Other than that, you will get the following features and benefits in your payroll reports, such as:

1. Ability to use multiple work sites

2. Payroll tax calculations and contributions

3. Tax liability in the QB Payroll

4. Payroll tax deductions and wages summary

5. Time tracking

6. Record of casual and sick leaves

7. Employees’ compensation

These are the most significant benefits you will get from the payroll report.

Is it possible to switch from one Payroll subscription to another?

Yes, it is possible to switch from the existing QuickBooks subscription to another one. However, you should be aware that the process for switching subscriptions may depend on the particular subscription you are switching to. Contact QB customer support for assistance with modifying the subscription.

How can you cancel the Payroll subscription?

You can cancel your Payroll subscription through your QuickBooks Payroll company file.

1. Start by selecting the My Payroll Service from the Employees dropdown menu, followed by selecting Account/Billing Info

2. Next, sign in using the Intuit account login, and the Account Portal page will be accessed, and then select Cancel Service

3. Go through the on-screen instructions to cancel the Payroll subscription

Additionally, you can also cancel the QuickBooks Desktop payroll subscription from your Intuit account by signing in to it. Next, click on Details under the Product & Services. After that, follow the Cancel Service and follow the on-screen instructions to complete the procedure.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.