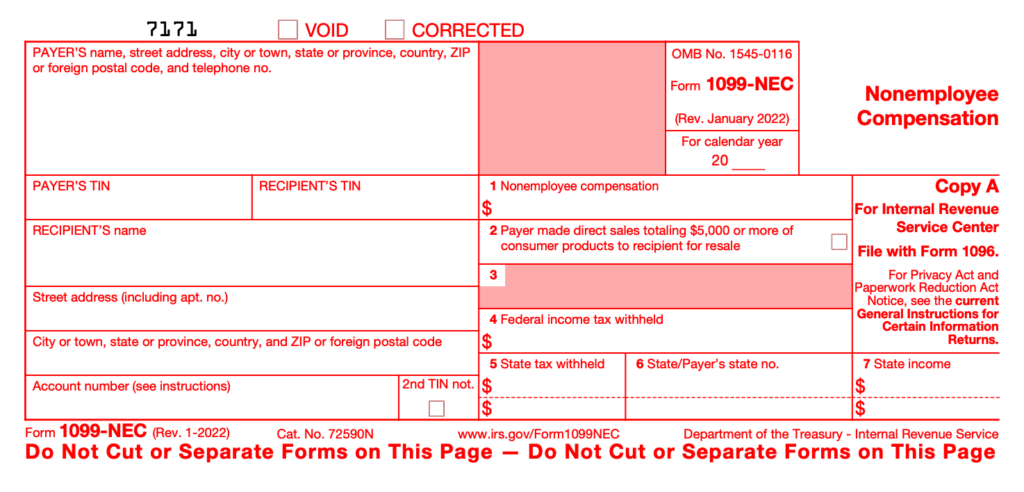

IRS form 1099 is a record that is used to track money paid to a non-employee. IRS uses a few 1099 forms, including 1099-MISC, 1099-NEC, etc. According to U.S. tax law, you’re required to file a Form 1099-NEC for anyone (contractors, freelancers, vendors, or any other non-employee) that you have paid $600 or more in the previous year. If you have a QuickBooks Payroll product, you first need to get your contractors or vendors set up in QuickBooks before you can file their 1099s. Though adding a contractor through payroll is not a complex process, it can be tricky if you are not tech-savvy. With this in mind, we have curated this blog that guides you on how to set up a 1099 contractor In QuickBooks easily. Read the blog till the end.

Setting Up a 1099 Contractor in QuickBooks

The method of setting up a 1099 contractor depends on the version you are using. The steps are also different in QBD for Mac and Windows. Check the payroll service you are using and follow the steps accordingly. Let’s look at how you can set up a 1099 contractor in QuickBooks.

Set Up a 1099 Contractor in QuickBooks Online and QuickBooks Contractor Payments

There are two steps to set up a contractor in QuickBooks Online, which include adding your contractor as a vendor and then tracking the payments for 1099s:-

- Move to Expenses, then choose Contractors.

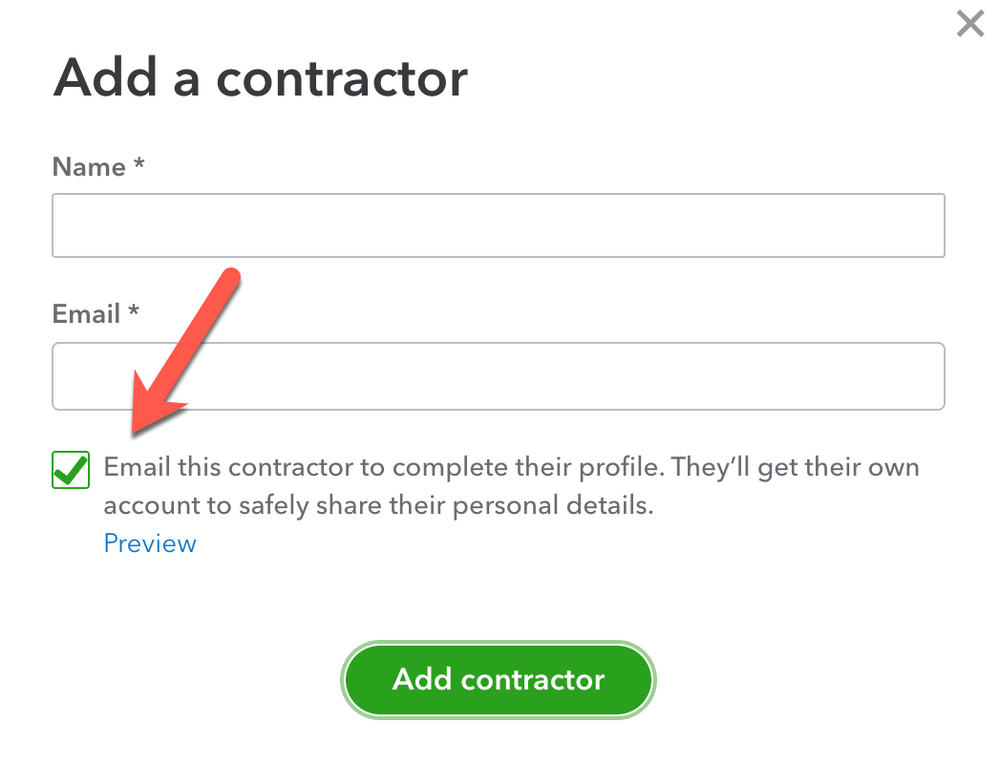

- Choose Add a Contractor.

- Enter your contractor’s info, or check the Email this contractor checkbox so that they can fill it out.

- Select Add Contractor when you’re done.

Note: If you have opted in for the ‘Email this contractor’, wait for the contractor to fill out their info. On the other hand, If you haven’t chosen to send an email, follow the steps below.

- Choose ‘Add’ next to Personal details or Bank account, and then enter the contractor info.

- Select Save when finished.

In this way, all Vendors added through payroll become automatically eligible for 1099s. Also, QuickBooks starts tracking all of their payments. At the time of filing your 1099s, you can easily add the tracked payments to the form.

How to Manually Add a Contractor in QuickBooks Online

Simply uncheck the box in which you can link their email while adding them as Contractors . Here’s how you can do it:

- Choose Workers or Payroll, and then choose Contractors.

- Select Add a Contractor and then enter the contractor’s name.

- Uncheck the box that reads “Email this contractor to complete their profile…“

- Choose Add a Contractor again.

- Select Add and then ensure whether the contractor is an individual or a business. When you are done, enter their info.

- Lastly, select Save and Close to conclude.

For QuickBooks Contractor Payments Without QuickBooks Online

- Move to Contractors, then choose Contractors.

- Choose Add a Contractor.

- Enter your contractor’s info (name and email address). Check the Email this contractor checkbox if you want the contractor to fill out their info themselves.

- Lastly, select Add Contractor.

If you have chosen the ‘Email this contractor’ option, wait for the contractor to fill out their info. However, if you haven’t chosen to send an email to the contractor, follow the steps below.

- Choose Add besides Personal details or Bank account and enter the contractor info.

- Lastly, when finished, select Save.

Set Up a Contractor in QuickBooks Desktop for Windows

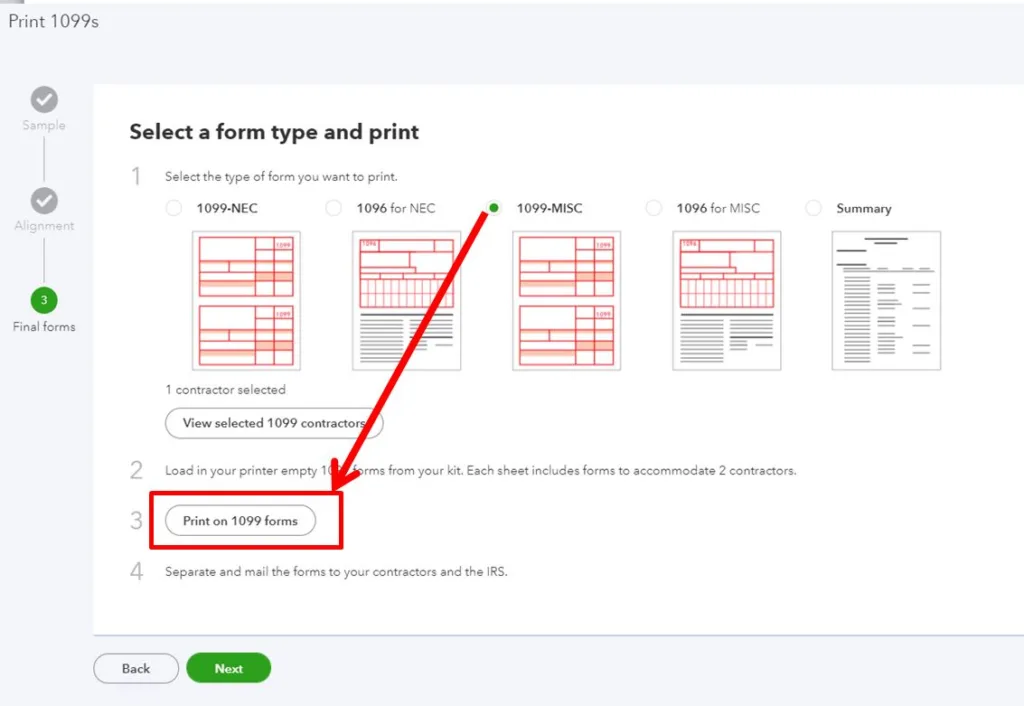

There are three steps to setting up a contractor in QuickBooks Desktop for Windows. Firstly, you need to activate the 1099-MISC feature. Secondly, add a contractor as a vendor, and lastly, start tracking the contractor payments for 1099. Let’s look at these steps in detail:-

1: Activate the 1099-MISC feature

- Move to the Edit menu and choose Preferences.

- Tap on the Tax:1099 menu and then click on the Company Preferences tab.

- Choose Yes in the Do you file 1099-MISC forms? section.

- Lastly, tap OK to save settings.

2: Adding your contractor as vendor

- Move to the Vendors menu and choose Vendor Center.

- Click on the New Vendor dropdown and select New Vendor.

- Fill out the fields with the required information on each tab. You can receive this info from a W-9 form. Moreover, you can edit and change this info later on.

- Lastly, tap on OK after you are done.

3: Tracking Your Contractor Payments for 1099

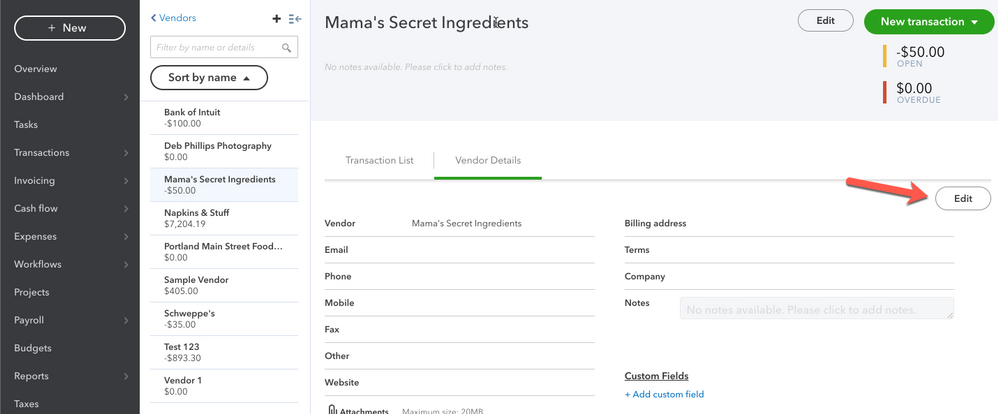

- Go to the Vendors menu and choose Vendor Center to continue.

- Choose a vendor’s name and then tap on Edit.

- Go to the Address Info tab to cross-check the info:-

- Check that you have entered the correct two-letter state abbreviation and ZIP code.

- The vendor’s legal name must have been entered in the First Name, M.I., and Last Name fields if the vendor is a person.

- Leave the Company Name field blank if you only know the company name and not the person’s name. Consequently, it prevents them from showing up twice when you prepare your 1099-MISCs.

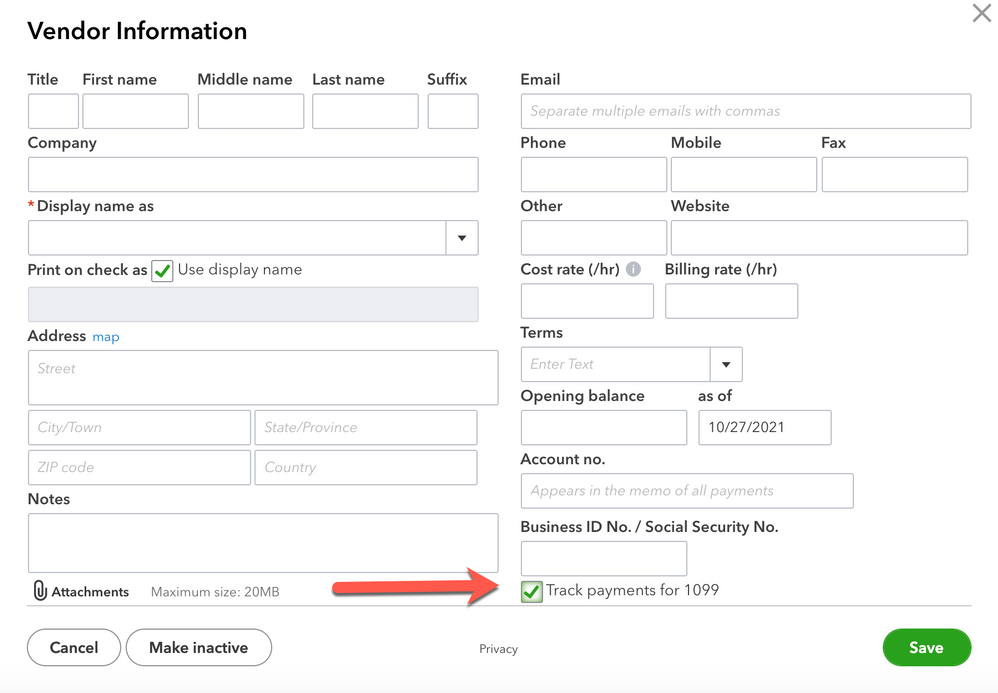

- Choose the Tax Settings tab.

- Select and tickmark the Vendor eligible for 1099.

- Type in the vendor’s tax identification number in the Vendor Tax ID filed.

- Click on OK when you are done.

QuickBooks begins to track all of their payments behind the scenes. You can easily add the tracked payments to the 1099s form when you’re ready to file it.

Set up a 1099 Contractor in QuickBooks Desktop for Mac

It’s a two-step process where you need to activate the 1099-MISC feature and then set QB to track the contractor’s payments for 1099s. The detailed steps are given below:-

1: Activate the 1099-MISC feature

- Go to the QuickBooks menu and choose Settings.

- Tap on the 1099s section.

- Select and then tickmark the 1099-MISC forms are filed box.

- Choose the account for every 1099 category that is associated with your business for reporting and taxation:-

- Go to the Account column and choose an account from the dropdown list.

- In order to associate multiple accounts, From the drop-down list, choose Selected Accounts and then click the desired accounts in the Select Accounts window. Lastly, hit OK when all appropriate accounts have been selected.

Note:- Some companies don’t need to report on all 1099 categories. Many organisations just submit figures for Box 7: Nonemployee compensation. Please consult an accounting expert or the IRS for more information on reporting requirements.

- In order to change a threshold amount, enter the new amount in the Threshold column. It is optional, though.

2:- Tracking Contractor Payments for 1099s

- Move to the Lists menu and select Vendors

- Choose a Vendor and then tap on Edit Vendor in the Vendor List window.

- Click on the Address Info tab to check the following information:-

- Ensure the Address field contains the correct two-letter state abbreviation and the ZIP code.

- The vendor’s legal name should be entered in the First Name, M.I., and Last Name boxes if the vendor is a person.

- Leave the Company Name field blank to avoid double names on the 1099-MISC form if you know the company name but don’t know the person’s name.

- Go to the Additional Info tab.

- Check the ‘Vendor eligible for 1099’ checkbox and enter the vendor’s tax identification number in the Tax ID field.

- Lastly, hit OK.

Note: If Can’t Activate Direct Deposit due to QuickBooks error code 40001, Follow the instruction for updating QuickBooks & running it as an administrator.

Conclusion

In conclusion, these are the methods to set up a 1099 contractor in QuickBooks. Make sure that your contractor fills out a W-9 form to make the process faster. If you are stuck at any step and don’t know what to do, reach out to an expert for professional assistance. Contact Asquare Cloud Hosting’s expert team now.

FAQs

Any business that hires independent contractors (non-employees) and pays them $600 or more per year is required to file a 1099 form with the IRS. They will need to use the 1099 contractor form in QuickBooks to report those payments to the IRS.

Before actually getting into the facts and ways to get the contractor done, you must keep a few things in mind. Let’s have a quick look!

a. Before you set up a 1099 contractor in QuickBooks, obtain a W-9 form from the contractor. This form provides you with the contractor’s legal name, address, and taxpayer identification number (TIN), which you will need to complete the 1099 form.

b. It is important to keep accurate records of all payments made to the contractor throughout the year.

c. Before filing the 1099 form, it is important to verify the contractor’s TIN and legal name with the IRS. Quickbooks has a feature that allows you to do this electronically.

The tax filing due dates are different for each form.

a. Form 1099-NEC’s due date is January 31.

b. Form 1099-MISC due date is March 31 in case you file electronically

The IRS has framed certain rules to decide if a worker is an employee or a contractor. If you want assistance in classifying your workers, check with the IRS.

Oriana Zabell, a professional cloud engineer, has over three years of experience in desktop, online QuickBooks support and troubleshooting. She is currently working as a cloud hosting consultant with Asquare Cloud Hosting. She loves to read and write about the latest technologies such as cloud computing, AI, DaaS, small businesses, manufacturing. When not writing, she is either reading novels or is indulged in a debate with movie fanatics.