Last Updated on November 25, 2025

Let’s learn the right way to unvoid a check in QuickBooks Online or Desktop by following this step-by-step procedure for a hassle-free experience. When you will unvoid a check with the help of this blog, it will not only tell you the right way but also help you in avoiding the issues that can interrupt you while doing this process.

Although this process may sound simple, you might find it complex, just like some other users. However, for the paychecks, the QB doesn’t have an automated unvoid feature; therefore, you will have to unvoid the required checks manually.

Some users may feel an inability to follow these guides to unvoid check in QuickBooks. For those, our team of QB experts is ready. Dial us at +1(855)-510-6487 to speak with a professional regarding this process.

Learn to Re-enter and Recover Information in QuickBooks Desktop

To unvoid a check in QuickBooks Desktop, first, it is required to re-enter and recover the transaction data by following the steps given below.

- Start by launching the QuickBooks Desktop

- Next, browse and access the desired transactions

- Tap on the More tab, which is located on the bottom bar

- Choose Audit History from the options

- Now, tap on the Show All button from the top right corner of the screen to view all edits and the original details for the transaction

After accessing the transaction information, you should use the back button in your browser to move back to the screen where you can re-enter all the information.

Note: Learn how to Void an Invoice in QuickBooks to correct billing errors or remove inaccurate transactions while keeping your records accurate and organized. Follow simple steps to manage invoices efficiently.

Here’s How to Unvoid a Check in QuickBooks Online or Desktop

Carry out the instructions mentioned in this section to unvoid a check in QuickBooks Online & Desktop versions.

Follow this Method to Know How to Unvoid a Check in QuickBooks Online

There is no automatic way to undo a voided transaction in QuickBooks Online. However, you can re-enter the transaction manually if you wish to access and view any details for a particular transaction. For that, you should follow the steps given below.

- Start by opening the QuickBooks Online

- Next, locate and open the transaction you want to unvoid

- Now, you should tap on the More option at the bottom of the page

- Then, tap on Audit History

- Choose the Show All option to access all the original information, with edits that are done in the transactions

- Ensure to note down all the information that is needed to re-enter the transaction

Note: Remember that once a transaction has been voided, the amount on it should be 0. Also, you should use an appropriate amount while re-entering the transaction.

Lastly, choose the Back button on the browser, followed by proceeding to the voided transaction, After entering the correct transaction details, your records will update accordingly.

Follow the Method to Know How to Unvoid a Check in QuickBooks Desktop

It is essential to know that you will not have any option to restore the invoice once it is voided. However, if you really want to unvoid a check in QuickBooks Desktop, use the Audit Log to see the information and re-enter it.

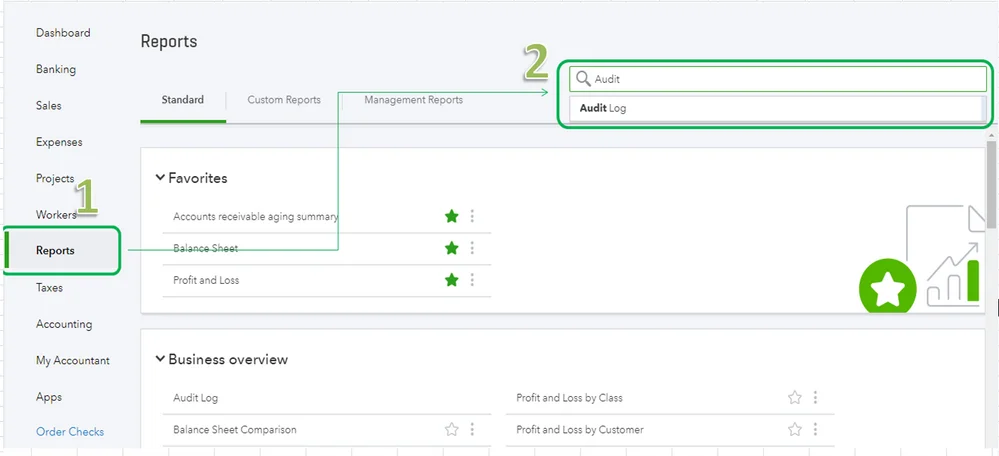

- Start by opening the QB application and tapping on the Gear icon

- Next, navigate to the Tools and then choose Audit Log

- Head to the Filter and from there, select the User Date and Event Filters option

- Here, you need to tap on the Apply option

- Now, browse and find the invoice that has been voided

- Head to the History column and tap on View

- You should note the details of the transactions from the Audit History, then use it while creating a new invoice

Note: Remember that when you undo a voided transaction, the QB will retrieve the details of the original transaction.

Once done, following the above given instructions, you will have the voided as well as the newly restored transaction that you will find in the deleted/voided transaction record.

The Right Way to Unvoid a Paycheck in QuickBooks

Implement the process mentioned below to unvoid a paycheck in QuickBooks.

- Open QB and click on the Reports

- Next, select Accountants and Taxes from the context menu

- Now, select the Voided/Deleted Transactions Detail

- Here, you should head to the voided transaction that you wish to retrieve from the list of voided transactions

- Then, copy or note down the transaction amount

- Tap on Lists in the main navigation menu

- Now, click on Chart of Accounts from the drop-down list

- Tap twice on the account that contains the voided transaction to access the account register

Note: You should know that when you void a transaction in QB, the amount changes to zero, but in the account register, it still shows the transaction.

- Go through the transactions in the account register, click on to highlight the voided transaction

- Here, you need to type or paste the original transaction amount into the transaction field

- Lastly, tap on the Save or Record button to unvoid the transaction with the retrieved information in the account register

The method outlined above will help you unvoid a Paycheck in QB Desktop. To find voided transactions in QuickBooks, follow the process below.

Learn How to Locate Voided Transactions in QuickBooks

You should follow the steps below to locate the transactions in QuickBooks Enterprise.

- If you want to observe empty transactions, first, access the QuickBooks application

- Next, tap on the Gear icon and head to the Tools menu

- Now, select the Audit Log option

- You should use the filters later so you can obtain the required comprehensive details

- Lastly, check the Apply button, and then you will see the list of transactions

It is advised that you follow all the methods mentioned above as needed and carry out the steps in the given order to avoid further inconveniences. Now, let’s wrap up this informative blog with a quick view table to get an instant look at the details about the topic.

A Quick View of this Blog

The quick view table below provides a condensed version of the information on how to unvoid a check in QuickBooks Online or Desktop.

| Know why unvoiding a check in QB Desktop matters | If you void a transaction in QB, the amount turns to zero, and it’s marked as voided. Now, it’s a great feature that helps you avoid storing unnecessary data, but what if you voided it by mistake? It’s an issue. When you leave a check voided, it shouldn’t lead to confusion. In such a case, to get back the voided transaction, you need to unvoid it. |

| Here’s how to unvoid a check in QuickBooks | Head to the Gear icon, click on the Tools menu, choose Audit Log, select Events filters > User Date, tap on the Apply button, locate the voided invoice, tap on Audit History, and reverse the voided transaction. |

| Unvoid a check in QuickBooks Online | Open QB, access the transaction, click on More, tap on Audit History, choose Show All, and re-enter the transaction. |

| Learn to unvoid a paycheck in the QB application | Open QB, click on Reports, select Accountants and Taxes > Voided/Deleted Transactions Detail, tap on Lists, choose Chart of Accounts, double-click the account that contains the voided transaction, tap to highlight the voided transaction, tap on the Save or Record button to restore the transaction. |

| Here’s how to locate the voided transaction in QB Desktop | Open the QB application, head to the Gear icon>Tools, and choose the Audit Log option. Utilize the filters to obtain the required information, and lastly, click the Apply button to see the list of information. |

Conclusion

This blog has covered the correct way to unvoid a check in QuickBooks Desktop or Online. It outlines the steps to locate and re-enter the transaction amount to access the voided check details. Additionally, we have mentioned the way to unvoid a paycheck in the QuickBooks application. All you need to do is implement the method as per the given instructions to avoid any technical difficulty. If you find these methods challenging to implement, consider seeking professional assistance by calling +1(855)-510-6487 and speaking with an expert.

Frequently Asked Questions (FAQs)

How can you undo a deleted check in QuickBooks?

To restore the deleted check transaction, you should follow the steps below.

1. Start by tapping on the Reports menu and head to Accountants & Taxes

2. Click on Audit Trail in the side menu

3. Next, filter the date on which you deleted the transaction

4. Now, tap on Refresh

5. Choose the deleted transaction and double-click it in the new list

6. Lastly, you should copy the details

How can you record a voided check in QuickBooks Online?

To record a voided check in QuickBooks Online, you should follow the instructions below.

1. Start by selecting the + Create

2. Select Check under the Vendors

3. The following fields must be completed: Bank Account, Check #, Payment date, or Account

4. Next, choose More and Void

5. Lastly, select Yes when “Are you sure you want to void this?” prompts

What is the difference between void and delete, and how does it help to unvoid a check in QBDT and QBO?

Let’s say you deleted a check, so now you can’t reverse it in your bookkeeping. But when you void a check, you can easily unvoid a check in the QuickBooks application. However, voiding a check won’t affect your other transactions that are related to that check.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.