Last Updated on January 22, 2026

Tax table updates are crucial before sending paychecks. Without the latest tax table version, QuickBooks may not calculate payroll taxes correctly. However, when updating payroll, you may encounter QuickBooks error 15222. When you face this error, the following message can be seen on the screen:

| “The payroll update did not complete successfully.” |

| “QuickBooks was unable to verify the digital signature. “ |

This could be because of incorrect internet or firewall settings, an invalid digital security certificate, or a poor network connection. Let us dive into why you cannot update the tax table in QuickBooks, then discuss key ways to solve this issue.

If you need any help with your payroll tax tables, feel free to contact our experts at +1(855)-510-6487.

Different Reasons Why You Can’t Update Payroll in QuickBooks

Below are some common reasons the payroll update fails and results in QuickBooks error 15222.

- The QuickBooks digital signature might be outdated, invalid, or missing.

- QuickBooks File Copy Service (FCS) is probably disabled.

- You are using an outdated version of QuickBooks.

- Windows or an antivirus firewall might be restricting QuickBooks from connecting to Intuit’s server.

- You are logged in to Windows as an administrator.

- The internet settings are misconfigured, causing a connection issue between QuickBooks and the server.

- The shared download drive might not have been mapped correctly.

- QuickBooks might be missing a crucial file or component required for payroll updates.

- You might not have administrator permissions to install or modify the computer

Now, let’s move on to the next section and understand how to fix that.

Note: QuickBooks users may face update or payroll issues due to QuickBooks Error 15227, which usually occurs from damaged files or system conflicts. Fixing it quickly helps ensure smooth software performance and uninterrupted accounting tasks.

Troubleshoot QuickBooks Error 15222 When Updating Payroll

As there are various causes of QuickBooks error 15222, we will need to troubleshoot them one by one. To do so, go through the solutions below and follow the instructions.

1. Run QB as an Admin and Download Updates

If insufficient permissions prevent you from updating QuickBooks Payroll, updating it as an administrator might help.

- Firstly, log out of your company file and close any QuickBooks Desktop windows.

- Now, go to the desktop or the Start menu.

- Locate the QuickBooks logo.

- Right-click on it.

- Tap on Run as Administrator.

- When a confirmation message asks whether you want to allow this program to make changes to your computer, choose Yes.

If the admin access couldn’t resolve your issue, proceed to the next troubleshooting step.

2. Utilize QuickBooks Tool Hub

Issues with QuickBooks can often cause error code 15222. Fortunately, there are tools to resolve this, as manually fixing program components is not easy. Therefore, download and install QuickBooks Tool Hub on the system.

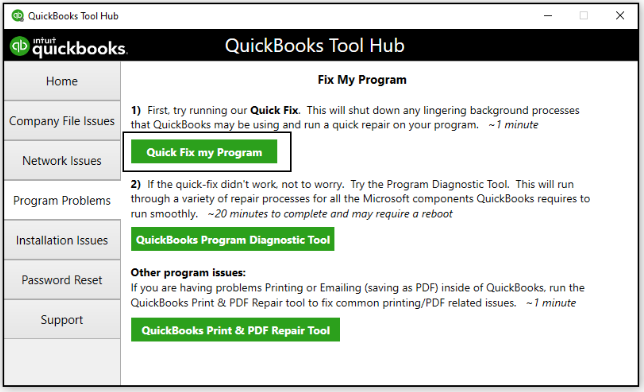

- Launch QuickBooks Tools Hub.

- Then, click the Program Problems tab.

- Now, run Quick Fix my Program.

The tool closes any running background programs and performs an instant repair.

- Now, head back to the Program Problems in QuickBooks Tool Hub.

- Tap on the QuickBooks Program Diagnostic Tool.

Let the tool repair the QuickBooks Desktop application, and once it is done, resume the payroll update. If you see a message mentioning QuickBooks error 15222, let us check for network issues.

3. Use the QuickBooks File Doctor

QuickBooks File Doctor can repair both company files and network issues that may prevent you from updating payroll. The tool will fix the data issues and open firewall ports.

- Access the QB Tool Hub.

- Go to the Company File Issues tab.

- Then choose the Run QuickBooks File Doctor.

- Choose the option with “Repair the file for your existing version of QuickBooks.”

- Tap on Next.

This will help you fix the company file and network issues in your system. Once it is done, restart QuickBooks and update the tax table.

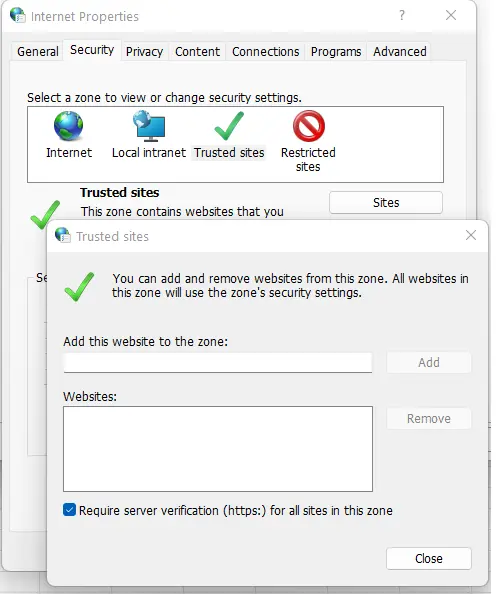

4. Add Intuit Sites as Trusted

QuickBooks and other programs use the default browser’s internet settings to connect to online sites. To ensure your computer doesn’t interrupt QuickBooks’ connection to the server, configure your Internet security settings and add Intuit sites as trusted.

For Google Chrome

- Go to the Settings.

- Choose the Customise and control Google Chrome option.

- Go to the Privacy and security section.

- Choose Site Settings.

- Select the Third-party cookies option.

- Under the Allowed to use third-party cookies section, choose Add.

- Enter *.intuit.com, then choose Add to save.

For Safari

However, if that doesn’t resolve the payroll update error 15222, check the firewall and antivirus settings.

- Access the Safari browser.

- Enter the *.intuit.com

- Tap Enter.

- Choose the Bookmarks option.

- Then, select the Add Bookmark option.

- From the dropdown menu, choose Favourites.

- Choose Add.

For Microsoft Edge

- Choose the menu icon from the top.

- Go to Settings.

- From the left pane, choose Cookies and site permissions.

- Then, select the Manage and delete cookies and site data option.

- From the Allow section, choose Add.

- Input *.intuit.com, then choose Add to save.

If this doesn’t resolve the error, try configuring the Windows firewall and antivirus.

5. Configure the Windows Firewall and Antivirus

Windows firewalls can restrict QuickBooks from connecting to the internet. Therefore, check whether Windows Firewall is blocking QuickBooks and resolve the issue. To prevent that from happening, add QuickBooks to your antivirus exclusions.

- Access the Windows Start menu.

- Type Windows Firewall in the search box to open it.

- Choose the Advanced Settings option.

- Then, right-click on the Inbound Rules.

- Then tap on the New Rule.

- Select the Port, then click Next.

- Ensure to choose the TCP option.

- Enter the specific local ports in the fields.

- QuickBooks Desktop 2020 and later: 8019, XXXXX.

- QuickBooks Desktop 2019: 8019, XXXXX.

- QuickBooks Desktop 2018: 8019, 56728, 55378-55382.

- QuickBooks Desktop 2017: 8019, 56727, 55373-55377.

- Once you enter the port number, choose Next.

- Select the Allow the Connection option, then click Next.

- Now, create a rule and allot a name like QBPorts(year).

- Hit Finish.

Now, follow the same steps for the Outbound rules to manually configure the firewall.

6. Install Digital Signature Certificate

If QuickBooks digital security is missing, invalid, damaged, or outdated, you will encounter QuickBooks error 15222 when updating payroll. Let us install the latest digital signature certificate to fix that.

- Go to the folder where QuickBooks Desktop is located.

- For instance: C:\Program Files\Intuit\QuickBooks

- Now, look for the QuickBooks file with the .exe extension, such as QBW32.exe.

- Right-tap on it and choose Properties.

- Under the Digital Signature tab, look for the signatures.

- Tap on Details on the Intuit Inc digital signature.

- Now, tap on the View Certificate option from the Digital Signature Details window.

- Click on the Install Certificate option from the Certificate window.

- Tap on the Next button.

- Lastly, tap on Finish.

After Windows has installed the digital security certificate, restart the computer and download the payroll updates.

7. Clean Install QuickBooks Desktop

If you encounter a payroll error in your system, clean install the QuickBooks Desktop to resolve the issue. Doing this will help you reinstall the application from scratch and eliminate the issues.

8. Set Accurate Date and Time in Your System

You can easily tackle the error in your system by fixing the correct date and time in your system by following the steps below:

- Go to the Start menu.

- Then go to Settings.

- Head to the Time and Language section.

- Then, the Date and Time option.

- Ensure to select the Set time automatically and enable it.

Correcting the time on your system can help you avoid error code 15222.

Quickview Table for QuickBooks Error 15222

In this section, let’s have a summary of what we have talked about in this blog.

| Description | QuickBooks error 15222 is a payroll tax table update issue that occurs when downloading a newer payroll version. |

| Causes Behind it | Possible causes of this error include an outdated QB application, incorrect date and time settings, and a misconfiguration in the digital signature registration due to incorrect mapping of the shared drive. |

| Ways to Fix | This issue can be resolved by using the QuickBooks Tool Hub, updating the QBDT to the latest version, installing the digital signature, performing a clean install of the QBDT application, or setting the correct date and time in your system. |

Conclusion

This was all about how to fix QuickBooks error 15222 when updating the payroll. We discussed the underlying causes and expert-backed solutions to the problem. To prevent similar mistakes in the future, update your software and operating system regularly and keep the data intact. However, if you continue to encounter issues when updating the tax table, connect with our QB expert at TFN.

Frequently Asked Questions (FAQs)

How do you fix error code 15222 in QuickBooks when updating payroll?

To resolve QuickBooks error code 15222, check the internet, firewall, and antivirus settings. Moreover, run QuickBooks File Doctor, install a digital signature for QuickBooks, and log into Windows as an administrator.

What is error code 15212 in QuickBooks payroll?

Error code 15222 may appear during QuickBooks Payroll updates. This is often due to network issues, incorrect internet or firewall settings, antivirus or third-party interruption, or an outdated, missing, or damaged digital security certificate.

What are the causes behind the QuickBooks error 15222?

The reasons due to which the error 15222 may emerge on your QBDT application are as follows:

1. An outdated QB version.

2. Incorrect date and time settings.

3. Corruption in the QB installation files.

4. Antivirus or firewall settings are interrupting the process.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.