Last Updated on May 5, 2025

QuickBooks offers a variety of added benefits to Chase banking customers. The application is capable of tracking income and expenses to keep accounts in sync by integrating with the bank’s software system over an internet connection. You can download account transactions to an external file and import them into QuickBooks for free as a Chase customer. Also, may set up a direct connection to Chase from within QuickBooks and receive transactions automatically for a monthly subscription. You can utilize the information to reconcile accounts and streamline your financial bookkeeping once the transactions are available.

3 Things To Know Before You Download Chase Bank Statements To QuickBooks

Downloading your bank statement into QuickBooks is a very easy process, although you should check into a few things before actually initiating the process. These things help ensure that you don’t face any errors while trying to download the file-

- Firstly, check the size of the file you are trying to download, & ensure the size should not exceed 350 KB.

- Look for the format of the file you are trying to upload and ensure that it is a supported format such as QuickBooks Online for QuickBooks. In case the format is not supported, a message will appear “ The File is not a Proper web Connect File.”

- If the oldest transaction in the file has a date that is earlier than the opening balance date in the register, the opening balance and date will be changed. A duplicate balance entry will be sent along with it.

If you are looking for professional help to learn how to download chase statements into QuickBooks, Dial +1(855)-510-6487 to contact our expert.

Related Post: Resolve QuickBooks Error 103: Can’t Connect the Bank Account

How To Download Chase Bank Statements Into QuickBooks?

There are two different ways of downloading bank statements in QuickBooks- Web Connect and QuickBooks Direct Connect. You can use either of them based on your preferences-

Method 1: Using QuickBooks Direct Connect

This is an inbuilt feature of QuickBooks through which you can download Chase bank statements. You need to perform just a few steps within the application, and you are good to go-:

- Log on to the Chase Online Web page.

- Go to “Customer Center” and tap on “Reference Center”. Now go to the link for “Activate Money, Quickens, etc.”

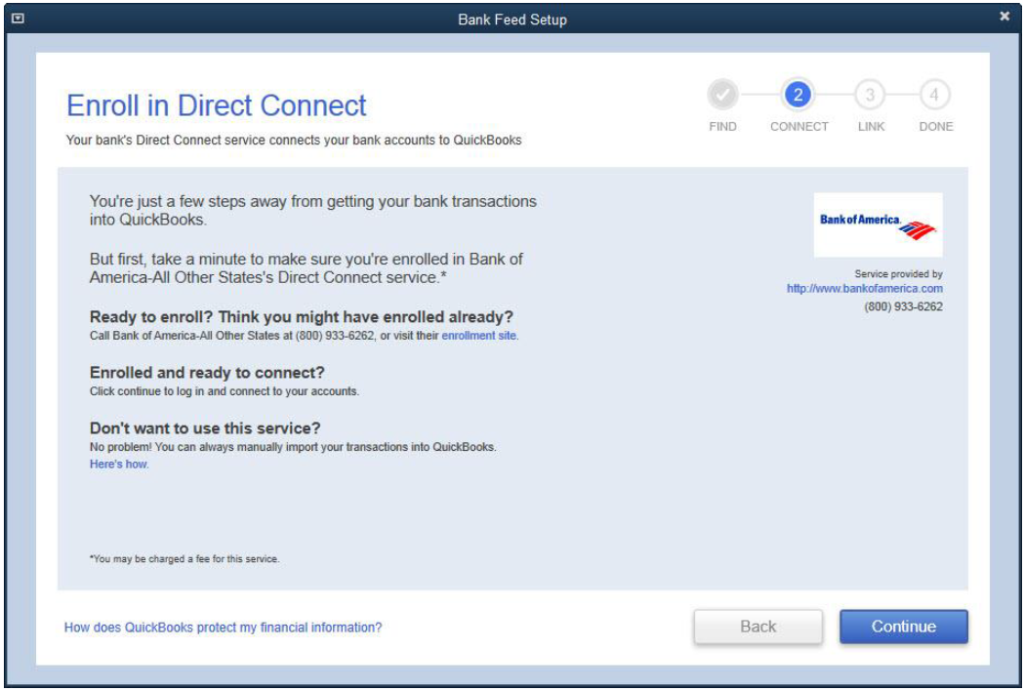

- Click “Continue” after selecting “Activate Direct Access through the PFM service ($9.95/month).” Complete the configuration for direct access by following the on-screen instructions.

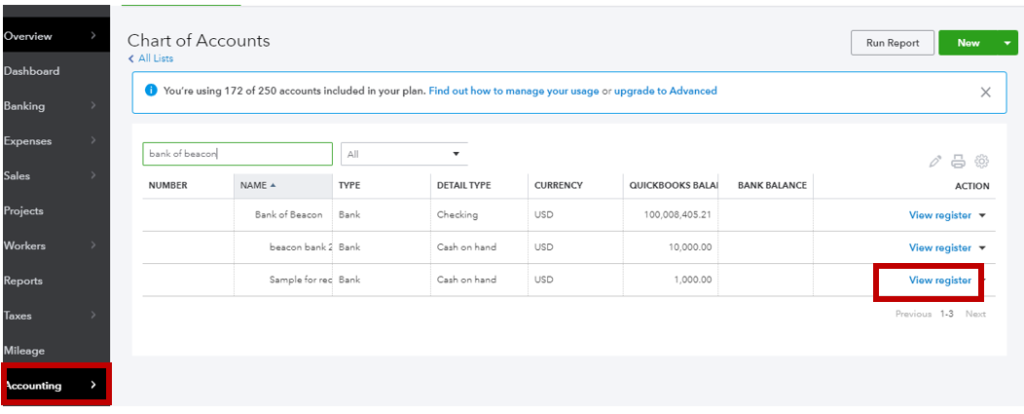

- Now launch QuickBooks on your computer. Go to the “Banking” section of the menu. Select “Online Banking” followed by “Set Up Account from Online Services.”

- Choose a company account from the drop-down menu, or type in a new account name. To proceed, click “Next.”

- Scroll down to the Financial Institutions drop-down list and select “Chase” or input “Chase” into the box. To complete the account setup, click “Next.”

- After selecting “Direct Connect,” click “Next.” From the drop-down menu, select “Yes, my account has been activated for QuickBooks Online Services.” Click “Next” to proceed with the setting.

- When asked, enter your Chase Online username and password. To access and download, choose an online account.

- “Download Online Accounts” and “Receive Transactions” are the options you should select. To complete the connection process, click “Finish.”

Also Read: 4 Finest Solutions To Fix QuickBooks Error Code 12029 Efficiently.

Method 2- Through Web Connect

This method requires you to go to the Chase Online Banking Page in order to generate QuickBooks OFX. Follow these steps in order to do so-

- Visit the Chase Online Banking Page to sign up or log in.

- Select Customer Center Tab and then scroll down to Reference Centre

- Now press on the link “Activate Money, Quicken, etc.”

- Choose the ‘Download Now’ option in order to generate QuickBooks OFX- formatted file and then tap Continue.

- Now you need to select an account from which the transactions are required to be downloaded, and also select the date range.

- Choose the QuickBooks radio button, then the QB version from the drop-down menu. Tap on Export.

- Click on the “Save” button if asked and select the destination folder in order to save the file. Intuit recommends you save the file on the desktop.

- Navigate to the target folder, where the OFX-formatted file is stored. Rename the file to “Filename.qbo” (including the quotation marks), where the filename is the name of the file you downloaded. QuickBooks Web Connect only recognizes QBO-formatted files; thus, this step is required.

- Run QuickBooks on your system

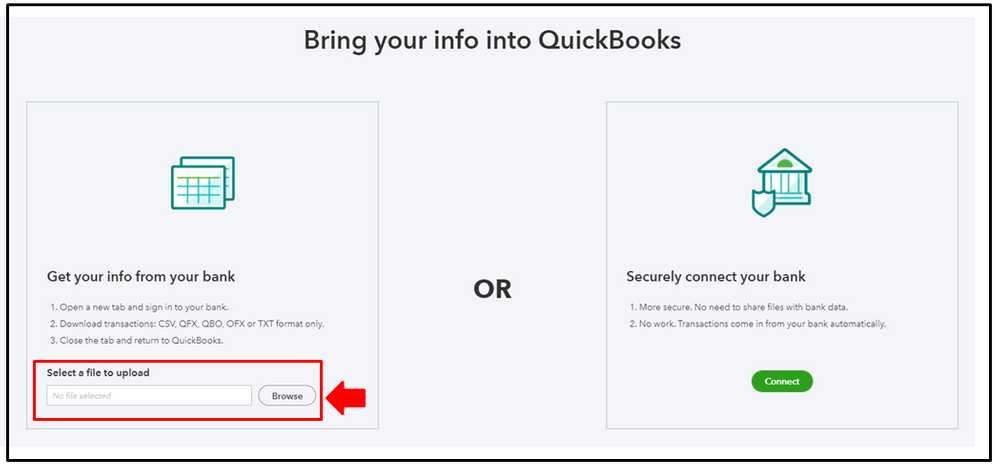

- Tap on the File menu and access utilities “Import” and “Web Connect Files.”

- Find the file with OFX format that you downloaded from Chase Online on your Desktop.

- When prompted in the “Select Bank Account” window, select “Use an existing QuickBooks account” and select your account from the drop-down list. Select “Create a new QuickBooks account” and give it a name if your account isn’t available. Click on “Continue”.

- Under Online Banking, go to ‘My Shortcuts’ and open the downloaded transactions.

Note:- In 2009, Washington Mututal bank was taken over by Chase Bank. WAMU users can update their bank name in QuickBooks itself.

What Are The Ways To Solve The Chase QuickBooks Download Problem?

There are times you might be unable to download Chase Banking transactions to QuickBooks desktop. It might be due to sign-in issues, and it is very easy to fix it-

- Tap on the Banking menu and choose Add Account

- Find your bank and choose it to get its URL

- Sign in with your username and password, and make sure you use the sign-in URL as which is listed in QuickBooks

- Look at the account page in order to ensure that there are any sign-in issues,

- In case everything is OK, you need to choose a blue title from the Banking menu in QuickBooks.

- Now click on Update

Also Read: This Is How to Delete Duplicate Transactions in QuickBooks Desktop & Online.

Reconnecting a Chase Account with QuickBooks

There are times you face an error while downloading Chase credit card transactions. These might be due to faulty settings and are very easy to fix. You can solve it by following these steps-

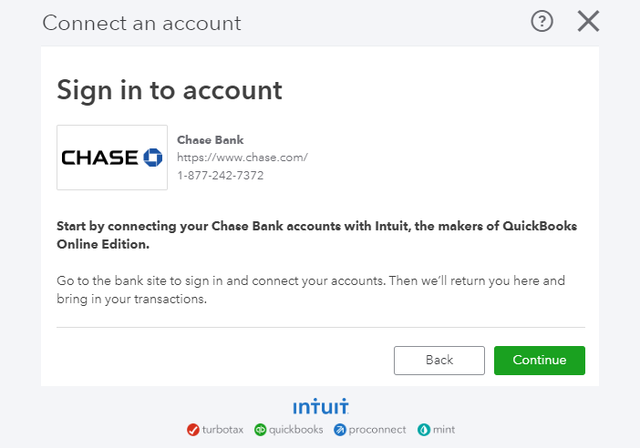

- Click Add Account on the Banking page.

- Select the Chase Bank from the results.

- Follow the steps to log in.

- Make sure that the accounts are checked. Press Continue on the window that opens up.

- Close your window when a window appears asking QBO to map your Bank accounts.

Conclusion

We hope you know what to do when you want to download your Chase transaction history in QB. The QB application also offers other instruments for businesses to manage their account better. If you still have any doubts left, contact Asquare Cloud Hosting Helpline Number and they can further help you out.

Frequently Asked Questions

Yes, Chase transactions could generally be synced with QuickBooks every day. However, I recommend checking with the official Chase Bank and QuickBooks websites for the most current and accurate information regarding synchronization frequency.

Yes, QuickBooks allows integration with various credit cards beyond Chase. Many major credit card providers offer integration options, enabling you to sync transactions and manage finances seamlessly.

You need to link your Chase credit card account, categorize transactions, and assign them to employees to track employee expenses with Chase.

If you see discrepancies between Chase & QuickBooks, it’s important first to investigate & reconcile the differences. Discrepancies can occur due to various reasons, like timing delays, data entry errors, or technical issues. Hence, regular reconciliation ensures accurate financial records.

To check your credit card balance through QuickBooks, link your credit card account, sync transactions, and view the balance in the software. QuickBooks updates balances regularly, helping you monitor your credit card’s financial status conveniently.

Oriana Zabell, a professional cloud engineer, has over three years of experience in desktop, online QuickBooks support and troubleshooting. She is currently working as a cloud hosting consultant with Asquare Cloud Hosting. She loves to read and write about the latest technologies such as cloud computing, AI, DaaS, small businesses, manufacturing. When not writing, she is either reading novels or is indulged in a debate with movie fanatics.