Last Updated on November 20, 2025

Reconciliation discrepancies, incorrect adjustment entries or missing transactions could be the reason you wish to undo the reconciliation. This lets you record an entry to the previous reconciliation period, modify or delete entries, and helps keep the books intact.

In this blog, you will learn how to undo a reconciliation in QuickBooks Online and Desktop. Alright then, let us get started with it!

Reasons Why You Might Need to Undo Reconciliation in QuickBooks

There are various instances when you might need to undo the reconciliation in QuickBooks and do it over again. For instance,

- There might be discrepancies in the bank statements and transaction entries, and you need to redo reconciliation to fix them.

- The payment record might have been inaccurate, or the date was entered incorrectly.

- There might be various hidden banking errors.

- You want to check for unethical activity or fraud by the bookkeeper, accountant, or employees.

- Adjustment entries made to force close the reconciliation were incorrect.

Now, let us tell you some crucial things to know about reconciliation.

Essential Things to Know Before Undoing Reconciliation in QuickBooks

Reconciliation is a tricky thing, and if done wrong, it can upset the books and financial reports. Therefore, before you go ahead and undo QuickBooks reconciliation, here are some things you must know.

- When you undo an older reconciliation, such as for April, it will undo all the reconciliations that were done after this time period, such as in May and June. Thus, you will need to redo all the reconciliations that followed this one.

- The best way to resolve a reconciliation discrepancy is by starting with the most recent reconciliation and working the way backward.

- When you undo a reconciliation in QuickBooks, it doesn’t affect or work on manually reconciled transactions. Thus, you will need to check the register for these transactions and undo them manually. To be sure, you can access the transaction audit history.

- Before you delete a reconciliation in QuickBooks Online, make sure to download the attachment file, as it might get deleted.

- Moreover, you can print bank reconciliation in QuickBooks before undoing it. QB Desktop users should save a company file backup as well.

Once you have ensured the above, let us see how to unreconcile in QuickBooks Online Accountant.

Section A: How to Undo a Reconciliation in QuickBooks Online

In this section, we will walk you through the steps of undoing a reconciliation in QuickBooks Online, including the QBOA (accountant version).

1. Steps to Undo Reconciliation Accountant (QBOA)

Let us show you how to undo a reconciliation in QuickBooks Online accountant. Therefore, read the instructions carefully and follow them in the order they are given.

Note: If you use another QuickBooks Online version, you can skip to the next step.

- Open QuickBooks Online Accountant and sign into the company file you wish to make changes to.

- Now, open the Accounting menu.

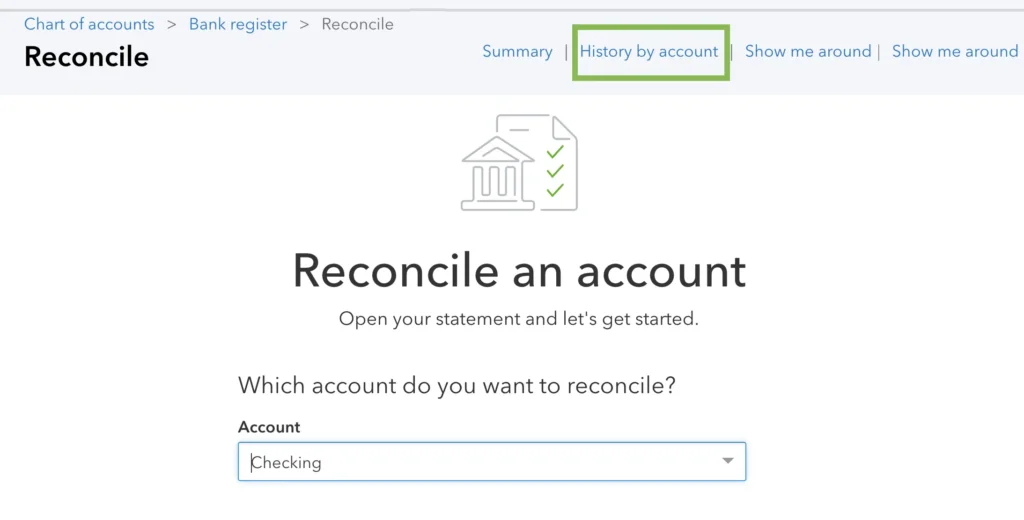

- Tap on the Reconcile tab and choose History by Account.

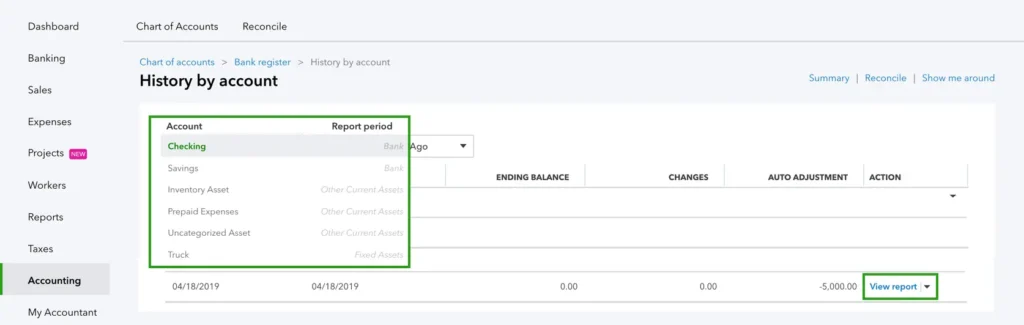

- Now, choose the account you wish to reconcile, followed by the date range, using the drop-down menu.

- On the list, find reconciliation and choose View report. This will fetch the Reconciliation Report.

- Now, check for the discrepancies and changes that you wish to make.

- Finally, when you are ready, tap on the dropdown menu that you will see in the right side of your row in the Action column.

- Choose Undo, followed by Yes, followed by Undo.

Now, you are ready to redo reconciliation in QuickBooks Online Accountant. If you don’t see Undo, you need to double-check whether you have opened the client’s company file using QuickBooks Online Accountant or not.

You May also see: Fixing: QuickBooks Reconciling the Beginning Balance Wrong

2. How to Undo a Reconciliation in QuickBooks Online (Standard Version)

In a QuickBooks Online version other than QBO Accountant, you need to manually un-reconcile each transaction. Let us show you how.

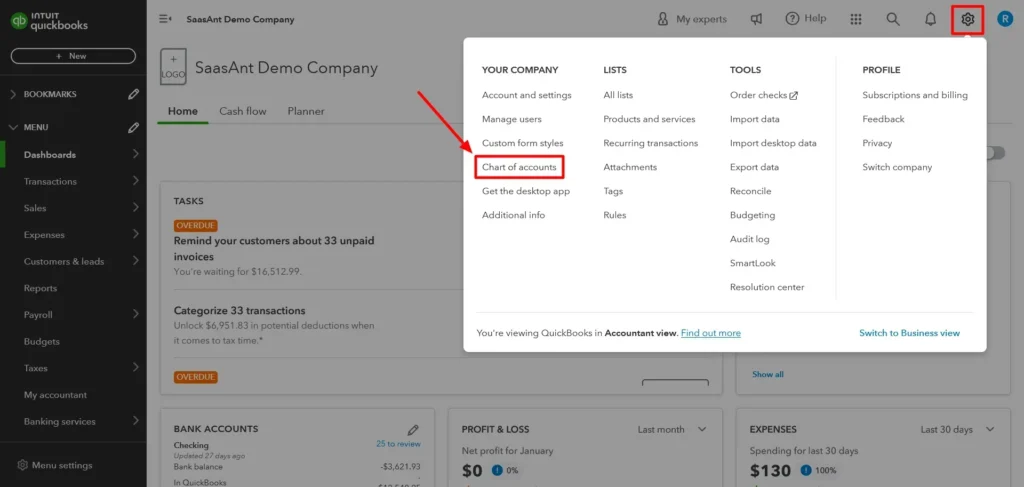

- Log in to QBO company and then tap on the Gear or Settings icon you will see on the top.

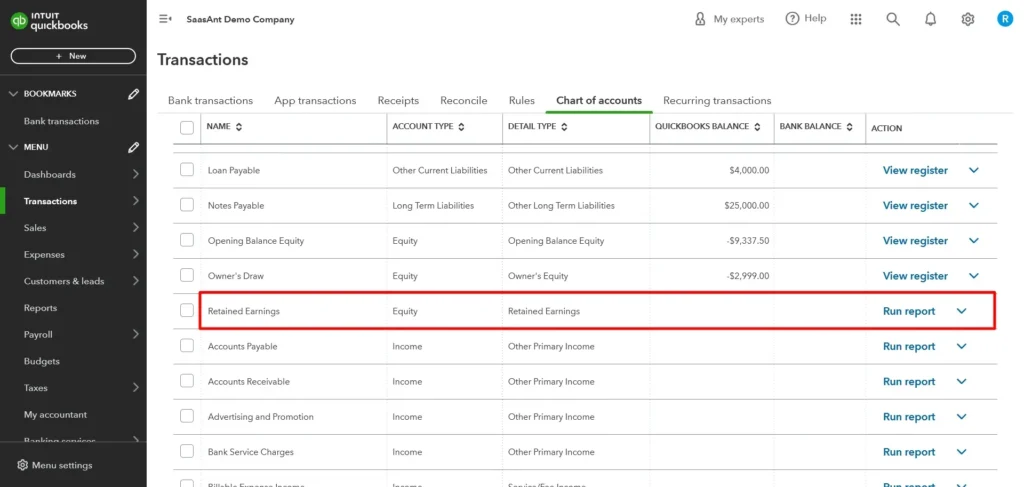

- Choose Chart of Accounts, followed by the account for which you wish to undo the reconciliation.

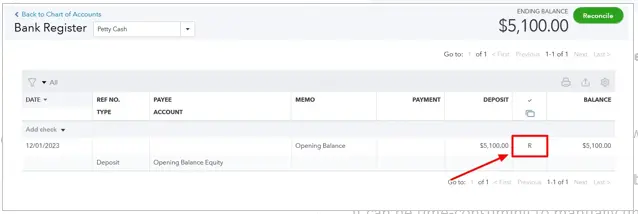

- Now, tap on View Register and choose the transactions you wish to unreconcile.

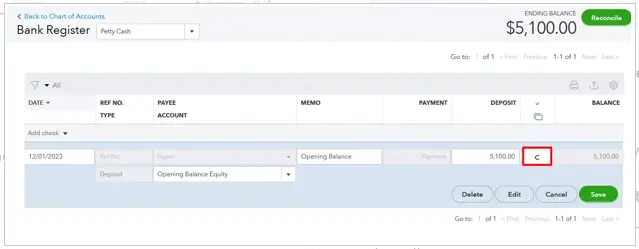

- Tap on the R status multiple times until you see it as blank or cleared (C).

- Choose to Save and then select Yes as confirmation.

Now, you can reconcile the transactions for the account again. Alternatively, you can invite your accountant to undo the whole reconciliation in a short time.

3. How to Invite Your Accountant to Undo the Reconciliation

It can be time-consuming to manually undo each transaction. Thus, QuickBooks Online allows you to invite your accountant, who can undo the reconciliation for you. Your accountant must have a QBO accountant subscription to do so.

- Tap the Gear or Settings icon on the top right and choose Manage Users.

- Click on the Accounting Firms tab and tap on the Invite button.

- Type in the accountant’s details and choose to Save.

- Now, your accountant can undo the whole reconciliation.

Once your accountant has unreconciled the books, you can start reconciling them.

Section B: How to Undo a Reconciliation in QuickBooks Desktop

QuickBooks Desktop allows you to unreconcile only the most recent reconciliation. However, before you do so, list down all the discrepancies and create a backup of the QuickBooks company file. Now, follow the steps below to undo a reconciliation in QuickBooks Desktop.

- Launch QuickBooks Desktop, and go to the Banking menu.

- Now, from the Banking menu, choose Reconcile.

- Choose the account and the date, then enter the balance.

- Now, tap on Undo Last Reconciliation and choose to Continue when you see the confirmation Window.

This will unreconcile the books and allow you to reconcile them again.

Section C: How to Fix QuickBooks Reconciliation Discrepancies

Before you resolve the QuickBooks reconciliation discrepancies, you should know what leads to them. This could be because of an incorrect beginning or opening balance, a deleted transaction from the previously reconciled period, incorrect or missing entries, to list a few.

There are certain things you can do to fix a reconciliation discrepancy in QuickBooks, such as:

- Check the beginning and opening balances and ensure they are correct

- Utilize QuickBooks Reconciliation Report to fetch the transactions that were changed since the last reconciliation

- Run the missing checks report to find the transactions not included in the bank statement

- Utilize the QuickBooks Transaction Detail Report to review all the transactions that have been changed

- Check and verify the adjustment made during the last reconciliation.

Alternatively, you can undo the last reconciliation and do it again.

Conclusion

This was all on how to undo a reconciliation in QuickBooks Online and Desktop. Hopefully, this will help you resolve any reconciliation discrepancies you are struggling with. However, if you face an issue or need assistance, you should reach out to an expert. Dial +1(855)-510-6487 to speak to an accounting expert!

Related Searches:

how to undo bank reconciliation in QuickBooks online

undo bank reconciliation in QuickBooks online

how to undo a reconciliation in quick books online

how to unreconcile in QuickBooks

Frequently Asked Questions

How do I undo reconciliation in QuickBooks Desktop?

To undo reconciliation in QuickBooks Desktop, you can open the Banking menu and click on Reconcile. Now, select the account for which you want to unreconcile the transactions, and then tap on the dropdown menu and choose Undo Last Reconciliation.

How do you fix the previous reconciliation in QuickBooks Desktop?

To resolve the previous reconciliation in QuickBooks Desktop, check for missing or incorrect transactions or incorrect reconciliation adjustments. When the need be, you can undo the last reconciliation and do it again.

How do I correct bank reconciliation in QuickBooks Desktop?

To correct the bank reconciliation in QuickBooks Desktop, you can run the QuickBooks Reconciliation Discrepancy report. Now, review the report to look for any discrepancies and fix them. Moreover, check the opening and beginning balances and ensure they are correct.

How many reconciliations can I undo in QuickBooks?

If you use QuickBooks Online accountant (QBOA), you can undo reconciliations for past reconciliation periods without a limit. However, if you use the standard QBO version, you will need to manually modify each transaction. QuickBooks Desktop users can only undo the most recent reconciliation.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.