Last Updated on July 5, 2024

QuickBooks allows users to backup their company files to ensure the safety of data. QuickBooks error code skipped 111 arises while backing up the company file. It does not allow the backup process to get completed. Usually damage to the company file is the reason for this error. Incorrect details on the paychecks can also lead to this error.

Resolution for QuickBooks Error Code Skipped 111

Using the rebuild and verify utility is this error’s go-to resolution method. Users can also try editing the paychecks’ information and restoring the backup file to troubleshoot the QuickBooks error code skipped 111. The detailed steps that they need to follow are:-

Method 1- Use Verify and Rebuild Utility

QuickBooks has inbuilt utilities that can help you fix the company file damages. It can also help you resolve QuickBooks error 111. The steps you need to follow are:-

- Run QuickBooks Desktop on your system with your company file open.

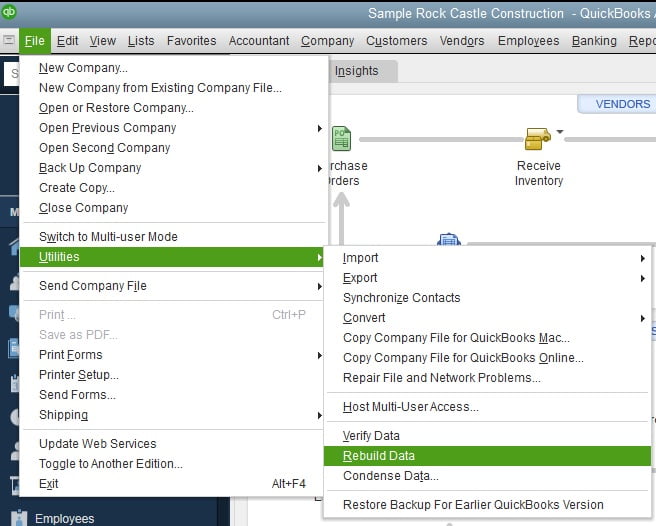

- Tap on the File button and choose Utilities from the option.

- Then further select Verify Data from the list and wait for it to complete the process.

- An error message will pop up on your screen telling you if your data file has been damaged or not.

(Note:- You need not follow the next steps if the message states that there is no damage in the data file)

- Again click on the File tab and select Utilities from the options.

- Choose the Rebuild Data option.

- Click on OK if any warming message pops up to close all the open windows.

- Tap on OK if a message pops up regarding creating a backup of your company file.

- Rebuild Data utility will start automatically once the backup is finished.

- Tap on OK when you see the message ‘Rebuild has completed’.

- Run Verify Utility once again to ensure that now your company file is not damaged.

Method 2- Edit Paychecks And Then Run Rebuild and Verify Utility

Entered information in your paychecks can also be a reason for QuickBooks company file backup error 111. You need to go through your paychecks, edit some information and then rerun the verify rebuild utilities. The steps you need to follow are:-

- Open Paychecks in QuickBooks Desktop.

- Make some temporary changes in the checks, such as date or amount.

- If any paycheck requires specific changes, click on Paycheck Detail and make the changes.

- Tap on OK once done and then click on Save & Close button.

- Ensure that you have saved all the changes you made.

- Also make sure you save your company file after all the changes.

- Now follow the above mentioned steps and run Verify and Rebuild data utilities.

Method 3- Restoring a Backup Company File

Damage in your company file is a reason for QuickBooks Error Message 111. You can restore your file to the last backup you saved which is damage free. The only downside to this error is that you will have to redo all the work that was done after that last backup was saved. These are the steps you need to follow to restore a backup:-

Note:- QuickBooks uses a backup company file with .qbb extension to create a new company file .qbw file.

- Run QuickBooks on your system and tap on the File tab.

- Choose the Open or Restore Company option from the list.

- Click on Local Backup and then tap on Next.

- Browse and select your last company backup file. It will have your company file name with .qbb extension.

- Choose the folder where you want to save the restored company file and then tap on Open.

Note:- If you use the same folder where your current company file is saved, there is a possibility of a new file overwriting your current file. You can rename your company file to ensure that no overwriting is done or use a different folder to restore your company file.

- Tap on save after you are done. In case a message pops up regarding overwriting your data, select the option most suitable to you.

So this has been all about QuickBooks Error Code Skipped 111. These solutions will help you create a backup of your company file once again. In case the error still persists, reach out to an expert and they will guide you on what you need to do.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.