Last Updated on November 20, 2025

There are times when you are trying to create payroll tax tables, and you notice that your QuickBooks Payroll not taking out taxes when creating paychecks. This problem can be seen because your software or payroll is outdated, or the QB company data is damaged or corrupted. In this blog, we will delve into this problem and the reasons behind it. Moreover, we will also learn how you can tackle this problem.

If you need assistance with QuickBooks not taking taxes, please don’t hesitate to contact our experts at +1(855)-510-6487.

Reasons Behind Why QuickBooks Payroll Is Not Taking Out Taxes?

When creating paychecks and payroll tax tables, you may encounter an issue where your payroll does not deduct taxes. There are multiple reasons why this issue is causing your trouble. Let’s look into the root causes of this.

- The employee details or settings are either not correctly set up or are misconfigured.

- You may be using an outdated version of QuickBooks Desktop.

- If your company data or the company file is corrupted or damaged, it may cause issues.

- The employees either don’t qualify for the taxable wage base or have a gross wage that is lower.

- If your payroll subscription status is inactive, this error occurs.

- You are using outdated payroll tax tables in your QuickBooks.

After understanding the potential culprits for QuickBooks payroll not taking out taxes, we can proceed. Let’s now explore possible fixes.

Also See: QuickBooks Payroll Won’t Update? Here’s the Fix That Actually Works!

QuickBooks Payroll Not Taking Out Federal Taxes? Things to Try

After learning about the causes of QuickBooks Payroll not taking out taxes, it is essential to understand how to resolve this error and work smoothly.

1. Update QuickBooks Desktop

Furthermore, staying on the updated version can stop QuickBooks not taking out payroll taxes. Here are the steps to update the QB.

- Staying on the updated version of QuickBooks Desktop can stop Payroll not taking out taxes. Here are the steps to update the QB.

- Launch the QB Desktop.

- Now, select Help.

- Head over to update the QuickBooks menu.

- Tap the Reset updates option.

- Then, click Get updates.

- Lastly, restart your system.

After restarting, check if the error persists; if not, move on to the following troubleshooting method.

2. Updating QuickBooks Payroll Tax Table

Updating the QuickBooks Desktop to the latest version can solve the error. If not, follow the steps to update the QB payroll tax table, which may be the reason QuickBooks payroll is not taking out taxes. Here’s a guide to update the QB payroll tax:

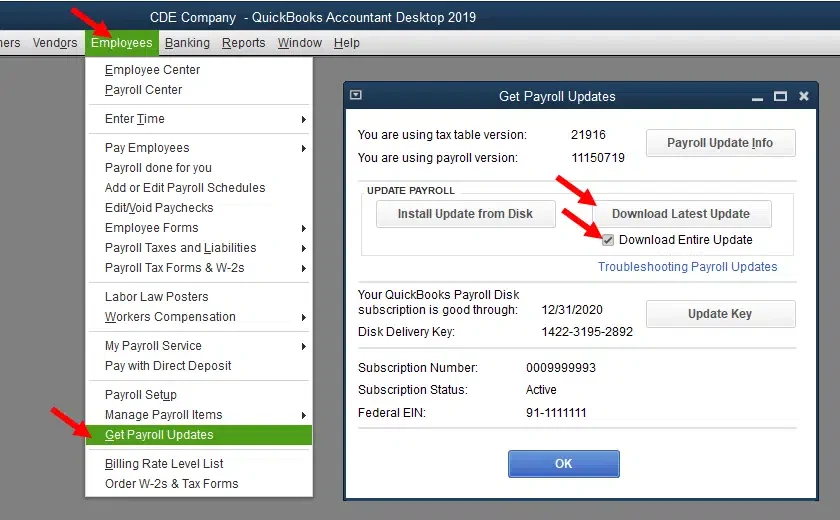

- Start with opening QB Desktop > choose Get Payroll Updates under the Employee menu.

- Move forward with tapping on Download Entire Update.

- Now, update the QB Payroll Tax Table to the latest available version.

Updating the payroll tax table can help fix the issues that stop the process.

3. Verifying the Employee Payroll Data

Besides, QuickBooks Payroll not withholding taxes can be fixed by verifying the employee payroll data. While verifying the employee’s paycheck is necessary to calculate taxes and update the payroll. Follow the steps below to do it.

- Open QuickBooks Desktop > head to the Employees tab > then click Scheduled Payroll.

- After taking the steps, click Resume Scheduled Payroll.

- Choose Revert Paychecks for the employee names whose changes are reversed.

- However, to verify the employee’s paycheck, look for the yellow highlighted area and select Open Paycheck Detail.

- Complete the payroll information and save the data.

4. Checking for Employee’s Tax Setup

When the file status on the federal form W-4 is Exempt, the employee’s paycheck may not be held back for taxes. The file status should be updated; hence, here are the following steps.

- Head to the Employee Centre under the Employees tab > Double-click on every employee’s name.

- Verify the Pay Frequency is right by checking the Payroll Info on the left.

- Click on the Federal tab, review the Allowances and Filing Status columns, and then click the Taxes button.

- Next, adjust the necessary and select OK twice.

5. Verifying the Payroll Subscription Status

Indeed, the payroll subscription can stop deducting tax files whenever they are invalid or inactive. Here is the guide for verifying the status of your payroll.

- First, all the company files must be closed.

- Reboot your system.

- Open QuickBooks > move to Employees > select My Payroll Service, then tap Manage Service Key.

- The Service Name and Status should be correct and Active.

- Select Edit and confirm with the correct service key number.

- Click Next, uncheck the Open Payroll Setup box > and click Finish.

Sometimes, you might need to refresh the payroll service when you see Service Status as Suspended before you can update the tax table or send paychecks.

- Go to the Employees tab, scroll down, and choose My Payroll Service.

- Tap on the Account/Billing information option.

- Type in the Intuit user ID and password.

- Head to the Service Information section and tap on the Service Status.

- If you see it as Suspended, hover the cursor over the Annual Billing Details field and type in your credit card information.

- Choose Save.

The problem manifests itself when QuickBooks payroll taxes are not deducted because of subscription expiry. The steps mentioned above are to configure the issue.

6. Checking Employee’s Tax Calculation Limit

When creating a payroll, if the default limit has been reached, it won’t calculate the employee’s taxes further. The user needs to update the tax calculation limit to do so. Here’s how.

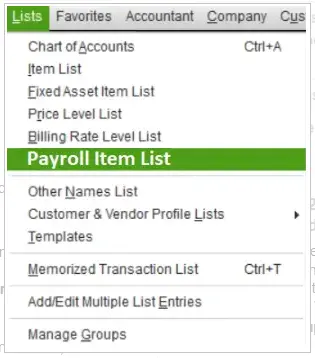

- Open QuickBooks, and head over to Lists.

- Click on Payroll Item List, then right-click on relevant payroll items.

- Click Edit Payroll Items, select Next, and wait for the Limit Type option.

- There will be three different options:

- Annual- Restart Every Year

- Monthly- Restart Every Month

- One-Time Limit.

- Now, the Limit Type can be changed for the employee.

- Click on Finish and reopen QB Desktop.

The employee’s paycheck should be created and checked to ensure the payroll properly deducts taxes.

You may also see: QuickBooks Payroll Not Calculating Taxes? Here’s the Fix You Need Now!

7. Verifying the Employee’s Payroll Tax Configuration

According to the QB payroll data, taxes are being calculated. Certain factors affect the calculation of payroll taxes, salary and wages, allowances, pay frequency, and filing status.

The following is a guide to ensure the factors are correctly mentioned in QB payroll.

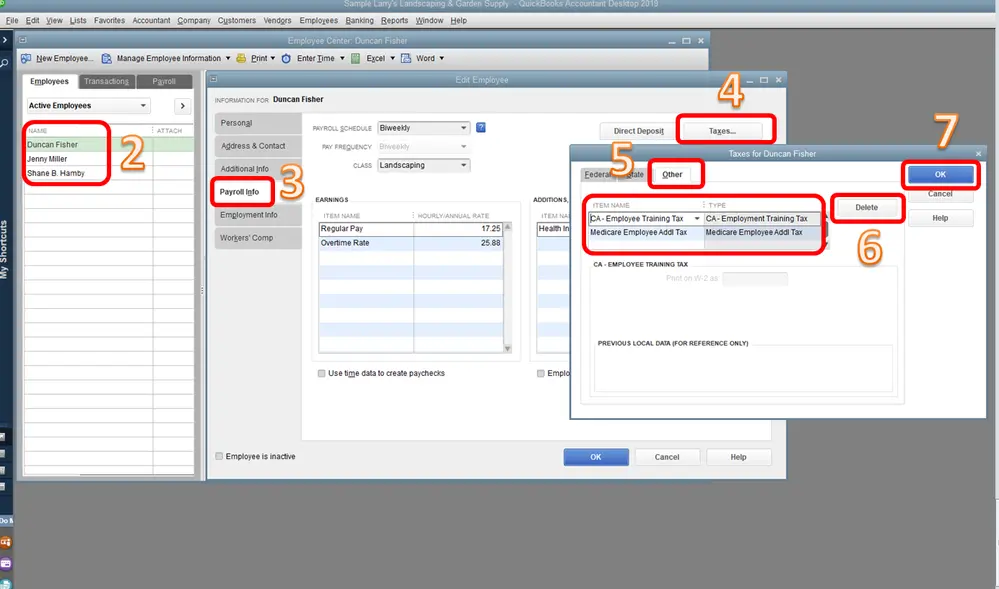

- Open QuickBooks Desktop.

- Then, navigate to the Employees menu and select Employee Center.

- Double-click on the name of the employee and click on Payroll Info.

- Verify the Pay Frequency and head over to the Taxes table.

- Choose the Federal option.

- Now, review the Filing Status and Allowances.

- Tap OK to save all the changes made.

Even if all the steps trigger the error, remove the duplicate payroll tax items. To delete the duplicate payroll tax items, proceed to the next step.

8. Deleting the Duplicate Payroll Tax Item

Duplicate payroll tax items can cause incorrect tax deductions. So, delete all the duplicate tax items; you can ensure the seamless calculation of payroll taxes. Here’s how to do so.

- Open QuickBooks and head over to the Employees tab.

- Select Employee Center > double-click on the employee’s name.

- Click on Payroll Info > then select the Taxes option.

- Choose Other and find the duplicate payroll tax item.

- Click on delete to erase the duplicate payroll tax item, and then hit OK.

Tips to Help You With QuickBooks Payroll Tax Calculations

Here are some tips that will help you ensure accurate tax deductions in QuickBooks Payroll:

- Ensure that your payroll tax table is updated to stay on the latest tax rates and regulations.

- Verify that every employee’s W-2 and state tax forms are filled accurately for proper tax and payout withholdings.

- Ensure to set up correct tax liabilities, such as federal, state, and local taxes, to get an accurate deduction amount.

- Verify if the benefits are accurately classified as taxable or non-taxable in the system settings.

- Set up and configure payroll items for earnings, deductions, and taxes to avoid errors during calculations.

- Verify and check the payroll reports, such as payroll summary and tax liability reports, to ensure the tax calculations are proper.

These expert tips will help you achieve accurate QuickBooks payroll tax calculations in your system.

Conclusion

In conclusion, we discussed why is QuickBooks Payroll not taking out taxes and how an outdated tax table affects that. Moreover, we walked through multiple troubleshooting methods to resolve this error. We also walked you through multiple troubleshooting methods to resolve this error. If you are still struggling with the same problem after performing the steps above, feel free to contact a QB Expert. Dial +1(855)-510-6487 24*7!

Frequently Asked Questions

Why is QuickBooks Payroll not taking out taxes?

When QuickBooks Payroll does not deduct taxes, the issue can be caused by a wrong payroll item setup, corrupted files, or duplicate payroll tax items. Moreover, this happens when the QB version and the tax table are not properly updated, or the installation is not done correctly.

What should I do when I encounter QuickBooks Payroll not taking out taxes?

If you find QuickBooks payroll not taking out taxes, update the QB Desktop application and the payroll tax tables. Here are some things you can do if the problem persists:

1. Verifying the Employee Payroll Data: Check that the Employee payroll data is correctly entered.

2. Checking for Employee’s Tax Setup: Verifying the tax setup is appropriate for the payroll creation.

3. Check the Payroll Subscription Status: Ensure that the Payroll Subscription is active to make the changes.

4. Check Employee’s Tax Calculation Limit: Extend the calculation limit for the employee tax files.

5. Verify the Employee’s Payroll Tax Configuration: Check for the employee’s tax files and the information.

6. Delete the Duplicate Payroll Tax Item: If there is any duplicate for any employee files, it should be removed to undergo tax file creation.

Why is QuickBooks not withholding federal taxes?

The IRS Form W-4 might have declared the employee exempt from federal income tax withholding. An employee might qualify for a withholding exemption to claim this exemption and have no federal income tax withheld from their wages.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.