Let us show you how to write off bad debts in QuickBooks Desktop and Online.

Bad debts refer to the amount of money that is irrecoverable from your debtor. It is the money that generally your customer or someone you lent but can’t recover now due to circumstances. Now, that is a loss for a business and should go on the debit side of the profit and loss statement.

Thus, it’s important to write off bad debts in QuickBooks so that you know the true position of the business. If you let the debt remain a normal debt, it will show as an asset in your financial statements. However, that is misleading because it is a sum that you will never recover. The money that your debtors owe is an asset for you, and thus, not writing off bad debts will make the asset side look inflated. Therefore, it is time to write it off and forget about it.

If you are the one handling your books, you need to know how to write off Bad debts in QuickBooks. In this guide, we will show you how to do that.

How to Find Bad Debts in QuickBooks?

Before you write off bad debt in QuickBooks, you need to identify them, which is quite easy in QuickBooks. You can access the Account Receivable Ageing Detail Report in QuickBooks for an overview of your customer’s unpaid invoices, outstanding balances, due amounts, and the time past the due date. Now, you need to decide which debts are long pending, have no chance of recovery, and should be written off.

Here are the instructions to get the Account Receivable Ageing Detail Report in QuickBooks Desktop and Online.

For QuickBooks Online

- Firstly, go to the Reports tab in QuickBooks Online and select Who Owes You.

- Now select the Accounts Receivable Ageing Summary Detail option.

- Now, you will need to customize the report to see how long each transaction is past due.

- Choose Customize and select the Past Due checkbox in the Rows/Columns section.

- Lastly, hit Run Report to conclude.

For QuickBooks Desktop

- In the top menu bar, select Reports.

- Choose the Customers and Receivables option and select Transaction List by Customer.

- Hit the Customize option.

- Now, for the columns and account type, select the Display and Filters option.

- Lastly, click OK, and you will be able to see the latest and aging customer balances.

Now that you have figured out the outstanding Accounts Receivable balances, let’s move forward and find out how to write off any bad debt you find.

How to Write off Bad Debts in QuickBooks Desktop

A new account is required to be created to write off bad debts in QuickBooks Desktop. It has to be an expense account that can be used to manage all the bad debts that occur in business. It is a two-step process.

Step 1: Create a bad debts expense account

As a first step, we will create an account in QuickBooks that will be used to track bad debts.

- Go to the Lists menu and choose the Chart of Accounts.

- Now go to the Account menu and click on New.

- Select Expense and then tap on Continue.

- Type in the Account Name by which you want to save it, such as Bad Debt.

- Click on Save and Close

Step 2: Clear Unpaid Invoices

Now, to write off bad debt in QuickBooks Desktop, we will clear these unpaid invoices.

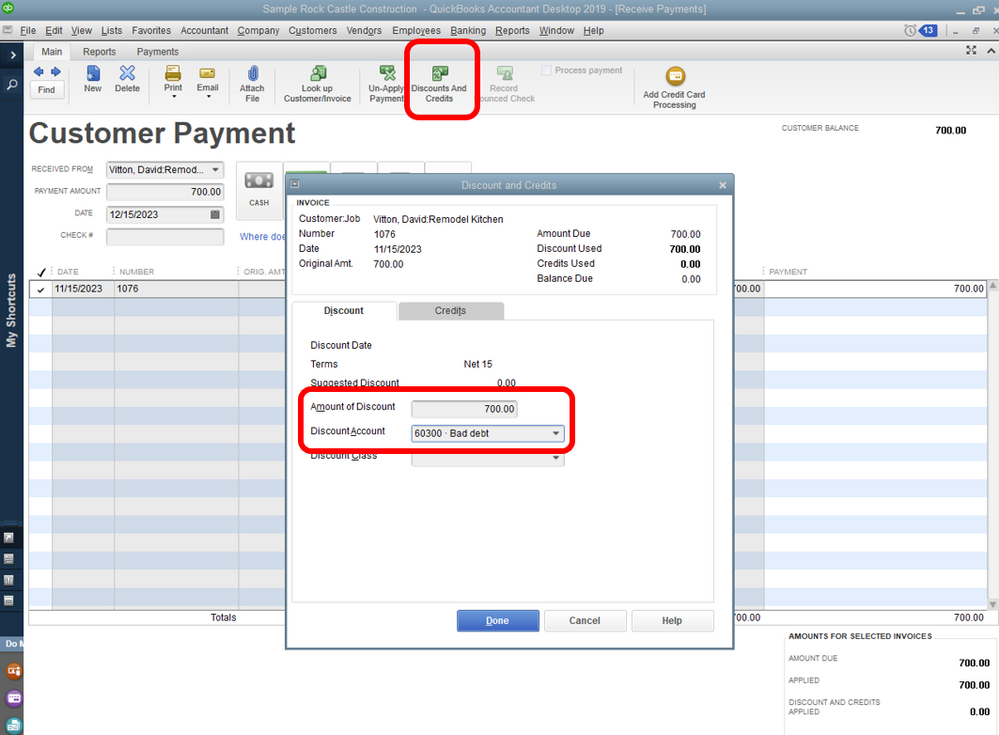

- Go to the Customers menu and tap on Receive Payments.

- Type in the customer’s name in the Received from section.

- Go to Payment Amount and enter $0.00.

- Now click on Discount and Credits.

- Enter the amount you wish to write off in the Amount of Discount field.

- Choose the account you created in step 1 for Discount Account and tap on Done.

- Click on Save and Close.

How to Record Bad Debt in QuickBooks Online

The process of recording bad debt in QuickBooks Online requires you to set up a separate expense account. This account can be used to record bad debts that occur in the user’s business. Then you would be required to create a bad debt item. These are the steps you need to follow.

Step 1: Review the Aging Accounts Receivable

Before you write off bad debt in QuickBooks Online, check the invoices or receivables that should be considered as bad debt. To do so, you can use the Accounts Receivable Aging Detail report.

- Open QBO and sign into your company.

- Choose Reports.

- Now, open the Accounts Receivable Aging Detail report.

Finally, figure out which accounts receivable you should write off as bad debt.

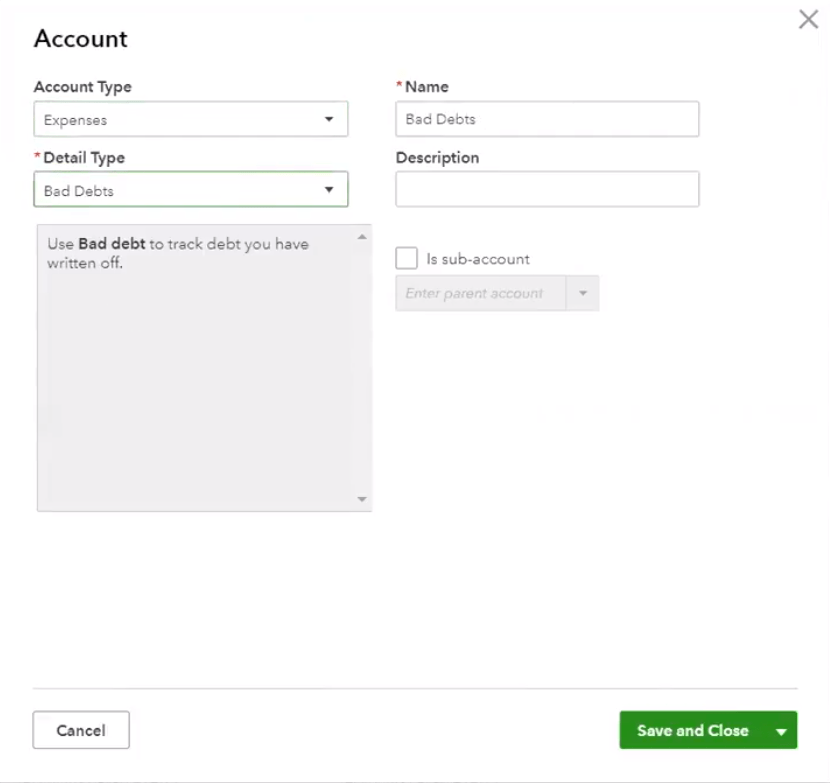

Step 2:- Set up an Expense Account for Bad Debts

If you don’t already have a bad debts expense account, follow the instructions below and create one.

- Tap on the Settings button and choose the Chart of Accounts.

- Click on New in the upper right corner.

- Go to the Account Type list and choose Expenses.

- Then go to the Detail Type list and choose Bad Debts.

- Enter the name by which you want to save this account in the Name field. Example: Bad Debts.

- Lastly, tap on Save and Close to conclude.

Now, let us create an item for bad debt to write off bad debt in QuickBooks Online.

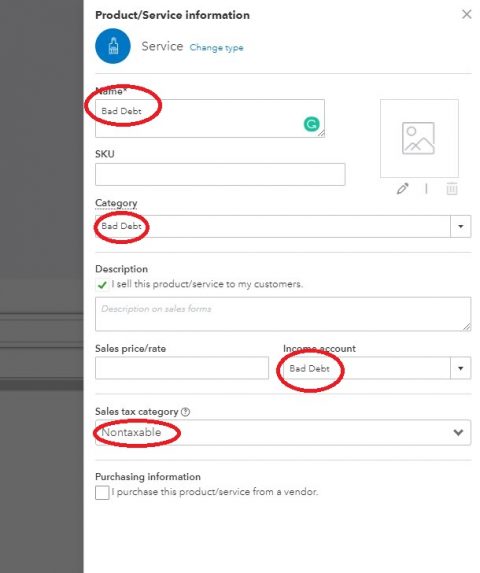

Step 3: Create an item for Bad Debt

Before following the steps below, you will need to create a non-inventory item to use as a placeholder for bad debts. The item you are creating is not real and is only created to balance the accounting.

- Click on the Settings button and choose Product and Services.

- Click on New in the upper right corner and then tap on Non-Inventory.

- Enter Bad Debts in the Name Field.

- Go to the Income account list and choose Bad debts.

- Tap on Save and Close.

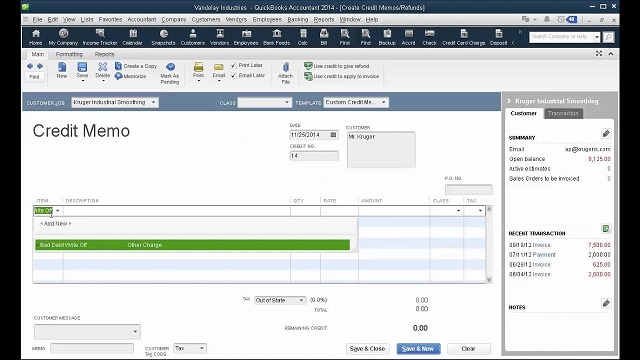

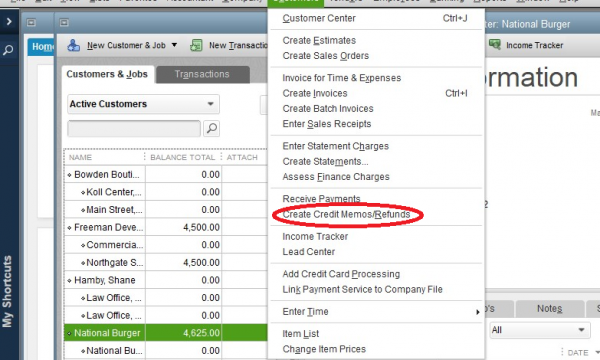

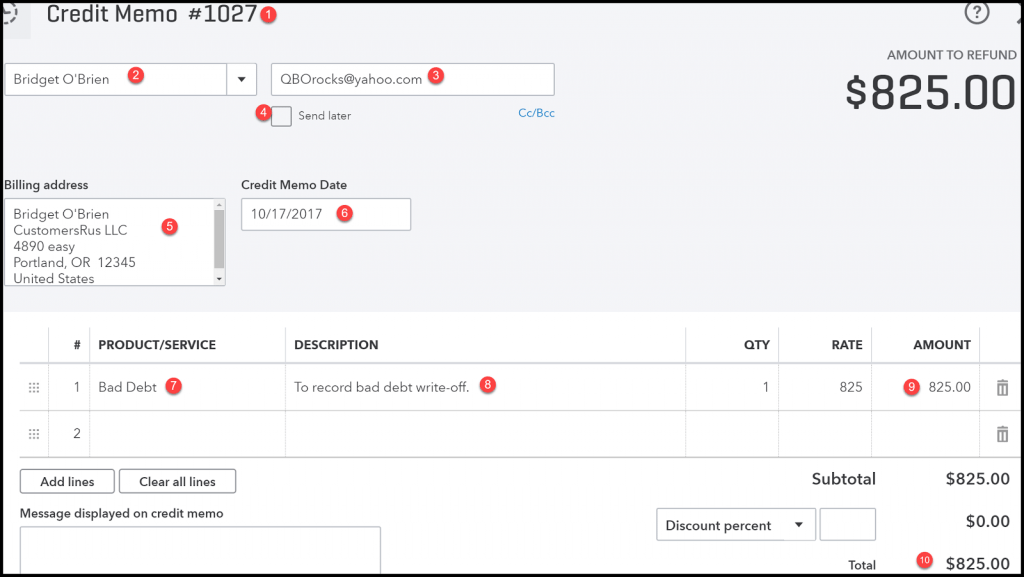

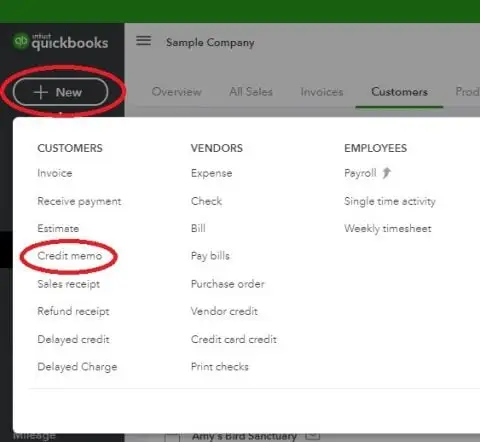

Step 4: Get a Credit Memo Created for the Bad Debt

- Click on the +New button.

- Choose a Credit memo.

- Go to the Customer list and choose the customer.

- Go to the Product/Service section and choose Bad Debts.

- Enter the amount you wish to write off in the Amount section.

- Enter Bad Debt in the Message displayed on the Statement box.

- Tap on Save and Close.

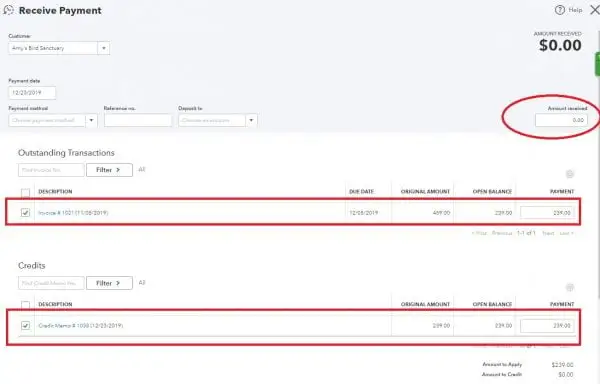

Step 5: Apply the Credit Memo You Created to Invoice

Once a credit memo is created for the bad debt, it is time to apply it to the invoice.

- Tap on +New.

- Select Receive Payments under customers.

- Go to the Customer list and select the right customer.

- Go to the Outstanding Transactions section and choose the invoice you created.

- Choose the credit memo from the Credits section.

- Tap on Save and Close.

The amount that was written off will now appear under the Bad Debts expense account in the Profit and Loss report.

Step 6: Run a Report for Bad Debts

If you want to check all the account receivables that you have marked as bad debts, you can run the Account Quick Report with the instructions below.

- Firstly, select the Chart of Accounts option in the Settings.

- Further, find the Action column in the bad debts account and click Run Report.

NOTE: To identify the bad-debt entity in the list of customers, you can add a note to the name.

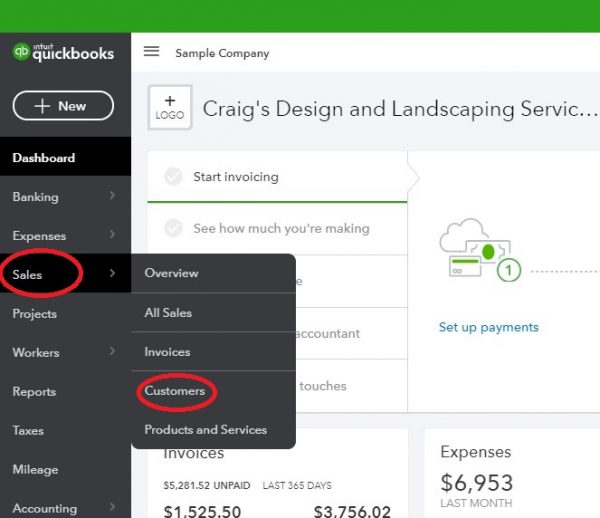

- Select Customers in the Sales section and select the name of the customer.

- Click Edit at the top-right corner and enter “Bad Debt” or “No Credit” in the Display Name as field after the customer name.

- Finally, select Save to conclude.

Need Assistance?

This was all on how to write off bad debt in QuickBooks Desktop and online to keep your account receivable up to date. This will ensure that your financial statements are correct and tell where your business stands at the present.

However, if you face an issue or have a query, reach out to a QuickBooks expert. Speak to a QB consultant now who will assist you in real time.

Frequently Asked Question

In an accounts receivable ageing detail report, you can customize the ageing method, Report period, Number of periods, Days per ageing period, and Minimum Days Past Due.

There is no need to create a new expense account to track bad debts if you have created an allowance account in QuickBooks.

If you do not write off an unpaid invoice in QuickBooks, you can face several possible consequences. For instance, you can overpay your taxes, as the amount you never received from unpaid invoices will be added to your total income. You can also have incorrect financial reports, like profit and loss reports, which can negatively impact your business.

You must write off invoices when a customer fails to renew a subscription for services offered, never returns a product, fails to pay for the registration after attending an event, or fails to repay a loan.

Oriana Zabell, a professional cloud engineer, has over three years of experience in desktop, online QuickBooks support and troubleshooting. She is currently working as a cloud hosting consultant with Asquare Cloud Hosting. She loves to read and write about the latest technologies such as cloud computing, AI, DaaS, small businesses, manufacturing. When not writing, she is either reading novels or is indulged in a debate with movie fanatics.