Last Updated on November 20, 2025

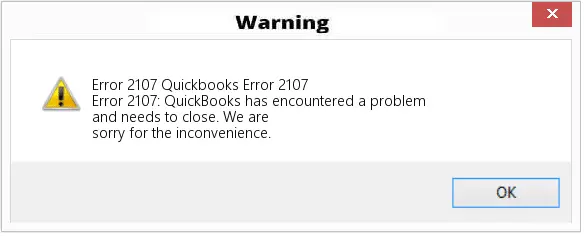

Some errors can keep you from sending paychecks on time, especially in accounting software like QuickBooks Desktop. QuickBooks error 2107 is something that you can get while sending paychecks or creating direct deposits. Here are the error messages that you might see on the screen:

| “Problem uploading data to service. Sign on was rejected.” |

| “We encountered a problem with your payroll transaction request. (Message Code 2107)” |

| “Encountered a Payroll Service Connection Error” |

There are different reasons why you come across the payroll error 2107 in QuickBooks Desktop. Let’s explore them in depth and find proven ways to troubleshoot the error.

Things That Give Way to QuickBooks Payroll Error Code 2107

Here are potential reasons that can give way to QuickBooks payroll error code 2107:

- There are invalid characters in the company or employee name, not supported by QuickBooks

- The internet connection might be unstable or poor

- Some QuickBooks registry or program files might have been deleted or corrupted.

- The operating system (Windows) is corrupt, outdated, or incompatible with QuickBooks.

- You haven’t updated your QuickBooks Desktop for long.

- Windows or an antivirus firewall might prevent QuickBooks from connecting to the servers online.

- The antivirus or security software considers QuickBooks programs as threats and blocks them from running or quarantines them.

- QuickBooks program or its installation is damaged or corrupt

- The computer is missing the crucial components required to run QuickBooks.

- You might be sending the direct deposit in multi-user mode.

Now, we will tell you what you can do in this situation.

You May Also See: Fix QuickBooks Error 30134 When Sending Direct Deposits

How to Troubleshoot QuickBooks Error 2107 and Resume Sending Direct Deposits

There are various aspects that we need to troubleshoot one by one to resolve QuickBooks error 2107. This includes the digital security certificate, system file checker, software updates, and more.

The solutions listed below will take you through the nuances of these processes and guide you through every step of it.

1. Switch to Single User Mode

QuickBooks payroll operations are often limited to one user at a time and might give way to errors if another user wasn’t correctly logged out of it. This makes QB believe that another user is already carrying out the payroll operations.

To rule out that possibility, you can switch to single-user mode. Here are the steps on how to do so:

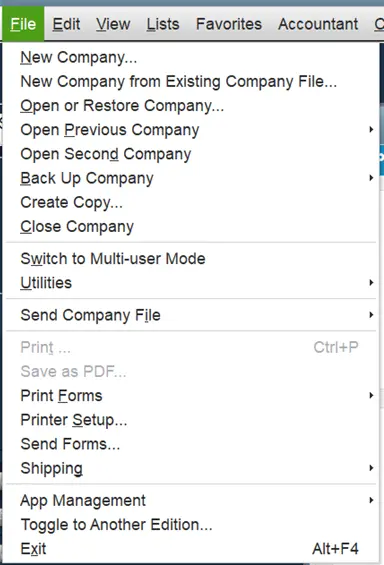

- Launch QuickBooks Desktop and open the File menu.

- If you see the option to Switch to Single-user mode, select it.

However, if you see the option to switch to multi-user mode, don’t select it. Try sending direct deposits and check if the error you faced earlier is resolved.

2. Ensure the Correct Time and Date on Your System

When carrying out payroll operations or installing updates, the time and date should be set right on your computer.

Ensure that by navigating Start > Settings > Time & language > Date & time. Make sure that the right time zone is selected.

3. Install Updates to Your Operating System

Whichever operating system you use, be it Windows, MacOS, or Linux, it should be updated to stay compatible with applications like Gmail, QuickBooks, and Outlook.

Updates bring enhancements and repair damaged components. They also prevent incompatibility issues between the operating system and software. Therefore, update MacOS, Linux, or Windows and then go to the next step.

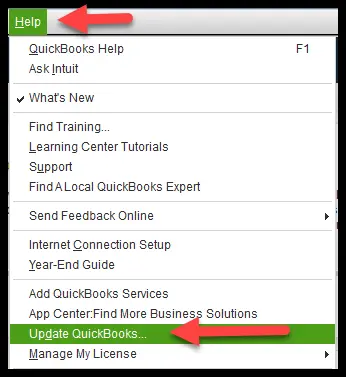

4. Update QuickBooks Desktop and the Payroll

Having updated the operating system, now update QuickBooks Desktop. This will refresh the software components and also install bug fixes if rolled out by the developers.

After that, update the payroll tax table for QuickBooks. If that doesn’t resolve QuickBooks error 2107, install a digital security certificate for QuickBooks.

5. Add Intuit as a Trusted Site

QuickBooks and other applications use default internet settings on the computer to connect to the servers online.

However, the internet settings often prevent QuickBooks from connecting to the internet. To address that, add Intuit to the list of trusted sites in Internet options.

6. Ensure the Legal Name and Employee Name Have No Invalid Characters

Many special characters are not supported in QuickBooks’ company or employee name, and you should avoid them. Here are all the accepted characters in QuickBooks:

| Character Description | Character |

| Exclamation point | ! |

| Number/pound sign | # |

| Underscore | _ |

| Minus sign/hyphen | – |

| Semi-colon | ; |

| Plus sign | + |

| Alphanumeric | A-Z, a-z, 0-9 |

| Comma | , |

| Single quote | ‘ |

| Dot or period | . |

| Tilde | ~ |

| Asterisk | * |

Go to the company name and ensure there are no invalid characters.

- Launch QuickBooks and log in to your company file.

- Open the Company menu and tap on Company Information.

- Select the legal name and edit it to delete special characters if there are any.

Check the employee’s name for which you are creating a direct deposit and ensure the same for it, too.

7. Check the Zip Code in the Company Information

QuickBooks payroll error 2107 can result from incorrect company information, such as the zip code.

- Launch the QuickBooks application and open the company file.

- Open the Company menu and tap on Company Information.

- Check the zip code and edit it if required.

Finally, make a direct deposit to the employee.

8. Install the Digital Security Certificate for QuickBooks Desktop

QuickBooks should have a digital security certificate to be able to install updates and make changes to the computer.

If the digital signature is corrupt or missing, you can encounter various payroll errors. That is why you need to install a QuickBooks digital security certificate:

- Close all QuickBooks windows and then go to where the QB icon is. Right-tap on the icon and choose Open File Location.

- Spot the application setup file (with a .exe extension), right-click on it, and choose Properties.

- You will see the Properties window. Tap on Details followed by Digital Signature.

- Tap on one of the items in the signature list section and choose Details.

- When you see the Digital Signature Details page, tap on View Certificate.

- Tap on Install Certificate from the Certificate window.

- You will now see the Certificate Import Wizard welcome window. Check the store location, make sure it is on the current user, and choose Next.

- Windows will accordingly select the certificate store.

- Choose Next, followed by Finish.

Now, after installing the digital security certificate, retry the payroll operation.

9. Create a QuickBooks Exception to the Firewall and Antivirus

QuickBooks needs access through the firewall ports to connect to the internet. To make sure that, create firewall exceptions for QuickBooks.

Another thing that can go wrong is that the antivirus or security software recognizes QuickBooks as a threat and blocks it from running or connecting to the internet. To prevent that, you need to grant certain exemptions to QuickBooks in your antivirus.

Once done, try sending the paychecks or updating the payroll.

10. Check the Company File for Issues

QuickBooks error 2107 can also be a result of issues with the company file. Fortunately, there is a QB utility that can find and fix that.

Run the verify and rebuild utility on your company file to search for issues and resolve them.

11. Run the QuickBooks Install Diagnostic Tool

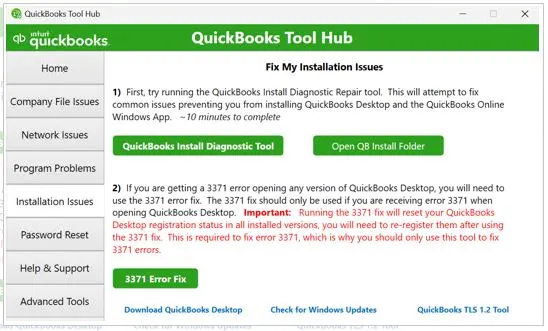

To repair damaged, missing, or incomplete QuickBooks installation or fix corrupt Windows registry or components, run the QuickBooks Install Diagnostic Tool. To do so, download and install the latest version of QuickBooks Tool Hub on your computer.

- Now, launch QB Tool Hub and go to the tab for Installation Issues.

- Tap on QuickBooks Install Diagnostic Tool.

It might take a while before the QuickBooks Install Diagnostic Tool appears and runs, and it might take much longer for the tool to be repaired. Let it take its time.

When it is done, restart the computer and resume the payroll operation.

Conclusion

We discussed what reasons might lead to a QuickBooks error 2107 when sending paychecks and then coupled that up with salient ways to resolve the error. You should be able to fix the issue and resume your payroll operations by carrying out the methods given in this guide.

However, if the problem still persists, speak to a QuickBooks expert at +1(855)-510-6487 . They can take care of the error for you.

Frequently Asked Questions

How do I fix the error code 2107 in QuickBooks Desktop?

To resolve the payroll error code 2107 in QuickBooks Desktop, configure the firewall and internet settings, ensure a stable network connection, ensure the system’s time and date are set correctly, check the company file for issues, install QB digital security certificate, and check the company name and legal information.

Why can’t I send direct deposits in QuickBooks?

Poor internet connection, internet connection settings, outdated payroll or QuickBooks software, or an invalid security certificate might prohibit you from sending direct deposits. Moreover, company file damage or installation issues can also cause such problems.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.