Last Updated on November 20, 2025

QuickBooks Payroll offers holistic and enhanced features for the employee’s payroll. Additionally, it provides an easy way to send paychecks and calculate accurate tax deductions. However, the state or the federal government updates the tax amount regularly. Therefore, to make correct deductions, it is mandatory to update payroll before sending paychecks.

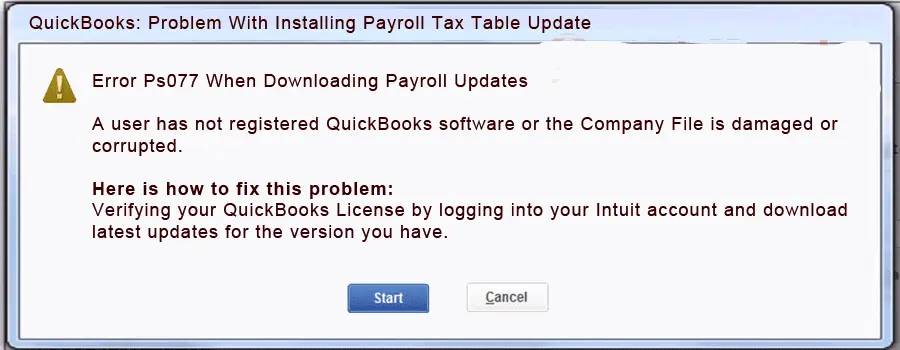

It is mandatory to ensure that the latest tax table is installed in your computer. However, sometimes while downloading this crucial update, you may encounter the QuickBooks error PS077:

| “Problem With Installing Payroll Tax Table Update” |

| “A user has not registered QuickBooks software or the Company File is damaged or corrupted.” |

The reasons for error code PS077 are many and varied, and thus, we need to carry out various steps to troubleshoot it. In this blog, we will discuss all the potential causes of the problem and take you through proven methods to fix it.

Reasons for Error PS077 When Downloading Payroll Updates

Before troubleshooting any issue, it is important to understand why it arises to prevent your software from experiencing this problem in the future. Here are different reasons why you run into QuickBooks error PS077 when installing the tax table updates:

- The tax table version installed is corrupt or damaged

- QuickBooks program is damaged, or its files of installation are corrupt

- Your computer doesn’t have the essential Microsoft components required by QB

- The billing information is incorrect or outdated, or the payroll subscription is inactive or paused

- There is data damage to the company file

- Internet settings or Windows Firewall is preventing QuickBooks from connecting to the server.

- Antivirus, security software, or a third-party program interrupts the payroll update.

Now that you have a certain understanding of what causes error code 15222 in QB, we will show you how to fix it.

Overcome QuickBooks Error PS077 and Update Tax Table Successfully

To resolve the QuickBooks error PS077 when updating the tax table, several steps must be taken, including verifying the status of the payroll service subscription, registering the QB Desktop application, and taking other necessary actions. Let’s delve into the troubleshooting methods we have mentioned below, one by one.

1. Update Windows Operating System and QuickBooks

You should make sure that both the Windows operating system and the QB software have their latest version installed. However, if you find any latest updates that are not installed, you need to install them.

This often resolves incompatibility issues, refreshes and fixes several device components, installs bug fixes, and performs other system optimizations. Firstly, update the Windows operating system. If you use another operating system, such as MacOS or Linux, update them instead. Now, update QuickBooks Desktop to the latest release and, finally, the tax table.

If you are met by an error, verify the status of the payroll service subscription and the service key number.

2. Check the Status of the Payroll Service Subscription

To update the tax table, you need an active payroll service subscription. Let us ensure that first.

- To begin with, close all QuickBooks windows and other programs and reboot your computer.

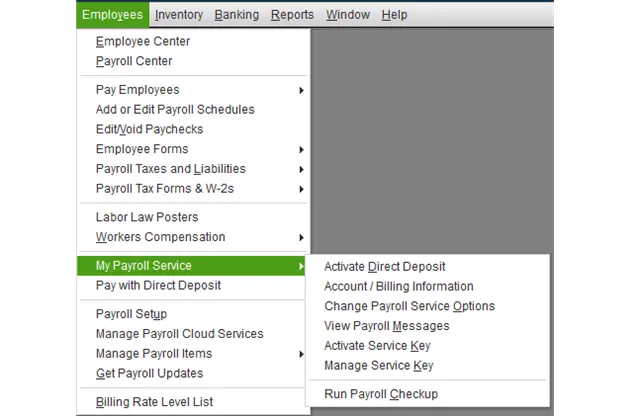

- Open QuickBooks, then the Employees menu in it, and choose My Payroll Service, followed by Manage Service Key.

- Verify that the Service Name is correct and the Status is Active.

- To view the service key number, tap on Edit, and if it is incorrect, correct it.

- Choose Next, unmark the box for Open Payroll Setup, and then tap on Finish.

QuickBooks will now download the payroll update. However, if it runs into an error, move to the next step.

You May Also See: Fix QuickBooks Error 12038: Failed to Download the Update

3. Ensure the QuickBooks Desktop is Registered Before You Update It

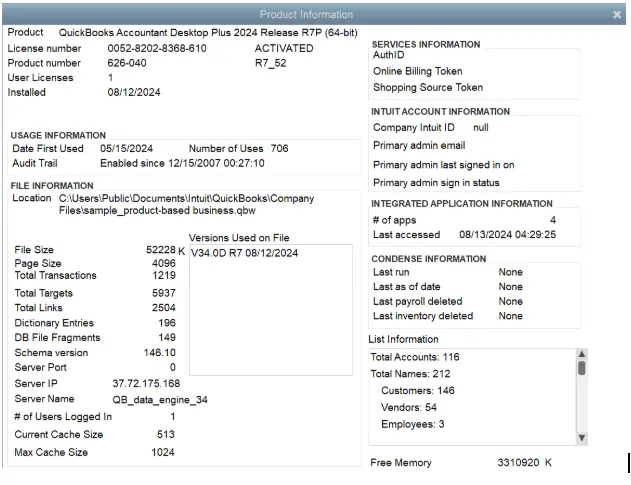

Check and make sure that the QuickBooks Desktop is registered before updating it. We can do so by accessing the Product Information Window.

- Launch QB Desktop and then press the F2 key on your keyboard.

- This will take you to the Product Information window.

- Notice the status beside the license number. Does it say Activated?

It should be Activated. If not, go ahead and register your QuickBooks Desktop. Once you have sorted this out, get the tax table updates. However, if you are met by QuickBooks payroll error PS077, resolve program issues.

4. Repair QuickBooks Program from the Tool Hub

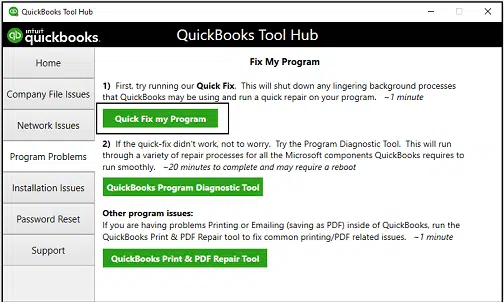

QB errors are often a result of corrupt programs that can be fixed using the tools available in the Tool Hub. However, to do so, you first need to download and install QuickBooks Tool Hub. After that, follow the steps below:

- Launch the Tool Hub, and then navigate to the Program Problems tab.

- Highlight Quick Fix my Program.

- Now, back in the Program Problems section in the Tool Hub, tap on QuickBooks Program Diagnostic Tool.

Give the tool the time it requires to run a complete repair on the QuickBooks program. Resume the payroll update and check if the error you faced earlier is resolved. However, if the problem persists, try the steps given in the next solution.

5. Disable User Account Control (UAC) on Windows

User Account Control (UAC) in Windows, which is meant to prevent unauthorized changes to the system, can also prevent payroll updates.

Therefore, disable the UAC settings on your computer and then install the updated tax table version. Here is how you can turn off the User Account Control (UAC):

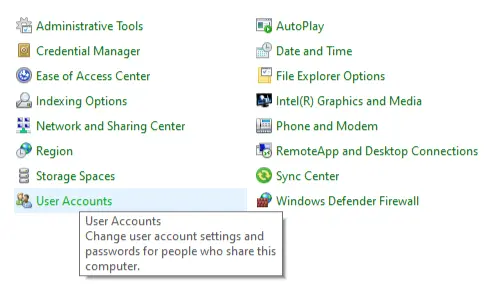

- Search for the Control Panel in the Start menu and open it.

- Go to User Accounts followed by User Accounts (Classic View).

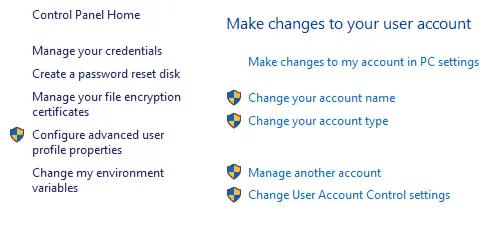

- Click on Change user account control settings. If you see a prompt, choose Yes.

- Drag the slider to Never Notify and choose OK.

This will turn the UAC feature off on Windows. Update the tax table and then follow the steps above, slide to Always Notify, and choose OK to enable the UAC again.

6. Rename and Add .OLD to the End of the CPS Folder

The CPS Folder has certain files required for the payroll update, and if they are damaged, it can lead to QuickBooks error PS077. If we rename the file to something QuickBooks can’t recognize, it will direct the software to recreate a fresh version of the file and potentially get rid of the error.

- First, close all QuickBooks Desktop windows and other programs running in the background.

- Open the File Explorer and navigate This PC > Local Drive C or the Drive containing program files.

- Now, open the Program Files folder or Program Files x86 folder and go to Intuit.

- Locate the CPS folder, right-click on it, choose Rename, and add .OLD to the end of the name.

- Save the changes and then restart QuickBooks Desktop.

Check if you can update the tax table now without an error. If you still see PS077, check the internet and firewall settings.

7. Configure Internet Settings, Windows Firewall, and Antivirus

QuickBooks needs to connect to the internet to download the latest version of the tax table. However, the internet settings, firewall, and antivirus should favor that, and that means they can also prevent it.

There are three things you need to do. Firstly, add Intuit as a trusted site to Internet Options. Now, configure the Windows Firewall to let QuickBooks through it.

Moreover, if you have an antivirus or security software, it can prevent QuickBooks programs from running in the background or quarantine them. Antivirus and security software also come with a firewall that might block QuickBooks’ access to the internet. Therefore, create QuickBooks exceptions to the antivirus. Now, download and install the latest tax table version.

Quick View of QuickBooks Payroll Error PS077

This section will show the condensed version of the information given above about QuickBooks error PS077.

| Error Description | QuickBooks error PS077 generally shows up when trying to download the latest payroll updates. It stops you from downloading the latest tax table updates, which are essential to do accurate tax calculations in employees’ payroll. |

| Significant Reasons | Corrupt or damaged tax table update, faulty QB program, lack of Microsoft components in the system, incorrect billing information, inactive payroll subscription, data damage, Windows Firewall, or third-party program interruptions. |

| How to Resolve | Update Windows Operating System, verify the Payroll Subscription, ensure the QB Desktop registration, repair the QB program, disable UAC on Windows, rename the CPS folder, or configure the internet settings and firewall security settings. |

Conclusion

We saw various things that might lead to QuickBooks error PS077 when updating the payroll, such as an unfavorable firewall or internet settings, inactive payroll subscription, QB Desktop application that is not registered, and so on. Then, we discussed many proven methods to troubleshoot such challenges and get you back on track.

However, if the trouble proves to be too hard to get rid of, speak to a QuickBooks expert at +1(855)-510-6487. They have years of expertise on the subject and will resolve the issue for you in no time.

Frequently Asked Questions

Can you tell me the reasons why I am getting QuickBooks error PS077?

QuickBooks error PS077 when updating tax tables can be caused by various reasons such as an outdated operating system, inactive payroll service status, incorrect service key number, unfavorable internet and firewall settings, antivirus or third-party interferences, and so on. Therefore, you need comprehensive troubleshooting to resolve it.

What is the QuickBooks error PS077 or PS032?

QuickBooks error PS032 and PS077 are from the PSXXX series of error codes that show up when the user tries to update payroll. To resolve it, check your network connection and internet settings, and make sure QuickBooks has access through the firewall.

How can you resolve the Payroll update errors?

To resolve the payroll update errors, such as PS077 and PS032, you should try the above-mentioned solutions, such as updating the QB Desktop, adding Intuit as a trusted site in the network settings, running the verify and rebuild tool, installing the QB update in safe mode, checking the date and time settings, or installing the digital signature. Lastly, it is recommended to restart your computer to experience a fresh and seamless working procedure.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.