Last Updated on November 24, 2025

The direct deposit feature in QuickBooks eliminates the need for paper checks for employee payments. In addition to saving time, money, and effort in payroll processing, it also streamlines the bank reconciliation process. With direct deposit, employees receive their wages on payday into their savings, checking, or money market accounts.

In this blog, we will provide the correct steps to setup QuickBooks payroll direct deposit, including adding a new employee, editing or deleting your bank account, and obtaining a direct deposit authorization form.

If you need help adding or modifying an employee’s details, you can contact our experts at TFN for a free consultation.

Things to Keep in Mind Before Setting up Direct Deposit in QuickBooks

Here are a few crucial things you must consider before set up QuickBooks Payroll Direct Deposit.

- Ensure that the bank accounts you set up for your employees’ direct deposit in QuickBooks are US bank accounts that accept ACH transactions.

- Begin according to the QuickBooks Payroll version you are using. If you are not aware of the version you have, follow the instructions below.

- If you are a QuickBooks Online user:

- Go to the Settings tab.

- Then, select Subscriptions and Billing.

- Here, check your QB payroll version.

- If you are a QuickBooks Desktop user:

- Launch QuickBooks.

- Now, click Payroll Center under the Employees tab.

- You can see your payroll services under the Subscription Statuses section in the Payroll tab.

- If you are a QuickBooks Online user:

QuickBooks charges a standard fee for each processed direct deposit transaction.

Read More: Facing QuickBooks Error 05396-40000 during validation or activation? This issue often appears after updates or license changes. Visit our full guide to fix it and restore smooth QuickBooks performance.

Why You Should Use Direct Deposit for Employees in QuickBooks?

When you opt to use the Direct Deposit feature in QB, there are multiple benefits and features you get when you choose DD.

- Employee funds are directly credited to their bank accounts.

- Timely payment. Even when the employee is out of town or unavailable.

- Secure payments reduce the risk of lost or stolen checks.

- An easier process that eliminates the need for checks or printing payslips.

Now that you know the advantages of using direct deposit, let’s move on to the next section on how you can easily set up direct deposit in your QBDT and online version.

Note: Facing payroll calculation errors or outdated taxes? A QuickBooks Payroll Tax Table Update ensures accurate deductions, compliance, and smooth pay runs. Visit our full guide to install the latest tax tables and avoid payroll issues.

Steps to Set Up Direct Deposit in QuickBooks Desktop and Online

Setting up QuickBooks Desktop and Online payroll direct deposit is a five-step process you must follow carefully to avoid unexpected errors when processing payroll.

Step 1: Get Ready with the Bank, Business, and Principal Officer Info

In the first step, gather all the information you will need to set up direct deposit in QuickBooks. You will require the info listed below to setup QuickBooks payroll direct deposit.

- Principal officer’s date of birth, social security number, and home address.

- Business address, name, and EIN.

- The bank routing and account number of your company or your online banking credentials.

- The bank account information for employees or contractors.

After gathering all the required information, we will proceed to connect the bank account to QuickBooks in the next step.

Note: Experiencing QuickBooks Direct Deposit not working? Payroll may fail due to bank verification, outdated payroll updates, or incorrect company settings. Visit our full troubleshooting guide to resolve payment delays quickly.

Step 2: Connect Your Bank Account

The QuickBooks Desktop payroll direct deposit service uses your payroll account to pay your employees. In this step, we will connect the payroll checking account to the QuickBooks direct deposit service. If you want to pay your employees instantly using direct deposit, use Instant Bank Verification to connect your bank account.

a. QuickBooks Online Payroll

- Access QuickBooks Online.

- Go to the Payroll section.

- Choose the Overview.

- Select Let’s Go from the Connect Your Bank section.

- Click on the Get Started option.

- Move to the Business section.

- Select the Edit option.

- Enter your Federal tax ID number, and check if there is any missing information.

- Click the Next option.

- Add the Principal Officer’s date of birth, name, and social security number of the Principal Officer.

- Click Next.

- Locate your bank’s name, then enter your online banking login credentials when prompted.

- Choose the Enter bank info manually option.

- Then, enter the account and routing numbers.

- Finally, click Save, then Accept and Submit.

b. QuickBooks Desktop Payroll

- Go to QuickBooks and log in using your QB admin credentials.

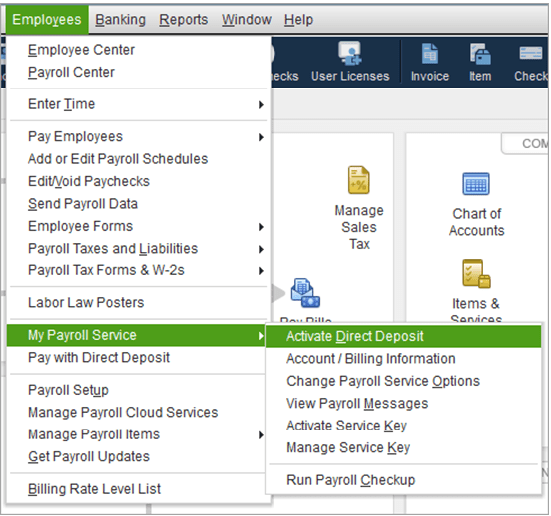

- Navigate to the Employees menu.

- Choose the My Payroll Service tab.

- Click Activate Direct Deposit.

- Then, select the Get Started button.

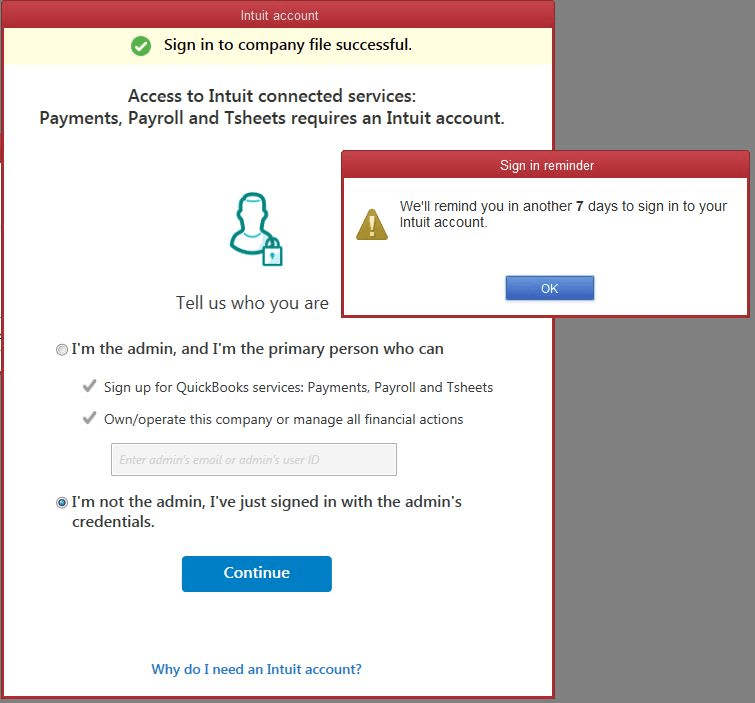

- Click on I’m the admin, and I’m the primary person who can, then verify your admin’s user ID or email address.

- Choose Continue.

- Then click Sign In after entering your Intuit Account’s user ID and password. If you don’t have an Intuit Account, then click on the Create an account option.

- At last, click on Get Started.

- Choose the Start option under the Business tab and fill in the required details.

- Click Next, then fill in the Principal Officer info.

- Select Next.

- Choose the Add new bank account option.

- Now, enter your bank’s name and online banking credentials to log in, or your bank’s routing and account number.

- Create a PIN to send payroll to Intuit, and confirm it twice.

- Click on Submit.

- Tap Next, then select Accept and Submit.

- Verify the Principal Officer’s SSN if prompted by QuickBooks.

- Click on Submit.

Note: Need QuickBooks Data Recovery or QuickBooks Data Repair Service? Restore lost files, fix corrupted company data, and rebuild damaged transactions securely. Visit our expert service page to recover your accounting records quickly and safely.

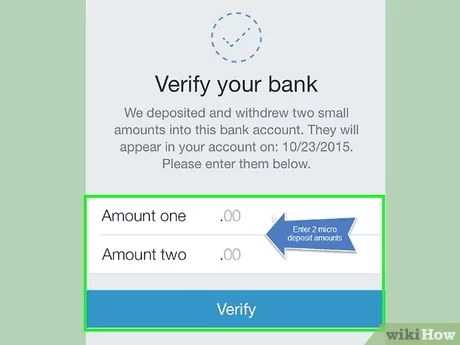

Step 3: Get Your Bank Account Verified

If you are unable to connect your bank account right away, Intuit will try to connect to your account with a test debit of less than $1. You must enter the deducted amount to authorize payroll transactions for your account. Sometimes, it can take up to 2 days to see the debit transaction on your account. Here are the instructions for verifying your bank account using QB Desktop and Online Payroll.

a. Instructions for QuickBooks Online Payroll

- In QuickBooks Online.

- Select Overview under Payroll.

- Choose Let’s Go on your Check your bank account item from the To-Do List.

- Choose the Verify Amount option.

- Enter the transaction amount without any decimal points, and verify it.

- Finally, select Verify.

If you can’t find the New payroll task option, follow the instructions below to verify the transactions.

- Go to Settings in the payroll.

- Select Payroll settings.

- Select the Edit option in the Bank accounts.

- Choose the Verify Amount option, enter the amount, and verify it.

Read Also: If you can’t Activate Direct Deposit due to QuickBooks error code 40001, follow the instructions to update QuickBooks & run it as an administrator.

b. Instructions for QuickBooks Desktop Payroll

- Sign in to QuickBooks Desktop as an admin.

- Then, choose Employees from My Payroll Service.

- Select the Activate Direct Deposit option and sign in to your Intuit account.

- Enter the amount that was debited from your bank twice.

- Then, select Verify.

- When prompted, enter your payroll PIN, click Submit, and OK.

If you don’t find the Activate Direct Deposit option, follow the instructions below.

- Go to the Employees tab

- Select the Manage Payroll Cloud Services option.

- Once it has fully loaded, close it and follow the steps above to verify the bank account.

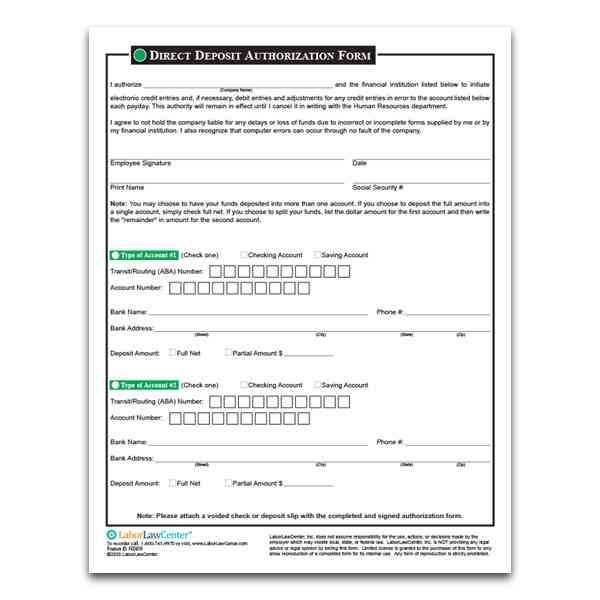

Step 4: Get a Direct Deposit Authorization Form from your Employees

Now, you must ask your employees to complete, sign, and date a DD (Direct Deposit) authorization form, along with a voided check from the employee’s bank account. Do not attach a deposit slip in place of a voided check. Then, follow the instructions below to setup QuickBooks payroll direct deposit.

a. QuickBooks Online Payroll

- Access the QuickBooks Online.

- Go to the Taxes section.

- Then, choose the Payroll tax option.

- Choose the Filing section.

- Then Employee Setup.

- Select the Bank Verification option next to Authorization for Direct Deposit.

- Hit View.

b. QuickBooks Desktop Payroll

Get a voided check or the bank account and routing number specific to your employees’ bank account directly from the employees. You don’t need to submit this voided check to QuickBooks; it’s solely for your records.

Step 5: Add your Employees to the Direct Deposit

The final step to setup QuickBooks payroll direct deposit is to add your employees to the direct deposit. Here’s how you can do so in QuickBooks Desktop and Online payroll.

a. QuickBooks Online Payroll

- Access the QuickBooks Online.

- Go to Employees under the Payroll section.

- Choose your employee.

- Select Start or Edit from Payment Method.

- Select the Direct Deposit option from the Payment Method drop-down list, then choose one of the direct deposit methods listed below:

- Direct deposit to two accounts

- Direct deposit to one account

- Direct deposit with a balance as a check

You must enter the account and routing numbers from the employee’s voided check, then hit Done.

b. QuickBooks Desktop Payroll

- Go to the Employees menu.

- Select Employee Center to get the employee list.

- After debiting the amount, access QuickBooks and sign in as QB admin.

- Click on any employee’s name.

- Go to the Payroll Info tab.

- Under the Direct Deposit window, click on the Direct Deposit button.

- Select Use Direct Deposit for [employee’s name].

- Choose whether to pay the employee by depositing the paycheck into one or two accounts.

- Enter the employee’s bank information, including the bank name, routing number, account number, and account type.

- If you select the option to deposit to two accounts, mention the amount or percentage to go into the first account under the Amount to Deposit field. The remaining amount will be deposited into the other account.

- Click OK to save the info.

- Enter your payroll PIN for direct deposit when prompted.

With the steps mentioned above, you can easily setup QuickBooks Payroll direct deposit in the desktop and online versions. If you wish to edit or delete employee information, the steps are as follows:

Steps to Edit Employee Information in Direct Deposit

- Tap on the Employee option.

- Go to the Employee Center.

- Choose the employee’s name.

- Choose the Direct Deposit button.

- Move to the list of employees section.

- Choose the Pay Method under the Employee’s name, then select DD.

- Add the bank account.

- Tap on OK.

Ensure you have included the correct information before adding any new information.

Read More: The QuickBooks Clean Install Tool helps fix installation errors by fully removing damaged program files and reinstalling QuickBooks. Use it to resolve performance issues and restore smooth functionality. Visit our complete guide for step-by-step instructions.

Steps to Delete Employee Information in Direct Deposit

- Tap on the Employees section.

- Click on the Employee Center.

- Choose the name of the employee whose data is to be deleted.

- Go to the Payroll Info tab.

- Tap on the Direct Deposit button.

- Uncheck the Use Direct Deposit for (Employee Name) box.

Now, you can easily setup QuickBooks payroll direct deposit in your application for your employees.

Conclusion

This was all on how to setup QuickBooks Payroll direct deposit in the desktop application and online version. The steps will help you start from scratch with the direct deposits to your employees hassle-free. We also saw how to edit or delete an employee’s information. However, if you face an issue and are looking for an easy, time-efficient solution, you can get in touch with our experts at +1-(855)-510-6487!

Frequently Asked Questions (FAQ’s)

How much do the services of QuickBooks Payroll Direct Deposit cost?

The service sign-up is free for all QuickBooks users. However, Intuit charges a fee for every direct deposit made to employees using your QuickBooks account. An additional per-transaction fee of $1.75 is also charged for direct deposit payments to W-2 employees and 1099 contractors. It’s usually $6.50/month for Core, $10/month for Premium, and $12/month for Elite.

How to edit an employee’s bank information for Direct Deposit in QuickBooks Desktop?

If an employee wants to change the bank account for direct deposit, you can make the necessary changes by following the steps below:

1. Tap on the Employee option from the Employee Center menu.

2. Choose the employee’s name.

3. Click on the Direct Deposit button.

4. Move to the list of employees section.

5. Choose the Pay Method under the Employee’s name, then select DD.

6. Add the bank account.

7. Tap on OK.

How to Remove an Employee from the Direct Deposit Service?

You can permanently remove an employee from QuickBooks to discontinue their direct deposit by following the steps below.

1. Open QuickBooks and select the Employees menu.

2. Click on Employee Center and right-click on the name of the employee you want to remove.

3. Select the Delete Employee option and confirm the action by clicking Yes.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.