Last Updated on November 20, 2025

Sometimes, you might see a QuickBooks error 2501 when you are paying an employee or making a direct deposit. The error might also show up when you are trying to upload payroll data.

This might happen if you recently made a change in your direct deposit account. However, there could be other reasons for the error. Here is what the error message 2501 in QuickBooks might look like.

| Message code 2501: Intuit was informed that a credit to an employees bank account was returned. QuickBooks Payroll Error 2501: QuickBooks has experienced an issue. Sorry for the inconvenience. |

In this guide, we will take a look at what causes the QuickBooks payroll error 2501 and how to resolve it. Alright then, let us begin.

Possible Reasons Why You Get QuickBooks Error code 2501

Let us look at different reasons that can lead to an error code 2501 in QuickBooks Desktop.

- A firewall or antivirus program is blocking QuickBooks Desktop.

- The software package for system security is still outdated.

- The employee data might be incorrect.

- There are not enough funds in the employer’s account to make the direct deposit.

- There might be a problem with the network or connectivity

- Problems with payroll service subscriptions

- QuickBooks Desktop might be incompatible with your Windows OS.

- QuickBooks Payroll installation is incomplete

- The QB company data is corrupted or damaged.

- Technical issues with the servers run by Intuit

- Direct deposit details might be incorrect

- QuickBooks Payroll or the Windows operating system are out of date.

- The direct deposit details have been modified and are no longer preserved.

- The checkbox for Direct Safety Deposit has not been cleared.

Now that we know several reasons why you get error message 2501 in QuickBooks, let’s fix it.

6 Salient Ways to Resolve QuickBooks Error 2501

In this section, we will list the different ways to resolve QuickBooks error 2501. Go through these methods and carry out the steps given below in order. However, before you do so, here are some quick things you can try if you face an issue when making direct deposits.

- Close other application programs and websites

- Restart your router

- Move closer to your router

- Check your internet speed and bandwidth

1. Update QuickBooks Desktop

The first thing you do when you get a payroll error is update QuickBooks Desktop. This will install the latest components on your system and get you important bug fixes. Therefore, update your QuickBooks Desktop to the latest release.

2. Get QuickBooks Payroll Update

Moreover, your software needs to have the latest tax table updated before you run payroll operations. Therefore, download and install QB payroll updates for your desktop application. Once you are done, move to the next step.

3. Review Your Direct Deposit Account

Usually, QuickBooks error 2501 arises, when there is a change in the direct deposit account. Therefore, check your QuickBooks direct deposit account. However, if this doesn’t fix the issue and you continue to face a problem when sending paychecks, continue to the next solution.

4. Verify and Rebuild Data

QuickBooks error 2501 might be due to data damage in the company file. To resolve this, let us run verify and rebuild data utility on the company file. After this, try sending paychecks or creating direct deposit.

5. Unmark the Direct Deposit Box and Reupload Payroll Data

If you face QuickBooks error 2501 when reuploading payroll data, let us unmark the checkbox to Use Direct Deposit. After that, try to re-upload payroll data. Let us show you how to do the same.

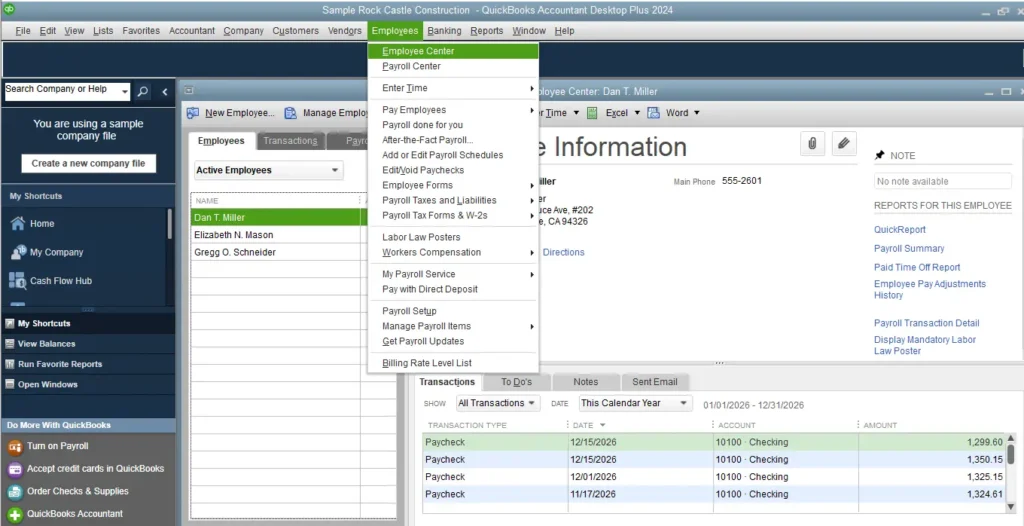

- Open QuickBooks Desktop and tap on the Employees menu.

- Go to the Employee Center and select the employee you find is affected on the list.

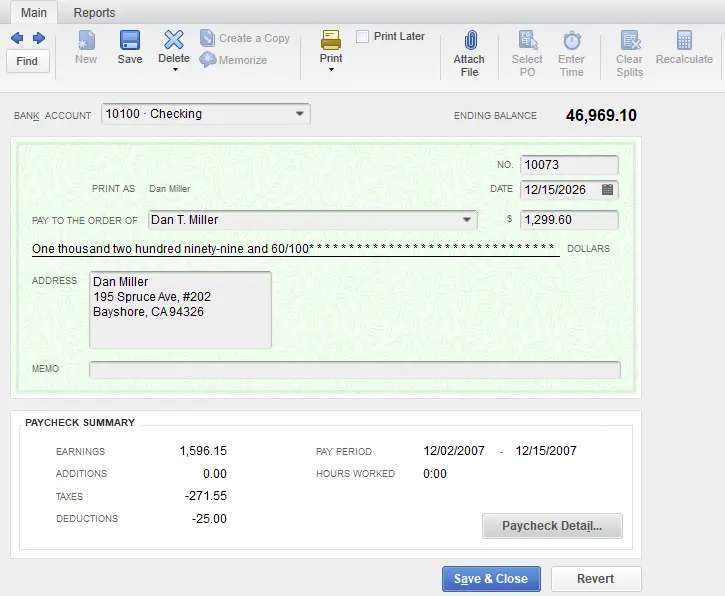

- Find the paycheck and double-click on it to open it.

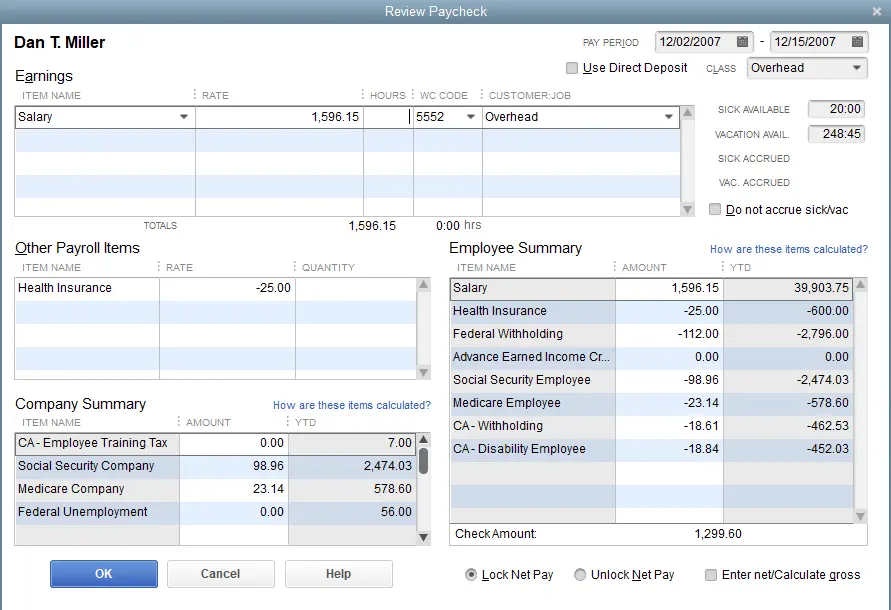

- Now, when the employee’s paycheck opens, you will see a checkbox to Use Direct Deposit box. De-select this checkbox.

- Choose Save & Close and resend payroll data.

- Do the same for all employees affected on the list.

Once you are done, try to upload your payroll data again and check if the error 2501 in QuickBooks is resolved.

6. Create a New Paycheck

However, if the above method doesn’t work and you continue to face an error 2501 when uploading QuickBooks payroll data, here is what you can do.

- For the impacted employees, unmark and delete all Direct Deposit (DD) information.

- Enter imaginary bank details after sending a zero payroll.

- Make a $1.00 pay cheque, then select Send data.

- Send data and void the check.

- Re-enter the impacted employees’ accurate DD information.

- After creating a fresh paycheck, send data.

7. Update Your Operating System

Although the operating system doesn’t have a direct role in sending paychecks, an outdated operating system might cause incompatibilities. Thus, update your operating system, be it Windows or MacOS. Once you are done, reattempt to send paychecks or upload payroll data.

Conclusion

This was all on how to resolve QuickBooks error 2501 when sending paychecks or making instant deposits. Follow all the steps written in this guide, and resume your payroll operations right away. However, if you continue to face an issue, speak to a QB expert. Dial +1(855)-510-6487 and connect to a QB advisor now!

Frequently Asked Questions

What is error code 2501 in QuickBooks payroll?

QuickBooks payroll error 2501 might occur when making instant deposits or uploading payroll data. This might happen due to a change in the instant deposit account in QuickBooks or damage in the company file.

How do I fix a connection error in QuickBooks?

To resolve the Connection error in QuickBooks Desktop, diagnose the network and check your wifi range. If you are on LAN, plug out the ethernet cable and plug it back in. Moreover, run QuickBooks File Doctor to check the network, which is the third option.

How do I fix the QuickBooks registration error?

Here are some things you can do to fix the QuickBooks registration error:

1. Install the QuickBooks File Doctor after downloading it.

2. Register the Specific MSXML Files

3. Set up the Windows Firewall.

4. Grant the Specific User Account Administrative Rights.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.