Last Updated on January 15, 2025

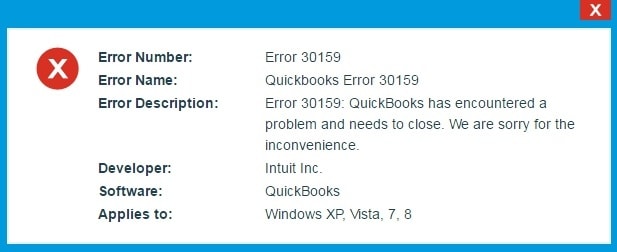

QuickBooks Payroll Error 30159 is related to the payroll subscription in QuickBooks Desktop. You may encounter this issue in multiple circumstances. For instance, when trying to reactivate a payroll subscription, you may see an error message on the screen, “30159 – Unable to load account for PSID null: Entitlement is Enabled, but Entitlement Unit is deactivated.” The error message demonstrates that you can’t reactivate your payroll subscription due to this payroll error. In another case, when trying to add an existing payroll subscription to the QuickBooks payroll account, you may see the same error code.

When it comes to the reasons, incorrect PSID in the company file or incorrect service key is considered primary. However, there is a wide array of reasons leading to error 30159 Quickbooks Desktop. In this specific blog, we have detailed all the known reasons comprehensively. Also, you will get multiple troubleshooting steps with crystal clear instructions to resolve the error swiftly. Therefore, read the blog till the end.

What is QuickBooks Error Message 30159?

QuickBooks error message 30159 is an error that occurs when attempting to open a company file. This error can be caused by a damaged or missing QuickBooks component, incorrect Windows permissions, or other issues that can prevent the file from being opened. To fix this error, make sure your QuickBooks software is updated to the latest version. But before moving forward to fix the error, ensure to check what are the reasons for pulling the issue.

What Reasons Lead to Error Code 30159 in QuickBooks Desktop

The payroll feature of QB is attached to multiple factors. Thus, the malfunction of even one factor may lead to this payroll error. For instance, Error 30159 QuickBooks Payroll is typically caused by incorrect information entered in the payroll setup, such as incorrect tax filing periods or incorrect employee information. It may also occur when files related to payroll are damaged Or missing. Go through the reasons below to learn about the causes of QuickBooks error 30159:-

- The payroll subscription is inactive.

- You have multiple active payroll agreements with an inactive Direct Deposit agreement.

- The QuickBooks Desktop file (paysub.ini) is damaged.

- You are using an outdated product.

- Incorrect service key or Incorrect PSID in the company file

- The Employer Identification Number (EIN) in the company file is incorrect.

- The QBDT version is not compatible with the Windows version.

- When the status of the payroll subscription in the QuickBooks Desktop Service Keys screen appears as “Invalid number or EIN.“

- Data damage also leads to QuickBooks Payroll setup error 30159.

- In case the Employer Identification Number (EIN) is accidentally deleted.

Easy way to Troubleshoot QuickBooks error 30159

As we have mentioned above, multiple reasons may lead to QuickBooks Enterprise Error 30159. Thus, we have detailed multiple solutions for the same. Also, the troubleshooting solution highly depends upon the reason causing the error in the system. You can directly jump on the befitting solution if you are aware of what is causing the error, but in case you don’t know the reason, we will advise you to follow all these solutions to fix the error swiftly:-

Solution 1. Log in as a System Admin

One major factor causing QuickBooks Payroll Error 30159 is an inactive subscription QB payroll. Follow these steps in order to ensure that your subscription is active:-

- Press the Windows Start button, go to All Programs, and click Restore.

- Open a new window, select the Restore My Computer tab, and hit Next.

- Select the Most Recent System Restore Point and click on the Next tab.

- Click the confirmation window and reboot the system.

The next step is to download and install the Malicious Software Removal Tool 32-bit or 64-bit

- Click on the Scan tab and then the Fix Error option.

- Lastly, conclude the process by rebooting the system.

If this doesn’t help you resolve the payroll error, opt for the next troubleshooting solution below.

Solution 2. Update the QBDT to the Latest Release

Updating QuickBooks is essential to have the latest product features, bug fixes, patches, security, etc. Secondly, it helps QuickBooks function more seamlessly. Therefore, consider updating the software to eliminate QuickBooks Payroll Error 30159.

If updating the software doesn’t help, consider updating the tax table in QuickBooks. See the solution below.

- Close QBD application.

- Switch on your display hidden files and folders option.

- Type in Paysub.ini in the search field.

- If there are any files with the same name, right-click on them and select Rename option. Add a number or an extra letter to every paysub file found.

- Now open QB again.

Solution 3. Get the Latest Tax Table Updates

As we know, payroll tax tables provide up-to-date, accurate rates and calculations for federal and supported state taxes, payroll tax forms, and e-file and e-pay options. Therefore, downloading and installing the newest tax table update may help immensely to get past the Payroll Error 30159 in QB. Follow the steps below for the same.

- 1. Move to Employees and select Get Payroll Updates.

- 2. Select Download Entire Update followed by Update. An informational window will appear on the screen, notifying that the download is complete.

If this also doesn’t fix the error code 30159 in QuickBooks Desktop, try the next solution given below.

- Log in to your system as Administrator.

- Press the start button and click on All Programs.

- Select Accessories and then click on System Tools.

- Tap on system restore.

- Search the ‘Restore my computer to an earlier time’ option.

- Now click on Next.

- Continue till the confirmation window appears.

- Now restart your system and restore the process.

Solution 4. Re-validating the Service Key to Refresh the Payroll

In this solution, we will re-validate the payroll subscription to ensure it is active and the error is not rooted in subscription-related issues.

- Move to the Employees menu and select My Payroll Service.

- Choose Manage Key Services and click Add.

- Type in the service key you noted in the service key field.

- Select Next and then hit Finish.

- Choose OK when the Payroll Update message appears.

- Verify that the Service Status shows Active and then hit OK.

If this doesn’t help you get rid of the error, consider verifying your QuickBooks Desktop Payroll subscription in the next solution below.

Solution 5. Verifying the Desktop Payroll Subscription

One major reason causing QuickBooks Desktop Payroll Error 30159 is an inactive subscription to QB payroll. Follow these steps to ensure your subscription is active:-

- Close all the open company files and consider restarting the system.

- Open the QuickBooks Desktop, move to the Employees tab, select My Payroll Service, and then select Manage Service Key.

- The Service Name and Status must be correct and will show as Active.

- Choose Edit and verify the service key. If the service key number is incorrect, enter the correct one.

- Choose Next, uncheck the Open Payroll Setup box, and then hit Finish.

- Now, the next step is to reboot the system.

- Then, download the entire payroll update. See solution 3 for the same.

- Lastly, reset the QBDT update to conclude. Follow the instructions below for the same.

Reset QuickBooks Desktop Update

- Open QuickBooks, move to the Help menu select Update QuickBooks Desktop.

- Now, select the Update Now tab and check the Reset Update checkbox

Check whether you still encounter the same error or not. If yes, try the next solution below.

Solution 6. Activate QuickBooks Desktop for Windows and Then Update It

After installing QuickBooks on the system, you need to register (activate) it. It simply means registering the software is of utmost importance to avail of its features. Secondly, unregistered QB may lead to error code 30159 in QuickBooks Desktop. Therefore, if you are unsure whether you have registered the software, let’s first check whether the software is registered or not.

- Hit the F2 key on the keyboard to open the Product Information window.

- Besides the license number, check whether it says Activated.

Note: If it doesn’t show Activated, consider registering the QuickBooks Desktop by following the steps below.

- Open QuickBooks and then move to the Help tab on the top.

- From Help, choose the Activate QuickBooks Desktop option.

- Lastly, follow the instructions on the screen to verify your info.

After the verification procedure, QuickBooks gets activated. Now, the next step is to update it to the latest release. For this, you can refer to solution 2 of this blog. Afterward, consider downloading the latest payroll tax table update again. Implement solution 3 of the blog for the same. However, if the error 30159 QuickBooks Desktop persists even after following these instructions, move to the next solution below.

Solution 7. Download and Install QuickBooks Tool Hub to Run Quick Fix My Program

The QuickFix My Program tool helps fix common issues within the program. It shuts down any open background processes that QuickBooks uses and then runs a quick repair on the program. However, you can only run this tool, provided the QuickBooks Tool Hub is installed on the system. Therefore, we will first see how to download and install the Tool Hub and then follow the steps below to run the tool.

- Launch QuickBooks Tools Hub on the system and select Program Problems.

- Select Quick Fix My Program

- Lastly, start QuickBooks Desktop and then open the data file.

Now, the next step is to download the latest tax table again. See solution 3 of the blog for the same. Another key point is that we ran the Quick Fix My Program tool to fix issues within QuickBooks. However, if this doesn’t help, you must check if error code 30159 has occurred due to data damage in the company file. Try the next solution below to ensure the same.

Solution 8. Run the File Doctor Tool to Fix Data Damage

QuickBooks File Doctor tool is known to fix damages in the company file. Since data damage is a significant reason behind QuickBooks Payroll Error 30159, running this tool will help you overcome the error. However, you can run this tool provided you have the QuickBooks Tool Hub installed on the computer. See solution 7 to download and install the Tool Hub. Now, let’s follow the steps to run the File Doctor tool.

- Open the QB Tool Hub, choose Company File Issues, and then Run QuickBooks File Doctor.

- The File Doctor Tool may take up to one minute to open. In another case, it may not even open. If it doesn’t open, search and open it manually.

- In File Doctor, select the company file from the drop-down menu you want to scan. In case you don’t find the company file, choose the Browse and Search option to find the file.

- Select the middle option, i.e., Check your file, and then hit Continue.

- Lastly, enter the QuickBooks admin password and then hit Next to conclude.

Once the scan finishes, open the QuickBooks application and try to access the company file to check whether the error 30159 has been fixed. If it doesn’t, consider the next solution below.

Solution 9. Rename the Paysub.ini File

There is a possibility that the paysub.ini file on the system is causing the error. QB does not allow you to have multiple paysub.ini files with a similar name, and thus, you need to rename them if you have more than one:-

- Close QBDT application.

- Select My Computer, then click on Organize.

- Select the Folder and Search option, then select the View tab.

- Select Hidden Files and Folders > Show Hidden Files, Folders, and Drivers.

- Click Apply, and then hit OK.

- Move back to My Computer and enter “Paysub” in the search bar.

- Right-click the Paysub.ini files and choose Rename.

- Lastly, change the .old extension to .ini.

If renaming the Paysub.ini file doesn’t help in your case, you might have entered the incorrect EIN in the company file. If so, you would like to try the next solution below.

Solution 10. Add EIN to the Company File

As mentioned above, an incorrect EIN can significantly cause enhanced payroll error 30159. Follow the below-mentioned steps to add EIN to the company file:-

- Log into QB.

- Tap on Employes and then select Payroll.

- Choose ‘Use My Existing Payroll Service.’

- The Account Maintenance window will open up.

- Tap on Add File.

- Mark the radio button next to the Add EIN Number.

- In case the radio button is disabled, it means you have already correctly subscribed to the EIN for your company file.

- Tap on Next.

- A review information window will open up. Go through it and verify that all the information is correctly added.

- Lastly, return to QuickBooks.

Solution 11. Updating Windows to the Newest Version

Updating Windows to the latest version is another essential step to troubleshoot error code 30159 in QuickBooks Desktop. In this section, we have detailed the steps comprehensively to update Windows. Follow the steps below:

- Go to the Windows Start button, select Settings, and then select Update & Security.

- The next step is to select Windows Update and then select Check for updates.

- Lastly, if the updates are available, install them to conclude.

Conclusion

So, this has been all about QuickBooks Payroll Error 30159. We discussed all the discovered reasons leading to it and what solutions to try to fix the error. Although the solutions were simplified for your convenience, if you find the instructions challenging, you can contact Asquare Cloud Hosting’s expert team. and They’ll provide instant resolutions of the error, saving not only your efforts but also your time.

FAQ

An error message is an integral part of any QuickBooks error. When payroll error 30159 in QB occurs, you may see more than one error message. For instance, “Error 30159

We’re having a problem verifying your account status. Contact Us for help resolving the issue.”

Another error message is, “30159 – Unable to load account for PSID null : Entitlement is Enabled, but Entitlement Unit is deactivated.”

There could be multiple reasons for this issue. For example, a damaged QuickBooks Desktop file: paysub.ini, an incorrect service key, or an outdated product could be the reason why your subscription is showing Inactive.

Canceling the QBDT payroll subscription comprises two essential steps. Firstly, complete the final payroll tasks and then look forward to canceling your payroll service. See how you can do the same in the QuickBooks Desktop Payroll Enhanced, Standard, or Basic.

Through the company file:

From the Employees dropdown menu, select My Payroll Service, then select Account/Billing Info. The next step is to sign in using the Intuit Account login, which opens the Account Portal page. Lastly, select Cancel Service and follow the on-screen steps to cancel your payroll service.

Through the Intuit account

Sign in to the Intuit Account, and under Products & Services, select Details next to the status of the payroll subscription that you want to cancel. The next step is to select Cancel Service and then follow the on-screen steps to cancel the payroll service.

For QuickBooks Desktop payroll-assisted

As far as QuickBooks Desktop Payroll Assisted, you need to complete the QuickBooks Desktop Payroll Assisted cancelation form to cancel the payroll service.

Oriana Zabell, a professional cloud engineer, has over three years of experience in desktop, online QuickBooks support and troubleshooting. She is currently working as a cloud hosting consultant with Asquare Cloud Hosting. She loves to read and write about the latest technologies such as cloud computing, AI, DaaS, small businesses, manufacturing. When not writing, she is either reading novels or is indulged in a debate with movie fanatics.