Last Updated on September 20, 2024

The USA does not have a federal sales tax. The percentage of sales tax levied on products varies from state to state. It generally ranges from 2.9 to 7.25. A provision allows companies to round off cents to whole dollars. To round off products with a value of either 50 cents or less, you can write the value of the previous dollar and for 51 cents or more, you jump on the next dollar.

You can automate the calculation of sales tax In QuickBooks. It has the provision of rounding off by the second digit. It means that changes would be made by $0.01. For example, if your sales tax is $82.378, QB will round it up to $82.38 and if it is $82.373 the rounded-off tax will be $82.37. QuickBooks is developed to do rounding off line-by-line. Sometimes QuickBooks Sales Tax Rounding Errors may occur, leading to certain discrepancies. Users have faced issues such as extra tax being added or tax less than what the agency’s books show is charged. It is because Quickbooks keeps a record of every debited and credited penny because of round-off and then adjusts it accordingly.

QuickBooks automatically calculates round up or down based on the amount entered on invoices or sales tax receipts. Although it is not a correct accounting process, QuickBooks tends to adjust the credited and debited figures. It is possible that you may see a difference of $0.01 in the sales tax column for the two products having the same quantity and price. While one product saw a reduction of less than a cent, the reduced cent is added to the second product. Putting those two amounts back to back, QuickBooks is not rounding off but rather equalling out the amount

Method To Fix QuickBooks Sales Tax Rounding Error

QuickBooks Sales Tax Rounding Error is categorized as a bug by the Intuit technical team for now. There are no one-time steps that you can follow to correct the ‘adjust rounding sales tax’ error. However, there are two manual ways to correct the difference. You can create a credit memo of $00.01 or make sales tax adjustments. The method to fix this error is different for both Desktop and Online versions. Let’s look at this method in detail:-

Note: If you require to figure out gross sales in QuickBooks, you can do so here.

Method to Fix Rounding Error Sales Tax in QuickBooks Online

Let’s look at both the procedures you can follow to fix rounding error sales tax in QuickBooks Online:-

Method 1:- Create a Sales Tax Adjustment

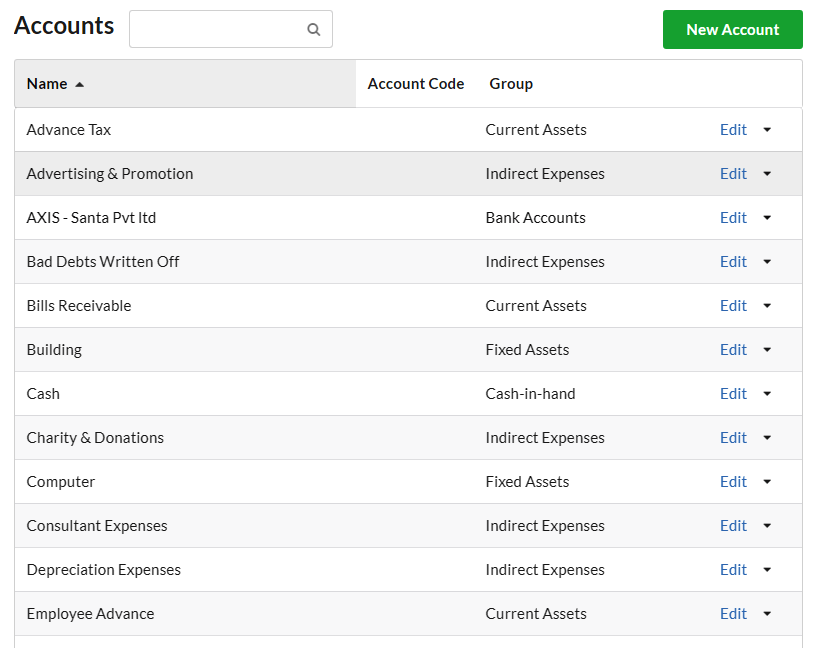

- Tap on the Gear icon present at the top and select Chart of Account.

- Choose New in the top right corner.

- Go to the Account Type menu and choose Income or Expense.

- You need to select an Income account to decrease your sales tax.

- You need to select an Expense account to increase your sales tax.

- Go to the Detail Type section.

- Select Sales of Product Income for the income account

- Select Taxes Paid for an Expense Account.

- Give a name to your adjustment account.

- Tap on Save & Close.

- Go to the left menu and choose Taxes.

- Now choose Sales tax and enter the tax period you need to make adjustments and tap on Prepare return.

- Select Adjust for the entry that is required to be adjusted.

- Enter in the Adjustment date and the Tax rate.

- Choose the Adjustment account for adjusting sales tax.

- Select an expense account in case you want to increase the tax due.

- Select an income account if you want to decrease the tax due.

- Enter $00.01 in the Adjustment amount section.

- Type in notes in Memo and tap on Save.

Also Read:- Why Latest QuickBooks Payroll Tax Table Update Require To Fix.

Method 2:- Create a Credit Memo and Apply it

- Tap on the Plus icon and choose Credit Memo.

- Select the name of your customer.

- Type in Credit Memo Date.

- Enter in the required information and enter $00.01 for the amount.

- Tap on Save and Close.

- Now press the +New button and choose Invoice.

- Generate the invoice and then select Receive Payment.

- Mark the credit and the invoice.

- Tap on Save and Close.

Note: This method can be used to decrease the sales tax amount; you can’t increase it.

Adjust rounding sales tax error in QuickBooks Desktop

The two processes to fix Sales Tax Payable in QuickBooks for QBD also to either create a sales tax adjustment or create a credit memo. Let’s look at these methods in detail.

Method 1: Create a Sales Tax Adjustment

- Go to the Customers menu and choose Enter Sales Receipts.

- Don’t enter anything in the Customer field blank.

- Tap on the Tax menu and choose 0% sales tax item.

Note: Click on Add New if none exists.

- Go to the Item column and choose the first empty line. Then tap on the Sales tax item you wish to adjust.

- Go to the Amount column, enter the adjustment amount, and press Tab or enter.

- Click on OK when the message ‘Changing the amount of a tax line item may cause your sales tax reports to be incorrect.

- Tap on Save & Close.

Note:- This method can only be used to increase the sales tax.

Read Also – Resolve QuickBooks Error 17337 (While Updating A Payroll)

Method 2:- Create a Credit Memo

- Tap on the Customers menu and choose Create Credit Memos/Refunds.

- Choose the customer name and enter it. If you do not wish to use a real customer, tap on Add New and give the name Accountant Use Only.

- Enter $00.01 in the amount column and press Enter or Tab.

- Click on OK when the message “changing the amount of a tax line item may cause your sales tax reports to be incorrect.”

- Click on the next empty line and select Discount item.

- Go to the Amount section and enter $00.01.

- Go to Tax column and choose Tax.

- Ensure that the total amount is $00.00.

- Click on save & close.

Conclusion

So this has been all about QuickBooks Sales Tax Rounding Error. It may just bring a very small difference of $0.01 but can lead to an imbalance in your balance sheet. While the IRS does allow the difference up to $1, the right accounting practice will ensure that the books are balanced. If you still have some doubts and need any help, reach out to an expert, and they will guide you in the best possible manner.

Read More: Fix QuickBooks Balance Sheet Out of Balance [RESOLVED]

Related Posts –

How To Fix QuickBooks Error 6069

How To Use QuickBooks Component Repair Tool

What is QuickBooks Migration Tool? Get Data Migration Easy

Troubleshoot QBDBMgrN Not Running On This Computer Error

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.