Last Updated on November 20, 2025

QuickBooks is an application developed by Intuit that offers payroll services for its users, such as sending paychecks, calculating taxes, and deploying employee paychecks. There can be times when you are performing payroll tasks and get interrupted by common payroll mistakes. However, this can occur due to human error or payroll mistakes in QuickBooks. This can be detrimental to your business financially and can also result in legal consequences; hence, it is essential to correct these mistakes promptly. In this blog, we’ll learn how to fix the most common payroll mistakes in QuickBooks Online and Desktop. So let’s dive right into the next section.

Are you struggling with incorrect information or mistakes in QuickBooks? Contact our experts today at +1(855)-510-6487, who’ll make this process smooth sailing.

Understanding the Significance of Accurate Payroll for Small Businesses

The payroll must be accurate to ensure that all your business processes are smooth. Even the most minor payroll mistakes in QuickBooks can cause significant disruptions and lead to financial losses. It can also dampen the morale of your entire workforce if they aren’t getting paid on time or if there are discrepancies in the paychecks. This can also result in legal consequences if there are any tax discrepancies. So it’s advisable to double-check your payroll to eliminate any mistakes beforehand.

Ensure that you have accurately input all payroll-related details, including employee ID and paycheck slips, to avoid this error. Now, let’s discuss some of the most general mistakes small businesses make while running their payroll operations.

Common QuickBooks Payroll Errors and Their Causes

Discover the QuickBooks Payroll Most Common Errors and learn how to fix them. From tax table issues to update failures, our guide helps you troubleshoot payroll problems efficiently and keep operations smooth. QuickBooks Payroll users may face a variety of errors that can disrupt payroll processing. Common subscription issues include Error PS038, PS034, and PS032, often caused by expired services, billing problems, or corrupt company files. Setup errors like missing payroll items or incorrect configurations can occur during initial setup. Update problems such as Error PS077 or 15243 arise when tax table updates fail due to disabled services or outdated components.

Calculation errors—including incorrect tax amounts or missing Social Security/Medicare deductions—are often due to setup mistakes or outdated tax tables. Connectivity issues like “View My Paycheck Not Working” or server errors stem from internet or configuration problems. Other recurring issues include payroll turning off automatically, restricted file access (Error 30159, 2107, 9000), and failed direct deposits.

The Most Common Payroll Mistakes in QuickBooks that People Make

In this section of the blog, we will discuss the reasons behind this issue that you might encounter. Therefore, you must keep your payroll accurate and free of mistakes to maintain their trust and confidence. Compliance with tax laws is also another reason to do so. Let’s take a look at the most standard mistakes people make while running payroll:

- Poorly Kept Records: One of the most important aspects is maintaining accurate records of your employees’ information, including overtime, sick leaves, banking details, and hours worked. Failing to do so can lead to discrepancies, which can harm your reputation among employees.

- Late Payments: When paying the employees, one of the reasons for the error is missing paycheck deadlines for your employees, potentially leading to a poor and lethargic work environment.

- Incorrect Calculation of the Payroll: If overtime and leave applications are not calculated during the salary period. This can have serious financial implications for both your employees and your company.

- Wrong Tax Calculations: If you have any of your employees in the wrong tax category, they can end up paying too much or too little tax, which can impact both your business and the employees.

These were some generic mistakes small business owners usually make while running their payroll services. Now, let’s discuss some cases of payroll mistakes along with their solutions.

How to Fix Payroll Mistakes in QuickBooks Online & Desktop? Casewise Solutions

Let’s take a look at some cases of payroll mistakes in QuickBooks with step-by-step guided solutions.

Case 1. Wrong Employee Account or Routing Number

You might have set up the wrong employee account or routing number in QuickBooks Payroll Direct Deposit. This can be fixed in both the Desktop and the Online versions. Let’s take a look at QBDT first.

a. Change Employee Banking Info in QBDT

With the help of the steps mentioned below, you can modify the employee’s banking info in your QuickBooks Desktop:

- Launch the QuickBooks Desktop

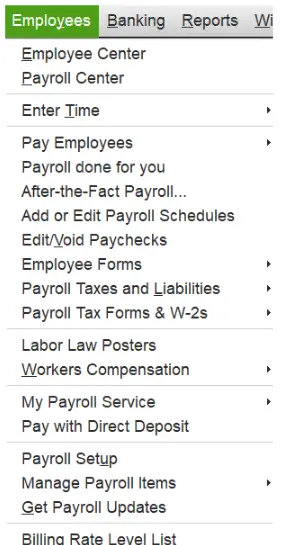

- Tap on the Employees menu

- To access the employee list, choose the Employee Center.

- Here, select the names of employees whose info needs to be corrected

- Now, click on the Payroll Info tab

- Press the Direct Deposit button

- The Direct Deposit window would open

- Then, click on Use Direct Deposit for [employee’s name]

- Now, choose from these two options:

- Deposit in one account

- Deposit in two accounts

- Now enter the following info:

- Bank Name

- Routing Number

- Account Number

- Account Type

- Click OK to save

- When asked, enter your direct deposit PIN

This would change your employee’s banking information in QuickBooks Desktop Direct Deposit. Now, let’s take a look at the steps for QB Online.

b. Change Employee Banking Info in QBO

Now, move forward and change your employee’s bank account or routing number in QuickBooks Online with the following steps:

- Choose the Employee option

- Go to Payment method

- Now, select Edit

- Enter the updated/correct banking information

- Click on Save to finish

This would fix the payroll mistake of having an incorrect employee account or routing number in QuickBooks. Let’s proceed to the next case.

Case 2. You Might Have Overpaid an Employee

While sending out paychecks, there can be times when you could’ve overpaid an employee. This issue can occur due to an incorrect amount in their gross pay. Let’s discuss how to resolve it as soon as possible. To reduce your employee’s wage in QB, you can follow the steps given below:

- Firstly, create a payroll item for reducing wages

- Open QBDT

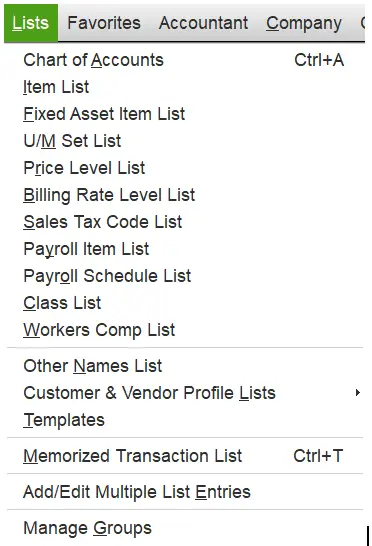

- Go to the Lists menu

- Select Payroll Item List

- Now, tap the Payroll Item button

- Click on the New option

- Now, choose Custom Setup

- Hit Next

- Click on Deduction and press Next

- Type in an easily identifiable name of the payroll item

- Choose the Next option

- Head to the Liability Account field

- Enter the same Expense Account that was used when the employee was overpaid

- Click on Next

- Now, choose a tax tracking type of Compensation

- Press Next twice

- Now, choose Calculate this item based on Quantity if the employee was paid hourly

- Choose Neither if you paid the employee with a salary item

- Click on Next and hit Finish

- Finally, add the new payroll item to your next paycheck

Note: The deduction item must be added to a paycheck with equal or more earnings than the amount that will be deducted, as QuickBooks can’t create a paycheck with a negative net pay.

Case 3. Correction in Direct Deposit

If the payroll mistakes in QuickBooks also encompass direct deposit errors. You can void a direct deposit paycheck error with the steps given below:

- Open QuickBooks Desktop

- Go to the Employees menu

- Click on Edit/Void Paychecks

- Change the Show paycheck dates from/through to the paycheck date you want to void

- Select the paycheck

- Press Void

- In the pop-up menu, enter Yes

- Click on Void

- Agree to the terms and conditions of voiding the paycheck

- Close the Edit/Void Paycheck window

- Now, open the Employees menu again

- Select Send payroll Data

- Finally, finish it off by pressing Send

This would eliminate any mistakes in your QuickBooks Payroll Direct Deposit.

Case 4. Edit QuickBooks Payroll Mistake in Timesheet

If you’ve mistakenly saved your timesheet in QuickBooks Online for the incorrect week, you can fix that by following the steps given below:

- Click on the Plus (+) icon

- Now, select the Weekly Timesheet

- Ensure you enter the correct employee

- Click on the Weekly Period dropdown menu

- Then, select the incorrect week

- Press the Trash (clear) icon to remove the hours from the wrong week

- Hit Save and close

- Repeat the steps for every employee

This would allow you to fix the QuickBooks Payroll mistake in your timesheet.

Payroll Mistakes in QuickBooks – A Quick View

A concise summary of this blog on the topic of fixing mistakes in QuickBooks Payroll is presented below in a tabulated format:

| Description | Due to human errors, mistakes can occur in your important QuickBooks Payroll processes. This can hamper your workflow and obstruct your business operations. |

| Cases you might be dealing with | Entering the wrong account or routing number of an employee, having overpaid an employee, direct deposit mistakes, or Payroll Timesheet mistakes. |

| Resolutions | Check your employee information and correct it, adjust the wage and tax deduction, and verify your banking details and direct deposit setup. |

Conclusion

In this blog, we discussed common payroll mistakes in QuickBooks that you can make. Moreover, we provided you with step-by-step guides specific to the scenario you might be dealing with. If you need help correcting payroll mistakes in your QuickBooks software, please don’t hesitate to contact our QB professionals at +1(855)-510-6487.

Frequently Asked Questions (FAQs)

How do I do a payroll correction in QuickBooks Online?

To correct a payroll paycheck in QuickBooks Online, first, go to Payroll and click on Employees. Then, choose Run Payroll. Proceed by changing the Pay Date and Pay period. Now, select the employee and add the corrected amount. Make sure the submission is marked as Paper Check and hit Submit Payroll. Now, navigate to Taxes and choose Payroll Tax followed by Payments. Review the liabilities in and hit Pay.

How do I edit my payroll in QuickBooks after submitting?

To edit a paycheck in payroll after submitting it first, ensure that it hasn’t been submitted through direct deposit, then select the Paycheque list and filter the dates you want to edit. Choose the paycheque and click on the dropdown menu under the Action column. Press Edit and make the necessary changes. Finally, hit Save.

How to fix payroll liabilities in QuickBooks?

To adjust the payroll liabilities in QuickBooks, follow the steps given below:

1. Run the QBDT app

2. Click on the Employees menu

3. Select Payroll Taxes and Liabilities

4. Now, press Adjust Payroll Liabilities

5. Select the last paycheck date of the affected month or quarter in these two fields:

a. Date

b. Effective Date

6. Under the Adjustment is for section, select Company

7. Go to the Item Name column

8. Choose the payroll item you wish to adjust

9. Now, in the Pay Liabilities tab, enter the Amount adjustment as negative

10. Click on OK

11. Finally, select Accounts Affected and press OK

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.