Last Updated on November 20, 2025

QuickBooks Payroll simplifies depositing paychecks and carrying out related operations for businesses with its enhanced and powerful features. With QB payroll, you can easily automate tax calculations, e-payment, and fee transactions, and make simple tasks seamless.

However, certain types of errors and technical glitches can appear on the screen while working with this application. Now, QuickBooks Payroll most common errors arise due to a significant cause, such as a faulty program, inactive subscription, or outdated QB software. It is important for you to resolve these issues to continue working seamlessly.

Therefore, we have curated all the major information on why these payroll errors arise and how to resolve them. It is advised that you follow the sections carefully and implement the method in the given order to avoid any technical difficulties. Let’s now start by learning about the different payroll errors and what they mainly indicate.

While resolving the payroll common errors in QuickBooks, you may need professional help due to technical difficulties. Don’t worry—our expert team is here to help. Dial our +1(855)-510-6487 to connect with a QB expert today.

Note: Avoid errors by checking out our detailed guide on Common Payroll Mistakes in QuickBooks and learn how to prevent them.

Different Payroll Common Errors in QuickBooks Desktop

The table below shows the most common errors that can interrupt you while performing the simple payroll tasks.

Let’s now figure out the reasons why you are facing these QuickBooks issues, as outlined below.

Reasons Behind the QuickBooks Payroll Most Common Errors

The generic cause of why you experience with QuickBooks payroll most common errors are given below:

- There might be problems with the QB payroll setup

- You may be using an outdated version of the QB software

- Slow internet connection and wrong network settings

- Faulty or corrupted company file

- Various errors can occur due to the lack of admin permissions

- The data integrity in QuickBooks may have been compromised

- Firewall or antivirus settings can interrupt the payroll processes

- Incorrect data & time on the system can prevent the payroll from updating

- A damaged CPS folder can cause many issues in the QuickBooks Payroll

After gathering information about why the most common QuickBooks Payroll issues arise, we need to examine the signs and preventive measures that precede their resolution.

Recommended Resolutions to Fix QuickBooks Payroll Errors

To resolve the QuickBooks Payroll most common errors, we have outlined some of the most effective methods below. Follow the instructions as given to perform the resolution more effectively.

Method 1: Disable the User Account Control (UAC) in Your System

The UAC settings improve the security for all users. Moreover, an admin can run most software, components, and processes with limited permissions. However, if the UAC is disabled, you will be unable to use QB Payroll and may encounter various errors. In such cases, you should enable it by following the instructions below:

- Click on Windows + R to open the Run window on the screen

- Next, enter Control Panel in the search bar and then select OK

- Now, select the User Accounts, and choose the User Accounts (Classic View)

- Click on Change user account control settings

Note: You should select Yes to continue if you get a prompt from UAC

- Toggle the slider ( As per the need)

- Here, set it to Never Notify and click OK to turn the UAC Off

- Set it to Always Notify and click on OK to turn UAC ON

After trying this method, restart your device and then check if your problem is resolved. If you encounter any payroll errors, follow the next solution to proceed.

Method 2: Verify Your Payroll Service Subscription

Sometimes, when QuickBooks is unable to check the Payroll service subscription, various payroll errors can arise, including PS033, PS101, or PS036. To fix them, you need to verify the subscription status.

- Start by closing all the company files and restarting your device

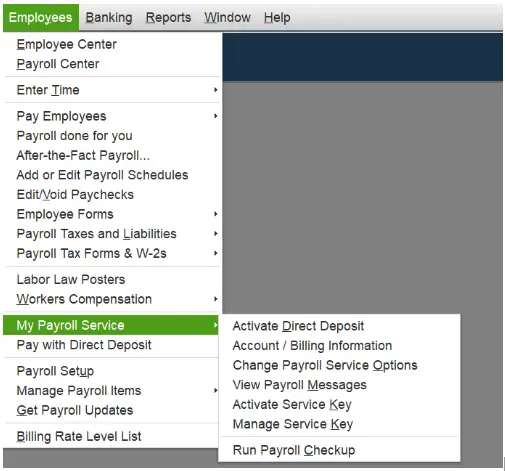

- Now, access the QB Desktop and head to the Employees tab

- Next, select the My Payroll Service, and then select Manage Service Key

- Here, ensure that the status is shown as Active

- Next, choose Edit and verify the service key number

- If you find it incorrect, you need to correct the service key

- Choose Next, uncheck the Open Payroll Setup box, then select Finish

Even if this doesn’t fix the QuickBooks Desktop payroll errors, you should try the next possible method.

Method 3: Update Your QuickBooks Desktop from Get Updates

You will experience many technical errors and glitches while performing tasks if the QuickBooks software, payroll, or the tax table isn’t updated. In such a case, you should check and update QuickBooks to the latest version if any updates are available.

After implementing the update procedure, check whether you can work without any of the QuickBooks Payroll most common errors. If you are still facing an issue, try out the following method.

Method 4: Rename the CPS Folder on Your Computer

You should try renaming the CPS folder on your device to resolve the QuickBooks Payroll errors. To implement that, follow the steps given below.

- Click on Windows + E keys to open the file explorer on the desktop

- Click on This PC and navigate to the Local Disk C

- Now, run the Program Files (x86), followed by the Intuit Folder

- After that, select the QB Desktop folder that matches the version you’re utilizing

- Next, tap on Components, followed by the payroll folder

- Right-click the CPS folder, and select the Rename

- Lastly, enter a new name and hit Enter

Once done trying this method, check whether the QuickBooks Payroll most common errors are solved or not. If you are still facing problems with QB Payroll, then follow the next possible method.

Method 5: Install the Digital Signature Certificate

When QuickBooks can’t verify the digital signature, you need to install the digital signature again. You can try these resolution methods by going through the instructions below.

- Head to the C:\Program Files\Intuit\QuickBooks

- Next, right-click on the QBW32.exe and select the Properties

- Now, select the Digital Signature

- Ensure that Intuit is chosen in the list of signatures

- Next, you should select the Details

- Tap on View Certificate in the Digital Signature Details

- Choose the Install Certificate from the Certificate window

- Now, you need to select Next until Finish is displayed, and then select the Finish

After installing the digital signature, restart your device. Next, open QuickBooks and check whether the problem is solved or not. If you are still facing the same issue, follow the next solution given below.

Method 6: Run Quick Fix My Program from Tool Hub

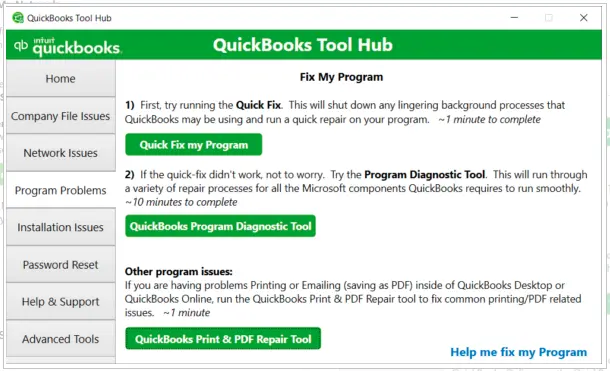

The problem could be the QuickBooks program itself, and to address this, you need to run the Quick Fix My Program tool. You should have the QuickBooks Tool Hub installed. After ensuring that, follow the instructions below to repair the damaged tool.

- First, open the QB Tool Hub

- Second, select the Program Problems

- Now, click on the Quick Fix my Program

With this move, your QB program will start to repair and then open your QuickBooks Desktop again, and check whether the problem is solved. If you are still facing the same issue, follow the next possible method to overcome this problem.

Method 7: Configure the Firewall Security Settings

Sometimes, the Windows firewall security settings can prevent the QuickBooks Payroll updating process, which can lead to the QuickBooks Payroll most common errors. In such cases, you should configure the Windows firewall settings. This will help you to set Intuit as a firewall exception.

Once you have tried this method, reopen QuickBooks Desktop and check whether the problem is resolved or not. If you are still experiencing any payroll errors, follow the next procedure to resolve this issue.

Method 8: Run the Reboot.bat in the QuickBooks

To resolve the QuickBooks Payroll most common errors, you should try to run the reboot.bat file by following the steps below.

- Close QuickBooks and all other programs

- Now, right-click the QB Desktop icon and select Properties

- Next, select the Open file location

- Choose by right-clicking the reboot.bat file, and choose Run as Administrator

Note: Make sure that while being in the ‘Windows Administrator’, you should run the ‘reboot.bat’. The file should display as reboot.bat or reboot; it will depend on Windows Folder Options settings.

- Now, a command (DOS) window (black window) will open with rapidly scrolling file names. Remember, do not close this window manually. If the reboot.bat file utility has been run, the window will close automatically

Once the reboot.bat file access process is done, Windows will close automatically. Now, restart the device and check if the problem is solved. Even after trying this method, if the problem persists, follow the next possible method.

Method 9: Verify Your Internet Settings On the Device

You should verify the Internet settings in QuickBooks to resolve the most common payroll errors. To do so, follow the instructions outlined below.

- Open the QuickBooks Desktop and head to the Help menu, select the Internet Connection Setup

- Next, you need to choose the Use my computer’s Internet connection settings to establish a connection when this application accesses the Internet option

- After that, select Next, followed by Advanced Connection Settings

- Now, select the Restore Advanced Settings on the Advanced tab

- Then, choose OK and select Done

This will modify the Internet settings according to your needs to update QuickBooks Desktop. Now check whether the problem is solved. If the problem still persists, you need to follow the next possible method to resolve it.

Method 10: Reinstall Your QuickBooks Program

Even after trying so many methods, if you are still facing the QuickBooks Payroll most common errors. In such a case, try reinstalling QuickBooks Desktop to resolve any issues by following the steps below.

- Start by opening the Windows Start menu and browsing for Control Panel

- Next, select the Programs and Features or Uninstall a Program

- Select the version of the QB software you want to remove from the list of programs

- Now, select the Uninstall/Change, Remove, and then Next

Note: If you don’t see this option in a specific scenario, sign out and then sign back in to Windows as an administrator.

- After uninstalling it, install QuickBooks Desktop again

Hopefully, the above-mentioned methods will help you in resolving several of the most common QuickBooks Payroll errors. Now, let’s wrap up this informative post with a quick view of the topic.

Quick View of the QuickBooks Payroll Most Common Errors

Follow the quick view table below about QuickBooks Payroll most common errors. This will show you the condensed version of the information mentioned above.

| What are the most common errors in QuickBooks Payroll? | Several errors exist that can hinder your work processes in the QuickBooks Payroll, such as error PS032, PS077, PS036, PS034, PS033, PS101, PS060, PS077, PS058, and PS107. These errors can arise due to several causes, such as an outdated QuickBooks version or a faulty program. |

| Reasons behind the most common errors in the Payroll | Incorrect QB Payroll Setup, outdated QB version, slow internet connection, incorrect internet settings, faulty company file, lack of admin permissions, lost data integrity, firewall or antivirus security settings, or a damaged CPS folder can cause several types of QuickBooks errors. |

| Proven ways to resolve the QuickBooks payroll errors | To resolve common payroll errors in QuickBooks, ensure your QB software is updated. Even after ensuring that, if you are still facing the same issue, disabling the UAC on your computer, verifying the payroll subscription status, renaming the CPS folder, installing the Digital Signature Certificate, running the Quick Fix My Program, configuring the Firewall Security settings, running the reboot.bat file, checking the internet settings, or reinstalling the QB program can help you to overcome this situation. |

Conclusion

This blog has covered significant information on QuickBooks Payroll most common errors. In this guide, you will go through all the major causes that lead to these payroll issues and the most effective ways to resolve them. Other than that, it is advised that you go through every aspect of the blog to avoid any further difficulties.

However, if you feel nervous about resolving the payroll-related issue or having technical difficulties, contact our specialists. Dial +1(855)-510-6487 to receive expert help from certified QB experts.

Frequently Asked Questions (FAQ’s)

How to fix payroll errors in QuickBooks?

To fix the QuickBooks payroll errors, you can try some of the most effective troubleshooting methods. However, before taking any action, you must first verify that the QuickBooks software and payroll are up to date. After ensuring that the problems still exist, try to repair the QB software by running the Quick Fix My Program tool. If this doesn’t solve your problem, you may need to rename the CPS folder or adjust the UAC settings on your system.

Why are you facing the QuickBooks Payroll errors?

Several reasons can cause you to encounter these most common payroll errors, such as a faulty QuickBooks program or incorrect internet settings. It might be possible that you are using an outdated version of the QB Desktop. If you are using the software on a slow internet connection, it may cause these errors to appear on your computer. Firewall or antivirus security settings may be preventing you from downloading the QB payroll updates.

How can I prevent payroll errors in the future?

You can prevent payroll errors in the future by practicing some healthy practices. The first thing you must ensure is that your payroll software is up to date. Additionally, remember to keep the payroll tax tables up to date. Next, always keep a backup file of your data to save it from data loss or error. Ensure to limit multi-user access during payroll and clean up unnecessary data to keep the file size manageable.

What do the QuickBooks Payroll errors indicate?

Many types of QB payroll exist that can arise in your QuickBooks company file. These common QuickBooks payroll errors typically indicate some of the most common issues, such as outdated QuickBooks software or incorrect date or time settings. Moreover, corrupted company files or a faulty QB program can be the reason for the many errors. Some errors may indicate the default settings in the Internet settings. Sometimes, when QuickBooks is unable to verify the subscription’s validity, this error could also arise.

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.