Last Updated on February 26, 2026

QuickBooks allows its users to send paychecks and manage salary-related information with the help of its payroll service. QB Desktop payroll has features like scheduling paychecks and automating them to simplify business operations.

Now, as paychecks involve variable figures like taxes and forms, the payroll has to stay up-to-date to incorporate the changes announced by local, state, or federal governments in tax rates and forms. Therefore, Intuit regularly releases the tax table updates you should download before distributing paychecks to the employees. However, sometimes the QuickBooks payroll won’t update owing to problems with the company file, network connection, or QB application.

This is a critical issue, and you should fix QuickBooks payroll errors before distributing paychecks. Payroll updates not only update the tax table but also make sure that your tax reports are accurate and compliant with government guidelines.

Some Common QuickBooks Payroll Update Error

QuickBooks payroll update errors payroll generally have five-digit codes in the format PSXXX or XXXXX. Here is an overview of the most common payroll-related errors in QuickBooks Desktop.

| Error Code | Short Description of the Error |

| Error PS038 | The common characteristic of QuickBooks payroll error PS038 is the inability to update the payroll or tax table. It arises due to an outdated QuickBooks Desktop or damage in the company file. |

Error PS032 and PS077 | A common thing in QuickBooks Desktop errors PS032 and PS077 is that you can’t download payroll updates. The error arises from outdated QuickBooks software or an incorrect payroll service key. |

| Error PS034 | QuickBooks error PS034 occurs when you can’t verify payroll subscriptions. Issues like incorrect permissions corruption or damage in company files can give way to this payroll error. |

| Error 12031, 12007, 12002, 12009, 12029 | QuickBooks errors 12031, 12007, 12002, 12009, and 12029 occur due to connectivity issues. The user is unable to download QuickBooks payroll update error in these circumstances. |

| Error 12152 | QuickBooks Error 12152 is an update error and interferes with the QuickBooks Desktop update. This is usually caused by issues in internet connectivity or firewall settings. |

| Error 15271 | Error 15271 means that the user cannot install the payroll updates. The error arises due to issues like damaged system files or insufficient permissions and can be fixed by carrying out the proper troubleshooting. |

| Error 15240 | QuickBooks Error 15240 hinders the payroll updates in QuickBooks Desktop. This happens when there is an issue in time or date settings or other discrepancies in the software. |

| Error 15270 | QB error 15270 arises when you try to download or install the payroll update error. Check out the detailed troubleshooting guide to fix the payroll error on our website. |

These errors arise due to problems in internet connection, connectivity, firewall, etc. Let us go through these reasons in detail.

Note: If you see the message “We Weren’t Able to Show Your Payroll Info”, it may occur due to a sync or account issue. Follow the troubleshooting steps to quickly restore access to your payroll information.

Why is QuickBooks Desktop Payroll Update Not Working?

The QuickBooks Desktop payroll won’t update because of an error that includes issues in the company file, application, or connectivity. Here is a list of the potential causes of QuickBooks payroll not updating.

- The QuickBooks application might be outdated.

- Integrity of your company file might be compromised.

- A third party is interfering with QuickBooks processes.

- The QuickBooks application might be damaged.

- You might have a poor internet connection, or the internet settings are incorrect.

Now that you have an understanding of why QuickBooks payroll won’t update, let us see how to fix it.

Top Solutions to Try If QuickBooks Payroll Won’t Update

We have compiled a list of solutions and methods to follow when QuickBooks payroll doesn’t update. These methods include updating your QB Desktop, running the verify and rebuild utility, and opening QuickBooks in safe mode. Moreover, if these methods don’t work, we will discuss how to clean and install the QuickBooks Desktop to fix payroll update errors. Let us look at these steps in detail.

1. Update QuickBooks Desktop to the Latest Release

QuickBooks payroll updates might not work in case you are using an outdated application version. Therefore, you need to update QuickBooks Desktop to the most recent version.

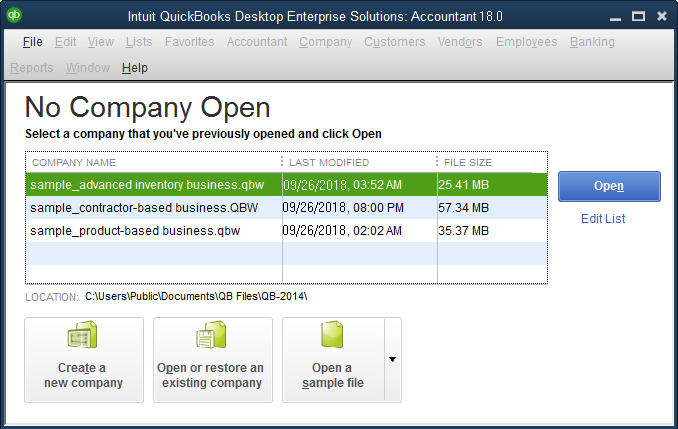

- Close your company file and then your QBD application.

- Press the Windows Start button and search ‘QuickBooks Desktop’ in the search bar.

- Right-click on the QBD icon and select Run as Administrator.

- Now QuickBooks will open in the ‘No Company Open’ window, and tap on the Help tab.

- Choose Update QuickBooks Desktop and go to the Options tab.

- Tap on Mark All and then click on Save.

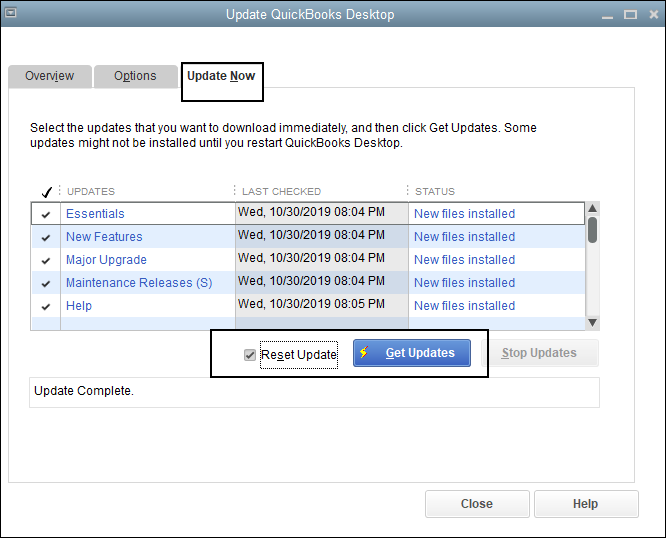

- Now go to the Update Now menu and tickmark the Reset Update box.

- Then click on Get Updates, and updates will start downloading.

- Now close the QBD application and then rerun it.

- Tap on Yes when the prompt to install it appears on the screen.

In case the issues still persist, you probably edit or delete the paychecks.

Related Post: QuickBooks Update Stuck: How to Fix It Fast

2. Add Intuit as a Trusted Website in Internet Settings

Intuit must be added as a trusted website in your internet settings to facilitate the software and payroll updates for QuickBooks.

- Launch the Start menu and type in Internet Options.

- Choose Internet Options.

- Click on the Security tab and choose the Trusted Sites zone.

- Tap on the Sites button.

- Now, add these websites to the zone field, and don’t forget to add the asterisk symbol (*)

- Enter https://.intuit.com and choose Add.

- Repeat the above for https://.intuit.net

- Now, repeat the same step for https://.QuickBooks.com

- Now, choose Close, followed by Custom level…

- Scroll down and come to the miscellaneous category.

- Go to the section for Access data sources across domains, choose Enable, followed by OK.

- Tap on Apply and then choose OK to close the Internet Options window.

Now, restart your computer and then launch QuickBooks Desktop. Try to update the QB payroll and see if it works.

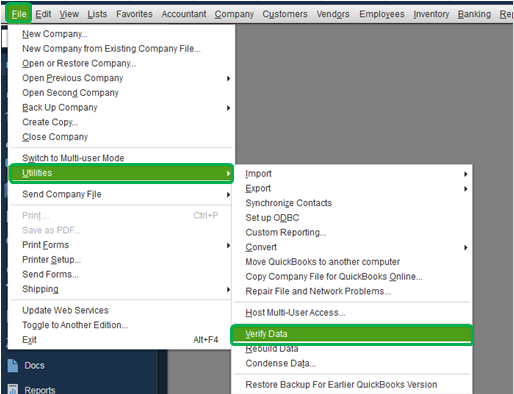

3. Run the Verify and Rebuild Tool

A compromised data file can be a reason why QuickBooks desktop payroll not updating the issue. QuickBooks has an inbuilt Verify and Rebuild utility that can help you fix it. Therefore, run the verify and rebuild tool to fix if it QuickBooks payroll won’t update.

Now, check whether you can update QB payroll. If you can’t, move to the next step.

Also Read: 4 Top Solutions To Troubleshoot QuickBooks Error PS058.

4. Install QuickBooks Update in Safe Mode

A third-party application might be interfering with your application, network, or firewall, and that is why QuickBooks payroll not working. Therefore, launch QuickBooks in safe mode and ensure that another application doesn’t interfere with the QB payroll update.

- Create a backup of your company file.

- Download and install a file of your version of the QuickBooks application.

- Note your QBD product and license information below.

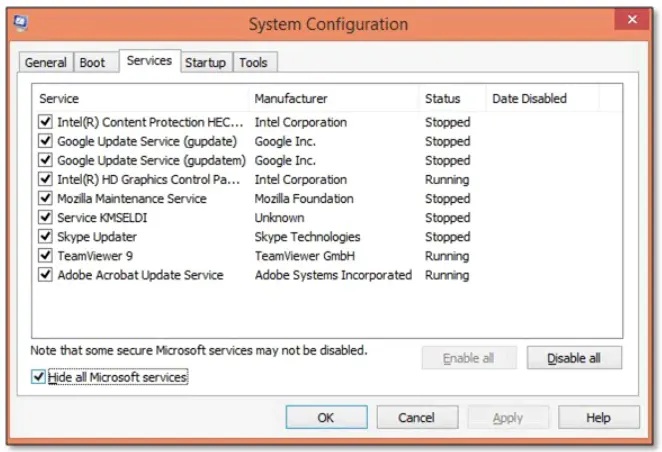

- Press Windows+R and the Run window will open up.

- Type in MSConfig and press OK.

- Now go to the General tab and choose Selective Startup and Load System Services.

- Go to the Services menu and select Hide all Microsoft Services.

- Tap on Disable All.

- Untick Hide all Microsoft services boxes and ensure that the Windows Installer box is already tick-marked from the list of services. Then click on OK and tap on Restart on the system configuration window.

Now, try to update the QuickBooks tax table and check if the error is resolved. Once you have installed the payroll updates,

- Now press Windows+R, and the Run command window will open.

- Type in MSConfig and click on OK.

- Go to the General tab choose Normal Startup and click on OK.

- Tap on Restart in the System Configuration window.

However, if this doesn’t help you update QuickBooks tax table, you can move to the next solution.

Related Post: How to create a backup of your company file

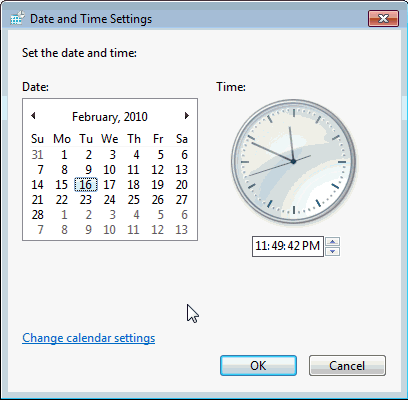

5. Check The Date and Time On the System

QuickBooks payroll is not updating error can occur due to incorrect time and date settings on the system. Here’s how to fix this issue so that the payroll can update to the latest release.

- Go to Settings or search for Time and Date Settings in the start menu.

- Now, click on Change Date and Time

- Edit the time and ensure that it is accurate.

- Do the same for the date and save the changes.

- Check the timezone and make sure the right timezone is selected.

Once done, restart your system and attempt to download the payroll update again.

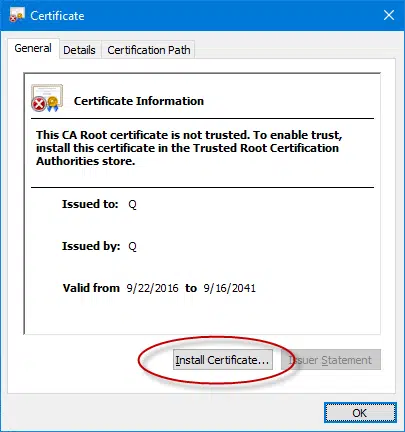

6. Install or Update the Digital Certificate for QuickBooks Desktop

If the payroll update doesn’t work, you can fix the problem by installing a digital certificate.

- Open File Explorer

- Go to the Intuit folder in Local Disk C or C Drive.

- Find the QBW32.exe file and right-click on it. Choose properties.

- Now, click on the Digital Certificate option in the menu on the left. Ensure that the Intuit checkbox is marked.

- Now, go to the detail tab and select View certificate.

- Choose the install certificate and proceed with the installation process until finished.

- Now, restart your computer and install the payroll update.

Conclusion

We have discussed why QuickBooks payroll won’t update and the troubleshooting methods to follow to resolve it. Go through these solutions, and if you get stuck in any method or have a query, you can contact our QB ProAdvisors. These professionals have years of expertise in resolving QB-related issues and are there to guide you 24/7.

Frequently Asked Questions (FAQ’s)

Why is QuickBooks Desktop Payroll not updating?

If your QuickBooks Desktop Payroll is not updating, it could be due to network issues, outdated QuickBooks software, or incorrect system settings. Troubleshooting these issues can help resolve the problem.

How can I fix QuickBooks Payroll when it won’t update?

If QuickBooks Payroll won’t update, try resetting your update, checking your internet connection, and ensuring you’re using the latest QuickBooks version. You may also need to disable antivirus software temporarily.

What is the latest QuickBooks Payroll update version?

The latest QuickBooks Payroll update version can be checked by visiting the official QuickBooks website or using your QuickBooks Desktop software under the “Payroll Center.”

How do I troubleshoot QuickBooks Desktop Payroll update issues?

To troubleshoot QuickBooks Desktop Payroll update issues, ensure your QuickBooks is updated to the current version, check your internet connection, and clear any update errors by resetting the update.

What does the QuickBooks Payroll Alert: Update Now” message mean?

The “QuickBooks Payroll Alert: Update Now” message indicates a new payroll update is available. Updating is essential to ensure accurate payroll processing.

How do I reset the QuickBooks Desktop Payroll update?

You can reset the QuickBooks Desktop Payroll update by going to the “Update QuickBooks” section, selecting “Reset Update,” and downloading the latest payroll update.

How do I check the current version of QuickBooks Payroll Update?

You can check the current version of your QuickBooks Payroll Update by navigating to the “Payroll Center” in QuickBooks Desktop and viewing the details under “Update” or “Latest Update.”

Kate is a certified public accountant (CPA) with expertise in various accounting software. She is technically inclined and finds passion in helping businesses and self-employed people carry out bookkeeping, payroll, and taxation without worrying about errors. Every once in a while, Kate loves to travel to far-off places and relax in the lap of nature.